|

|

|

|

|||||

|

|

The year 2025 will go down in financial history as the year the metals complex finally woke up. For investors watching the tickers, the moves have been nothing short of historic. A perfect storm of Federal Reserve rate cuts has weakened the dollar and lit a fuse under hard assets.

Gold has surged approximately 73% year-to-date, shattering ceilings to trade near $4,540 per ounce. Silver has performed even more aggressively, climbing more than 140% to trade above $70. These moves have generated life-changing wealth for early adopters, but they have also created anxiety among those on the sidelines.

The fear of missing out (FOMO) is palpable. New capital entering the market today faces a difficult psychological hurdle: Is it too late to buy at all-time highs? While precious metals may still have room to run based on monetary policy and geopolitical fears, the risk-to-reward ratio has undeniably shifted. However, scanning slightly further down the commodities list reveals a glaring divergence.

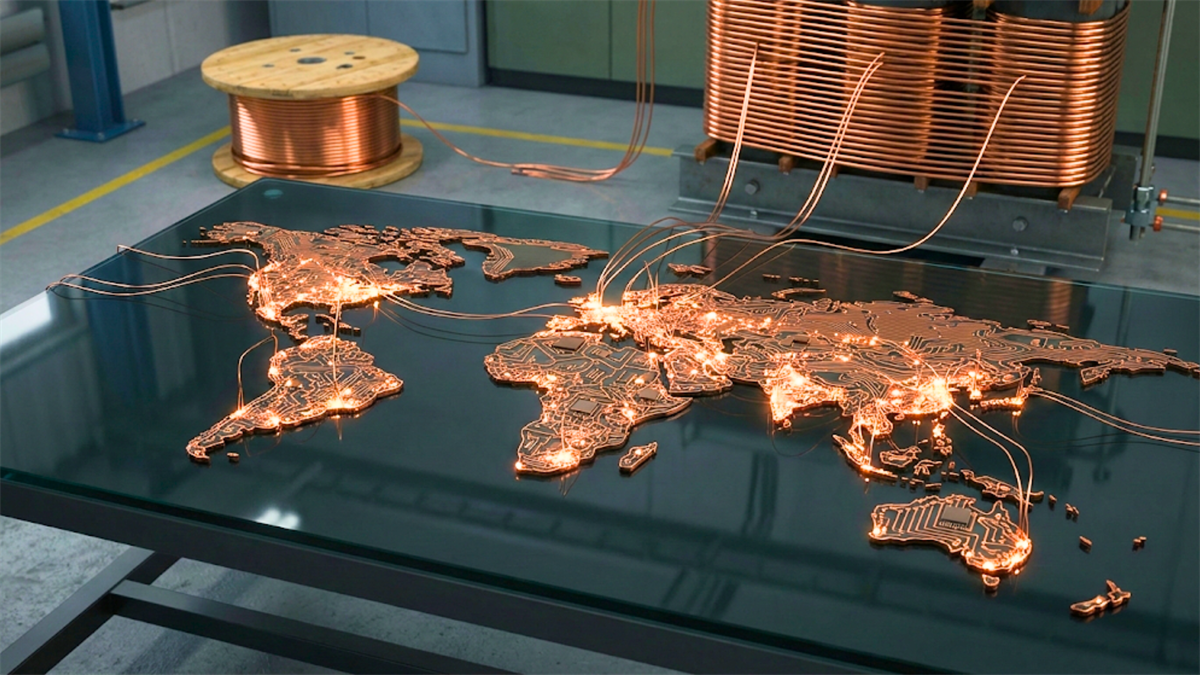

Copper, often called "Dr. Copper" for its ability to gauge the health of the global economy, is up roughly 38% this year. In a normal market, a 38% gain would be front-page news. But in the shadow of gold and silver’s parabolic runs, copper looks like a distinct value play. Trading around $5.77 per pound, copper has not yet experienced the catch-up rally that historically occurs in the second phase of a commodities supercycle. As 2026 approaches, market dynamics suggest the red metal is mathematically primed to close this valuation gap.

Historically, copper demand was tied to traditional, old-economy industries: homebuilding, manufacturing, and electrical infrastructure. If GDP growth slowed, copper prices dropped. That correlation is breaking down because a new, price-inelastic buyer has entered the market: Artificial Intelligence (AI).

The rapid buildout of AI infrastructure requires massive amounts of power and cooling systems, both of which are incredibly copper-intensive. A standard data center uses significant copper for cabling and power distribution, but the new generation of AI-specific centers requires exponentially more. Data from BloombergNEF indicates that copper demand specifically for data centers could reach 572,000 tonnes annually by 2028.

This surge in demand is colliding with a rigid, unresponsive supply chain. In the tech sector, software can be updated overnight. In the mining sector, reality moves much more slowly. It takes, on average, over 15 years to discover, obtain permits for, and build a new copper mine.

Wood Mackenzie, a leading energy research consultancy, forecasts a refined copper deficit of 304,000 tonnes for 2025/2026. This is known as a structural deficit. The demand is real and immediate, but the new supply is years away. This imbalance creates a natural price floor. For investors, this means the driver of copper prices is no longer just whether the economy is growing; it is the physical inability of miners to dig metal out of the ground fast enough to meet the tech sector's needs.

Investors looking to capitalize on this supply-demand mismatch have several options. The key is to identify companies with strong fundamentals that can convert higher copper prices into free cash flow without taking on excessive risk.

As North America’s premier copper producer, Freeport-McMoRan (NYSE: FCX) offers direct leverage to the spot price of the metal.

For investors seeking stability and income alongside growth, Southern Copper (NYSE: SCCO) is a compelling alternative.

Mining is an operationally complex business.

Strikes, weather events, political shifts in South America, or engineering failures can severely impact individual companies.

As the calendar turns to 2026, the distinction between the metals becomes clear. Gold serves a vital role in preserving wealth and providing insurance against monetary instability. Copper, however, offers a vehicle for aggressive growth. The combination of the green energy transition and the unexpected AI boom has created a demand shock that the mining industry is currently ill-equipped to satisfy.

The current valuation gap between the soaring precious metals and the steady industrial metals is unlikely to last. With global inventories at critical lows and the projected deficit widening, the path of least resistance for copper prices appears to be higher. For the measured investor, rotating a portion of profits from the high-flying gold trade into the sleeping giant of copper offers a logical strategy to capture the next phase of the supercycle.

Before you make your next trade, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis.

Our team has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and none of the big name stocks were on the list.

They believe these five stocks are the five best companies for investors to buy now...

The article "Gold and Silver Exploded—Now Copper May Be the Next Big Trade" first appeared on MarketBeat.

| Feb-16 | |

| Feb-14 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-12 | |

| Feb-12 | |

| Feb-12 | |

| Feb-12 | |

| Feb-12 | |

| Feb-11 | |

| Feb-11 | |

| Feb-11 | |

| Feb-11 | |

| Feb-11 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite