|

|

|

|

|||||

|

|

Suncor Energy Inc. SU is a leading integrated energy company based in Canada, primarily involved in the production of oil and natural gas, as well as the refining and marketing of petroleum products. The company operates in a variety of segments, including oil sands development, conventional oil and gas exploration, and renewable energy sources. As one of Canada's largest and most influential energy firms, Suncor plays a significant role in the oil and gas sector, contributing not only to the country's energy supply but also to global energy markets.

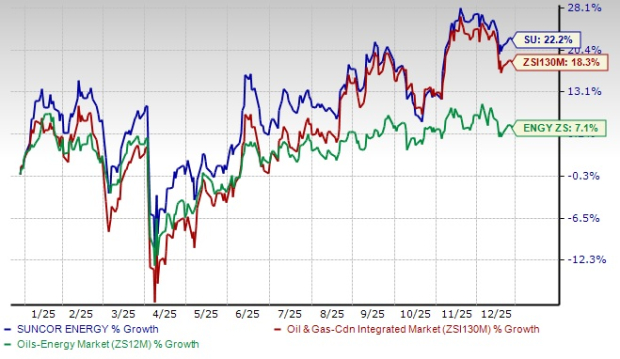

12-Month Stock Performance

Over the past 12 months, SU has outperformed both the Oil & Gas-Canadian Integrated sub-industry (ZSI130M) and the broader Oil-Energy sector (ZS12M). Suncor's growth of 22.2% stands out significantly compared to 18.3% growth of the Oil & Gas-Canadian Integrated sub-industry and the 7.1% increase in the broader Oil-Energy sector.

This outperformance highlights Suncor's resilience and strategic positioning within the industry, reflecting its ability to adapt and perform well even amid fluctuating market conditions. Additionally, over the past 60 days, the Zacks Consensus Estimate for SU's earnings per share has improved 15.14% for 2025 and 14.53% for 2026.

Let’s explore the key factors behind Suncor's strong performance over the past 12 months and assess whether this positive trend is likely to continue in the future.

Integrated Business Model Providing a Competitive Moat: Suncor’s fully integrated model — from oil sands extraction through refining and retail sales under the Petro-Canada brand — represents a distinct competitive advantage. CEO Rich Kruger has stated that the company has no true Canadian peer due to this unique structure. By capturing margin at every step of the value chain, the model provides natural hedges and delivers more predictable, ratable cash flows with reduced reliance on volatile crude oil prices, offering investors a premium value proposition.

Sustained High Downstream Utilization Guidance: The company expects its strong downstream performance to continue into 2026. Refinery utilization is guided to average between 99% and 102%, reflecting "continued improved performance across the company’s entire downstream portfolio." This sustained high utilization, even while incorporating planned turnarounds at all four refineries, indicates a structural improvement in reliability and efficiency, locking in higher throughput and sales volumes.

Prudent Balance Sheet Management and Deleveraging: SU has made consistent progress in strengthening its balance sheet. Net debt was reduced to C$7.1 billion as of Sept. 30, 2025, down from C$7.7 billion at the end of the prior quarter and C$8.0 billion in the third quarter of 2024. The net debt to trailing 12-month adjusted funds from operations (“AFFO”) ratio stands at a healthy 0.5x. This deleveraging provides financial flexibility and reduces risk, creating a buffer for economic downturns and supporting sustained capital returns.

Downstream Transformation From "Good to Great": Suncor's downstream segment is undergoing a notable transformation. Beyond record throughput and utilization, the company is strategically improving its sales channel mix. It is growing higher-margin retail and wholesale sales (retail sales up 8% year-on-year) while reducing lower-margin exports. This focus on value over pure volume, coupled with incremental capacity creep and a strong trading organization, enhances downstream profitability and its role in corporate financial resilience.

Record Operational Performance and Upward Guidance Revisions: The company is consistently setting new operational records. The third quarter of 2025 saw record upstream production (870,000 bbls/d), record refinery throughput (492,000 bbls/d), and record refined product sales (647,000 bbls/d). This strong performance is not a one-off. It prompted Suncor to upwardly revise its full-year 2025 guidance for production, throughput, and sales. This trend of outperformance and raising guidance indicates improving operational efficiency and reliability.

Commits to Aggressive Share Buyback Program for 2026: SU has explicitly reinforced its shareholder return focus for the upcoming year. The company recently announced its new guidance, an increase in monthly share repurchases to C$275 million, projecting a total of C$3.3 billion in buybacks for 2026. This represents a 10% increase from the prior C$250 million monthly run rate and underscores a firm commitment to returning 100% of excess cash to shareholders, directly supporting per-share metrics.

Sustained High Downstream Utilization Guidance: The company expects its strong downstream performance to continue into 2026. Refinery utilization is guided to average between 99% and 102%, reflecting "continued improved performance across the company’s entire downstream portfolio." This sustained high utilization, even while incorporating planned turnarounds at all four refineries, indicates a structural improvement in reliability and efficiency, locking in higher throughput and sales volumes.

Fort Hills Asset Optimization and Growth Potential: The Fort Hills asset, now fully owned by Suncor, is showing strong performance and growth potential. Third-quarter production was robust, and the mine plan development (North Pit 1 & 2) is progressing well. Management expressed high confidence in the plant's capacity and aims to take volumes toward nameplate (195,000-200,000 bbls/d) in the coming years. Successful optimization of this key asset contributes meaningfully to upstream growth and cash flow.

Suncor's integrated business model, which spans oil sands extraction to refining and retail sales through Petro-Canada, provides a competitive edge by capturing margin at every stage and offering more predictable cash flows. The company has also shown sustained high performance in its downstream segment, with refinery utilization expected to remain strong through 2026, reflecting improved reliability and efficiency.

With a focus on prudent balance sheet management, Suncor has reduced net debt and increased financial flexibility, enhancing its ability to weather economic downturns. Additionally, the company's aggressive share buyback program and record operational performance underline its commitment to delivering strong returns to shareholders. With the company’s potential for improved financial performance and enhanced operational stability, investors may want to stay optimistic about its growth prospects. As the company continues to strengthen its position in the oil and gas sector, it presents exciting opportunities for those seeking to capitalize on long-term gains.

Currently, SU flaunts a Zacks Rank #1 (Strong Buy).

Investors interested in the energysector might consider other stocks with favorable rankings, such as USA Compression Partners USAC and Oceaneering International OII, both sporting a Zacks Rank #1, and TechnipFMC plc FTI, carrying a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

USA Compression Partners is valued at $2.81 billion. The company is a leading provider of natural gas compression services in the United States. USA Compression Partners specializes in the design, operation and maintenance of compression equipment for the energy sector, focusing on helping customers optimize their natural gas infrastructure.

Oceaneering International is valued at $2.41 billion. The company is a global provider of engineered services and products to the offshore energy, aerospace and defense industries. OII specializes in underwater robotics, remotely operated vehicles and subsea engineering solutions for offshore oil and gas exploration and production.

TechnipFMC plc is valued at $18.06 billion. TechnipFMC is a global leader in providing technology and services for the energy industry, specializing in subsea, onshore, offshore, and surface projects. The company offers innovative solutions that enable its clients to deliver complex projects efficiently and sustainably.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 7 hours | |

| 8 hours | |

| 10 hours | |

| 10 hours | |

| 12 hours | |

| 12 hours | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite