|

|

|

|

|||||

|

|

Disney DIS and Comcast CMCSA represent two powerhouses in the entertainment and media landscape, each commanding significant market presence through diverse business portfolios. Disney, the century-old entertainment pioneer, operates through its iconic theme parks, streaming services, including Disney+ and Hulu, and unparalleled content creation capabilities. Meanwhile, Comcast combines its connectivity infrastructure with NBCUniversal's content assets, the Peacock streaming platform, and Universal theme parks. Both companies stand at pivotal junctures as they navigate evolving consumer preferences, streaming profitability challenges, and shifting media consumption patterns.

The competitive dynamics between these giants have intensified in recent months. Disney achieved a landmark fourth-quarter fiscal 2025 with full-year revenues reaching $94.4 billion and streaming operations turning consistently profitable. In November 2025, Disney announced record operating income of $10 billion for its Experiences segment while projecting double-digit adjusted EPS growth for fiscal 2026. Comcast, reporting third-quarter 2025 results in October, demonstrated resilience with solid free cash flow generation of $4.9 billion despite revenue headwinds. December 2025 brought significant corporate action from Comcast, with its board approving the separation of cable networks into Versant Media Group, scheduled for completion on Jan. 2, 2026, fundamentally reshaping its business structure.

The timing for comparison couldn't be more relevant. Let's delve deep and closely compare the fundamentals of the two stocks to determine which one is a better investment now.

Disney's investment thesis centers on an impressive transformation narrative, positioning the company for sustained growth across multiple revenue streams. The streaming business achieved a remarkable turnaround in fourth-quarter fiscal 2025, delivering operating income of $352 million in the quarter and $1.33 billion for the full year, successfully meeting its profitability target. Disney+ subscribers reached 132 million, adding 3.8 million in the fourth quarter alone, while combined Disney+ and Hulu subscriptions totaled 196 million. Management's guidance projects Disney+ and Hulu achieving 10% operating margins in fiscal 2026, demonstrating pricing power and operational efficiency.

The Experiences segment serves as Disney's profit engine, generating a record $10 billion in operating income for fiscal 2025, representing an 8% increase year over year. Fourth-quarter segment operating income reached $1.9 billion, up 13% from the prior year. CEO Bob Iger announced that advance bookings are up 3% for first-quarter fiscal 2026 and positive for the full year, indicating sustained demand. The company's strategic expansion received a significant boost with November 2025's landmark Disney theme park resort announcement in Abu Dhabi, UAE, in partnership with Miral. This seventh Disney resort globally taps into massive addressable markets within a four-hour flight radius of one-third of the world's population.

Disney's content momentum remains robust. The live-action Lilo & Stitch became the highest-grossing Hollywood film at global box offices in calendar 2025, generating 14.3 million views in its earliest Disney+ days for the service's largest premiere ever. Disney's cruise line expansion continues with Disney Destiny launching on Nov. 20, 2025, and Disney Adventure scheduled for March 10, 2026. Management provided confident fiscal 2026 guidance projecting double-digit Entertainment segment operating income growth, high single-digit Experiences growth, and double-digit adjusted EPS growth continuing through fiscal 2027. Disney doubled its share repurchase target to $7 billion and increased its annual dividend to $1.50 per share.

The consensus mark for fiscal 2026 earnings is pegged at $6.60 per share, indicating 11.3% year-over-year growth.

The Walt Disney Company price-consensus-chart | The Walt Disney Company Quote

Comcast presents a diversified business model balancing connectivity infrastructure with content and experiences, offering steady cash generation despite near-term challenges. Third-quarter 2025 results showed adjusted EPS of $1.12, matching the prior year and beating analyst expectations, while free cash flow surged 45% to $4.9 billion. The company returned $2.8 billion to shareholders through share repurchases and dividends, demonstrating a commitment to shareholder returns. Comcast's Content & Experiences segment delivered notable success with Epic Universe's opening on May 22, 2025, driving theme park revenue growth of 19% to $2.35 billion in the second quarter.

The Connectivity & Platforms segment, representing approximately 68% of revenues, faces structural headwinds but provides substantial cash flow supporting growth investments. Management implemented strategic pricing pivots in mid-2025, introducing five-year price guarantees and simplified packaging to stabilize the broadband customer base. Wireless emerged as a core growth driver with 378,000 line additions in second-quarter 2025, marking the business' best quarter ever, while convergence revenues grew 2.5%, supported by mid-teens wireless growth. Peacock showed meaningful progress with paid subscribers increasing 24.2% year over year to 41 million and revenues jumping 18% to $1.2 billion.

In December 2025, Comcast's board approved a transformative restructuring, separating cable networks and digital platforms into Versant Media Group, scheduled for completion on Jan. 2, 2026. The company also announced the redemption of $2.75 billion in outstanding notes, reflecting strategic financial management.

However, challenges persist. Third-quarter revenues decreased 2.7%, reflecting unfavorable Olympic comparisons, while Connectivity & Platforms lost 349,000 customer relationships. Management guided continued broadband ARPU pressure in early 2026 with no planned rate increases.

The consensus mark for 2026 earnings is pegged at $4.11 per share, indicating a decline of 1.79% year over year.

Comcast Corporation price-consensus-chart | Comcast Corporation Quote

Both Disney and Comcast trade at discounted valuations relative to historical ranges, though with markedly different multiples reflecting divergent growth trajectories. Disney trades at a 16.72x forward P/E, representing a premium to Comcast's 7.22x multiple. Disney's higher multiple reflects investor confidence in its streaming profitability turnaround, superior content monetization capabilities, global theme park expansion opportunities, and proven pricing power. Disney's premium valuation appears justified, given its transformation trajectory and integrated ecosystem, creating multiple touchpoints for IP monetization.

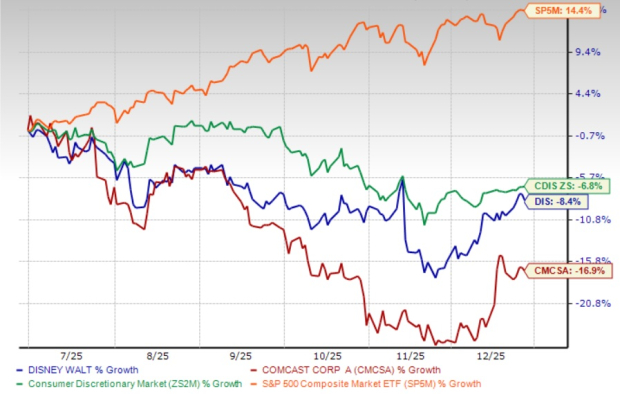

Six-month price performance through December 2025 favors Disney despite underperforming the Zacks Consumer Discretionary sector. While shares of Disney have lost 8.4%, Comcast has plunged 16.9% in the past six-month period.

Disney emerges as the compelling investment choice with superior upside potential. Disney's successful streaming transformation from losses to $1.33 billion in annual profitability, combined with record $10 billion Experiences operating income, demonstrates execution capability. The strategic Abu Dhabi expansion positions Disney to capture growth in emerging markets, while domestic parks maintain record revenues and industry-leading pricing power. Management's confident double-digit adjusted EPS growth guidance for fiscal 2026 and 2027, coupled with doubling share repurchases to $7 billion, reflects strong financial positioning. Investors should actively track Disney stock for attractive entry opportunities to participate in its transformation story and global expansion prospects, while maintaining a watchful stance on Comcast, awaiting clearer stabilization signals following the Versant separation. DIS and CMCSA carry a Zacks Rank #3 (Hold) each at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 4 hours | |

| 4 hours | |

| 6 hours | |

| 8 hours | |

| 10 hours | |

| 10 hours | |

| 11 hours | |

| 11 hours | |

| Mar-09 | |

| Mar-09 | |

| Mar-09 | |

| Mar-09 | |

| Mar-09 | |

| Mar-09 | |

| Mar-09 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about Finviz Elite