|

|

|

|

|||||

|

|

Microsoft MSFT and Oracle ORCL have emerged as two dominant players capitalizing on the enterprise cloud and artificial intelligence revolution. Both companies are investing billions in AI infrastructure to meet unprecedented demand from hyperscalers and enterprise clients. Microsoft, with its Azure cloud platform and OpenAI partnership, has transformed into an AI-first enterprise software giant. Oracle has pivoted from its database legacy to become a formidable cloud infrastructure provider, securing massive multi-year contracts with AI pioneers.

Both technology titans reported strong fiscal results in their latest quarters, with Microsoft delivering 18% revenue growth in the first quarter of fiscal 2026 and Oracle posting 14% revenue growth in the second quarter of fiscal 2026. The companies share similar growth drivers — surging cloud adoption, AI workload expansion, and massive capital expenditure programs to build datacenter capacity. Yet their financial profiles, strategic positioning, and execution risks differ significantly.

Let's delve deep and closely compare the fundamentals of the two stocks to determine which one is a better investment now.

Microsoft's diversified AI ecosystem positions the company for sustained growth across multiple revenue streams. The company's first-quarter fiscal 2026 results demonstrated robust momentum with Microsoft Cloud revenues surpassing $49 billion, up 26% year over year. Azure and other cloud services grew approximately 40%, driven by both traditional cloud migrations and expanding AI workloads. The company's commercial remaining performance obligations reached nearly $400 billion, up more than 50%, providing exceptional revenue visibility.

In December 2025, Microsoft announced $23 billion in new AI investments, including $17.5 billion in India — its largest investment in Asia — and $5.4 billion in Canada over the next few years. These geographic expansions demonstrate Microsoft's commitment to building sovereign cloud capacity and meeting global AI demand. The company also launched Microsoft 365 Copilot Business at $21 per user per month for small and mid-sized businesses, broadening AI adoption beyond Fortune 500 enterprises.

Microsoft's partnership with Cognizant, announced in December, extends its healthcare, retail, financial services, and manufacturing AI capabilities through agentic AI and Copilot integration. The company also announced Microsoft 365 pricing increases effective July 2026, reflecting pricing power and confidence in its value proposition. With operating income up 22% in the first quarter and adjusted earnings per share reaching $4.13, Microsoft maintains strong profitability despite heavy AI infrastructure investments.

Management's second-quarter fiscal 2026 guidance projects Intelligent Cloud revenues of $32.25 billion to $32.55 billion with 26-27% growth. While Microsoft acknowledged capacity constraints through at least fiscal year-end 2026, the company's $34.9 billion in first-quarter capital expenditures addresses this challenge. The diversified business model spanning productivity software, cloud infrastructure, gaming, and LinkedIn provides multiple growth engines and cushions against any single segment weakness.

The Zacks Consensus Estimate for MSFT’s fiscal 2026 earnings is pegged at $15.61 per share, up 0.1% over the past 30 days. The estimate indicates 14.44% year-over-year growth.

Microsoft Corporation price-consensus-chart | Microsoft Corporation Quote

Oracle delivered impressive cloud infrastructure growth of 68% in second-quarter fiscal 2026, with total cloud revenues reaching $8 billion, up 34% year over year. The company's remaining performance obligations surged to $523 billion, up 438% year over year, driven by massive contracts from Meta, NVIDIA, and OpenAI. This unprecedented backlog provides multi-year revenue visibility, with management projecting an additional $4 billion in fiscal 2027 revenues from faster RPO conversion.

Oracle's multicloud strategy gained traction in December 2025 with expanded Oracle Database@Google Cloud availability in India and other regions. The company has built more than 211 live and planned cloud regions globally and is halfway through embedding 72 Oracle Multicloud datacenters within Amazon, Google, and Microsoft clouds. The multicloud database business surged 817% in the second quarter, representing Oracle's fastest-growing segment.

December brought significant strategic developments, including Michigan regulators approving Oracle's 1-gigawatt data center with OpenAI, and the company securing a controlling interest in TikTok's U.S. operations through a joint venture. These wins position Oracle as a critical cloud and security infrastructure provider for major platforms. However, financing challenges emerged when Blue Owl Capital withdrew from backing the $10 billion Michigan project, forcing Oracle to explore alternative funding structures.

Oracle's elevated capital expenditure trajectory raises concerns. The company now expects approximately $50 billion in fiscal 2026 capex, up from $35 billion projected in September. Free cash flow turned negative $10 billion in the second quarter as infrastructure spending accelerated. Management maintains commitment to investment-grade debt ratings but acknowledged exploring customer-funded equipment purchases and supplier chip leasing to reduce financing needs. Software revenues declined 3%, highlighting Oracle's transition challenges from legacy licensing to cloud subscriptions. For third-quarter fiscal 2026, Oracle guided to 16-18% total revenue growth and 12-14% non-GAAP EPS growth, solid but moderating from recent quarters.

The Zacks Consensus Estimate for ORCL’s fiscal 2026 earnings is pegged at $7.33 per share, marking an upward revision of 7.6% over the past 30 days. The earnings figure suggests 21.56% growth over the figure reported in fiscal 2025.

Oracle Corporation price-consensus-chart | Oracle Corporation Quote

Microsoft trades at 28.8x forward earnings while Oracle trades at 25.38x forward earnings. Both stocks command premium valuations reflecting AI growth expectations. Microsoft's price-to-earnings ratio, while elevated, is supported by consistent double-digit revenue growth, expanding operating margins, and a multi-year AI monetization runway across productivity, infrastructure, and applications. Oracle's lower multiple reflects execution uncertainty around converting its massive backlog into profitable revenues while managing unprecedented capex without compromising financial flexibility.

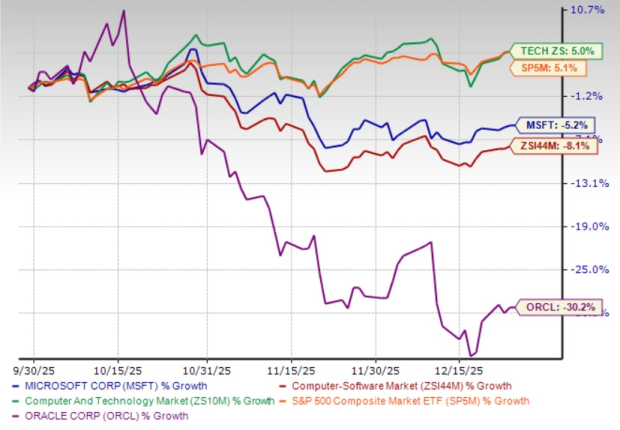

Microsoft's shares lost 5.2% in the past three-month period, outperforming Oracle, which has experienced significant volatility, plunging 30.2% in the same time frame due to financing concerns.

Microsoft emerges as the superior choice for investors seeking enterprise cloud and AI exposure. The company's diversified business model reduces concentration risk while its Azure platform benefits from both cloud migration and AI workload expansion. Microsoft's proven ability to monetize AI through Copilot adoption, strong pricing power evidenced by upcoming Microsoft 365 increases, and geographic expansion in India and Canada position it for sustained growth. While Oracle offers compelling cloud infrastructure growth, the company faces significant challenges around financing $50 billion in capex, converting its massive backlog efficiently, and managing customer concentration risks with OpenAI. Investors should watch Microsoft stock for attractive entry points given its 14% pullback from highs, while holding Oracle stock or waiting for better entry points until the company demonstrates improved capital efficiency and reduced financing uncertainty. Microsoft and Oracle carry a Zacks Rank #3 (Hold) each at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 23 min | |

| 50 min | |

| 1 hour | |

| 1 hour | |

| 2 hours | |

| 2 hours | |

| 3 hours | |

| 3 hours | |

| 3 hours | |

| 3 hours | |

| 3 hours | |

| 3 hours | |

| 4 hours | |

| 5 hours | |

| 5 hours |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite