|

|

|

|

|||||

|

|

Amphenol APH and TE Connectivity TEL are well-known global manufacturers of electronic connectors, sensors, and interconnect systems, serving similar industries such as automotive, aerospace, industrial, and data communications.

Per Fortune Business Insight report, the global electronic components market was valued at $393.63 billion in 2024 and is expected to grow from $428.22 billion in 2025 to $847.88 billion by 2032, with a CAGR of 10.3% over the forecast period 2025-2032. Both Amphenol and TE Connectivity are likely to gain from the massive growth opportunity highlighted by the growth pace.

However, tariffs on electronic components could increase production costs, potentially slowing growth and affecting profit margins for companies like Amphenol and TE Connectivity.

APH or TEL — Which of these Electronics stocks has the greater upside potential? Let’s find out.

Amphenol has been benefiting from higher revenues across the IT datacom, mobile networks, broadband, defense, commercial air and mobile devices automotive end markets.

In the fourth quarter of 2024, Amphenol saw record orders of $5.14 billion, up 58% year over year, resulting in a book-to-bill ratio of 1.16:1. The strong orders were primarily driven by increased demand from data centers, especially due to investments in artificial intelligence (AI) by several large customers.

Acquisitions have helped APH strengthen its product offerings and expand its customer base. The buyouts contributed 8% to 2024 revenues. The acquisition of CIT has expanded Amphenol’s footprint across defense, commercial air and industrial end markets. The Lutze acquisition strengthens APH’s broad offering of high-technology interconnect products for industrial markets and expands the range of value-added interconnect products.

In February 2025, APH announced the completion of its acquisitions of CommScope’s Outdoor Wireless Networks and Distributed Antenna Systems businesses, which are expected to generate $1.3 billion in 2025 sales. The company also concluded the acquisition of Lifesync Corporation, a medical interconnect provider with $100 million in annual sales.

TE Connectivity is benefiting from secular growth trends in key markets and increasing demand for connectivity solutions, especially in AI, automotive electrification, and industrial automation.

The company saw orders grow to $4 billion, both sequentially and year over year, in the first quarter of fiscal 2025, driven by strong growth in its Industrial segment. This includes increased momentum in AI applications and strong demand in aerospace, defense, and energy sectors.

TEL’s strong momentum in AI applications, particularly in digital data networks, has been noteworthy. Its design wins in hyperscale AI platforms have set the company up for substantial revenue growth, which is expected to exceed $600 million in fiscal 2025.

Acquisitions have also played an important role in strengthening TEL’s portfolio. The Harger acquisition in the first quarter of fiscal 2025 expanded TEL’s portfolio in grid reliability and connectivity solutions, particularly for renewable power and utility infrastructure, strengthening its position in the energy sector.

In February 2025, TEL announced plans to acquire Richards Manufacturing for $2.3 billion in cash, aiming to strengthen its position in the North American energy market. The acquisition is expected to add $400 million in annual sales.

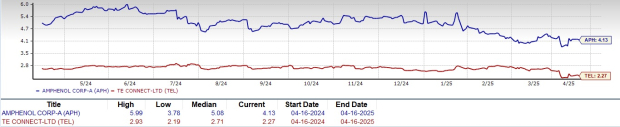

In the trailing 12-month period, APH shares have rallied 16.8%, outperforming TEL shares, which have lost 9.7%. The drop in TEL’s share price is due to a challenging macroeconomic environment and unfavorable forex due to a stronger U.S. dollar. TEL expects unfavorable forex to hurt fiscal 2025 revenues by more than $300 million on a year-over-year basis. Along with this, a broader market weakness in the tech sector and persistent fear over mounting tariffs by the current government have added to the pressure.

Valuation-wise, APH shares are currently overvalued, as suggested by a Value Score of D, whereas TEL shares are cheap, as suggested by a Value Score of B.

In terms of forward 12-month Price/Sales, APH shares are trading at 4.13X, higher than TEL’s 2.27X.

The Zacks Consensus Estimate for APH’s 2025 earnings is pegged at $2.34 per share, which has remained unchanged over the past 30 days. This indicates a 23.81% increase year over year.

Amphenol Corporation price-consensus-chart | Amphenol Corporation Quote

The Zacks Consensus Estimate for TEL’s fiscal 2025 earnings is pegged at $8.05 per share, which has remained unchanged over the past 30 days. This indicates a 6.48% increase year over year. (Find the latest EPS estimates and surprises on Zacks Earnings Calendar).

TE Connectivity Ltd. price-consensus-chart | TE Connectivity Ltd. Quote

Despite TEL’s headwinds, the company expects continued strong growth in hybrid and EV production. In the commercial transportation segment, demand for heavy trucks is expected to improve later this year, which bodes well for TEL’s top-line growth. Its cheap valuation and strong earnings growth also make the stock more attractive for investors seeking growth in the electronics components market.

Although APH’s robust portfolio and expanding clientele bodes well for the company, it suffers from macroeconomic uncertainty and geopolitical tension, which are affecting the business negatively. Seasonal declines are also expected in mobile devices and automotive markets in first-quarter 2025. Stiff competition also remains a headwind.

While TEL carries a Zacks Rank #2 (Buy), APH has a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-16 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-12 | |

| Feb-12 | |

| Feb-12 | |

| Feb-11 | |

| Feb-11 | |

| Feb-11 | |

| Feb-11 | |

| Feb-10 | |

| Feb-10 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite