|

|

|

|

|||||

|

|

The Federal Reserve reduced interest rates by 25 basis points at the end of its December Federal Open Market Committee meeting. This reduction in rate was highly anticipated by the market, lowering the federal funds rate to a target range of 3.5% to 3.75%.

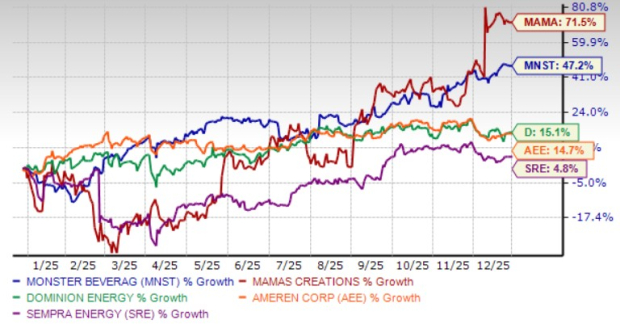

Given the current uncertainty relating to the path to be followed by the Federal Reserve on interest rates, let us focus on stocks from the less volatile Zacks Consumer Staples and Utilities sector. Consumer staples stocks like Monster Beverage MNST and Mama's Creations, Inc. MAMA currently sport a Zacks Rank #1 (Strong Buy). Utilities stocks like Dominion Energy (D), Ameren Corporation AEE and Sempra Energy SRE all currently carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Also, these stocks mentioned above belong to the category of low-beta stocks (beta greater than 0 but less than 1). In addition, all these stocks are expected to come out with earnings growth in 2026 along with a favorable Zacks Rank.

Jerome Powell’s term as chair of the Federal Reserve is set to end on May 15, 2026, and a new leader is expected to take over the role at that time. The Federal Reserve lowered interest rates three times in 2025 amid mixed data about inflation and unemployment. As the new chair takes office, clearer insight into how the Federal Reserve will operate under new leadership is likely to emerge in the second half of 2026, since three of the four scheduled meetings in the first half of the year will still be held under the current chair’s tenure.

How the Federal Reserve will act in 2026 under the leadership of the new Chair remains uncertain. A key question is whether the current pace of rate declines will be maintained or if the Fed will move toward more aggressive cuts. Ultimately, decisions on interest rates will continue to be shaped by core factors such as inflation trends, economic growth, consumer spending, and labor market conditions, which will guide both the formulation and timing of policy actions.

The interest rates play a vital role in the capital-intensive sector, such as utilities. Decline in interest rates undoubtedly makes utilities more profitable as it lowers capital servicing costs and boosts the margin of the company.

As the Federal Reserve prepares for a leadership transition in 2026, policy uncertainty is likely to remain elevated. Markets will closely watch whether the new Chair will be able to continue with the current rate cut levels or come out with a more aggressive easing stance.

The period of uncertainty when the Fed baton changes hands is the lack of clarity around future policy direction under new leadership. Until the new chair establishes credibility and communicates clear priorities, investors face uncertainty over the pace of rate cuts.

This uncertainty can heighten short-term market swings, especially for high-beta stocks that are more sensitive to interest rate changes and shifts in economic expectations. So low-beta stocks can be an ideal pick for investors amid the period of uncertainty.

We have used the Zacks Stocks Screener to shortlist five stocks from the consumer staples and utilities sector having a Zacks Rank #1 or a Zacks Rank #2 and a beta of less than 1, which indicates lesser stock volatility compared with the broader market. All these stocks are expected to continue their strong performance next year.

All stocks mentioned below also registered a gain in the last 12 months.

Monster Beverage is based in Corona, CA, and benefits from strong global demand for energy drinks, a powerful brand portfolio, and expanding international distribution. Its asset-light model, solid margins, and consistent cash generation support steady earnings growth, making it a resilient consumer staples-style holding amid economic uncertainty. The company currently sports a Zacks Rank #1.

Monster Beverage has a beta of 0.48. The long-term (three to five years) earnings growth of Monster Beverage is currently pegged at 16.81%. The Zacks Consensus Estimate for 2026 earnings per share indicates an increase of 5.14% in the past 60 days. The Zacks Consensus Estimate for 2026 sales of $9 billion reflects a growth of 9.48%.

Mama’s Creations Inc., based in East Rutherford, NJ, focuses on fresh, prepared Italian-inspired foods sold through major retailers. Its strong brand recognition, expanding distribution, and growing demand for convenient fresh meals support steady revenue growth and improving margins, making it an attractive small-cap consumer staples play. The company currently sports a Zacks Rank #1.

Mama’s Creations has a beta of 0.79. The Zacks Consensus Estimate for 2026 earnings per share indicates an increase of 4.35% in the past 60 days. The Zacks Consensus Estimate for 2026 sales of $218.2 million reflects a growth of 26.49%.

Dominion Energy, headquartered in Richmond, VA, operates regulated electric and natural gas utilities with predictable, rate-based earnings. Its focus on grid modernization, renewable generation, and stable cash flows supports dividend reliability and long-term growth, making it a defensive utility investment amid economic and rate uncertainty. The company currently has a Zacks Rank #2.

Dominion Energy has a beta of 0.70. The long-term earnings growth of Dominion Energy is currently pegged at 10.26%. The current dividend is 4.51% better than the Zacks S&P 500 Composite’s yield of 1.4%. The Zacks Consensus Estimate for 2026 earnings per share indicates an increase of 0.28% in the past 60 days. The Zacks Consensus Estimate for 2026 sales of $16.48 billion reflects a growth of 5.14%.

Ameren Corporation, based in St. Louis, MO, operates regulated electric and gas utilities across the Midwest. Its large capital investment plan, supportive regulatory environment, and growing focus on clean energy infrastructure drive predictable earnings growth, stable cash flows, and attractive long-term returns for defensive investors. The company currently has a Zacks Rank #2.

Ameren has a beta of 0.57. The long-term earnings growth of Ameren is currently pegged at 8.52%. The current dividend is 2.85%. The Zacks Consensus Estimate for 2026 earnings per share indicates an increase of 0.56% in the past 60 days. The Zacks Consensus Estimate for 2026 sales of $9.71 billion reflects a growth of 6.33%.

Sempra Energy, headquartered in San Diego, CA, operates regulated electric and natural gas utilities in the United States and Mexico. Its diversified asset base, long-term infrastructure investments, and constructive regulation support stable cash flows, steady earnings growth, and reliable dividends in volatile market conditions. The company currently has a Zacks Rank #2.

Sempra has a beta of 0.73. The long-term earnings growth of Sempra is currently pegged at 7.33%. The current dividend yield is 2.91%. The Zacks Consensus Estimate for 2026 earnings per share indicates an increase of 0.39% in the past 60 days. The Zacks Consensus Estimate for 2026 sales of $14.74 billion suggests growth of 8.5%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 8 hours | |

| 8 hours | |

| 9 hours | |

| 9 hours | |

| 10 hours | |

| 13 hours | |

| Feb-17 | |

| Feb-17 |

Monster Beverage, Stock Of The Day, Near Buy Point As Growth Accelerates

MNST

Investor's Business Daily

|

| Feb-16 | |

| Feb-16 | |

| Feb-16 | |

| Feb-13 | |

| Feb-13 |

Utility Stocks Ameren, CenterPoint Power Up In Buy Zones Amid Volatile Stock Market

AEE

Investor's Business Daily

|

| Feb-13 | |

| Feb-13 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite