|

|

|

|

|||||

|

|

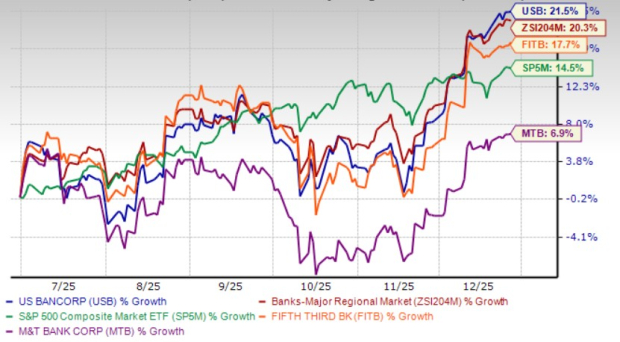

U.S. Bancorp’s USB shares have rallied 21.5% in the past six months, outperforming the industry’s 20.3% and the S&P 500 Index’s 14.5%. Further, the company’s price performance has been better than that of its peers, Fifth Third Bancorp FITB and M&T Bank Corporation MTB. Shares of Fifth Third Bancorp and M&T Bank have gained 17.7% and 6.9%, respectively, in the same time frame.

Following the recent rally, does U.S. Bancorp’s stock offer further upside or warrant a more cautious stance? Let us take a closer look.

Diversified Revenue Growth: The company continues to benefit from solid organic expansion supported by a broadly diversified revenue mix. Over the five years ended 2024, its revenue recorded a compound annual growth rate (CAGR) of 3.6%, with the upward trend continuing in the first nine months of 2025, supported by higher net interest income (NII) and fee-based businesses.

The company’s NII growth has been supported by investment portfolio repositioning and improved deposit trends. Looking ahead, three Federal Reserve rate cuts in 2025 and an expected reduction in 2026 are likely to stabilize funding costs, encourage loan growth, and improve margins, which is expected to support net interest income. Meanwhile, steady expansion in fee-based businesses, driven by product innovation, payments transformation, and growing consumer and commercial deposit relationships, is expected to provide additional revenue support.

Overall, the company remains well-positioned to sustain revenue growth, with management projecting total net revenues to rise 3–5% in 2025 from $27.6 billion in 2024.

Inorganic Expansion to Support Growth: Over the past several years, U.S. Bancorp has completed several acquisitions and partnerships, enabling it to enter new markets, strengthen its existing footprint and enhance its product and service offerings. Recently, in December 2025, the company expanded its embedded finance capabilities by adding KabelSync, Strictly and United Credit as partners to its Avvance point-of-sale lending platform. In the same month, the company enhanced its consumer engagement by expanding its Coinstar partnership, rolling out the Transfer to Account service across more than 100 branches and 10,000 retail kiosks nationwide.

Earlier, U.S. Bancorp strengthened its healthcare vertical with the acquisition of Salucro Healthcare Solutions in 2024. In 2022, the company expanded its branch footprint and digital banking reach through the acquisition of MUFG Union Bank’s core regional banking franchise. Additionally, in 2021, it also enhanced its institutional and fintech capabilities through the buyout of PFM Asset Management and the acquisitions of TravelBank and Bento Technologies.

Together, these inorganic initiatives, along with continued investments in innovation and talent, are expected to diversify revenue streams and support long-term growth, particularly in fee-based businesses.

Decent Liquidity to Support Capital Deployment: The company continues to maintain a sound liquidity position. As of Sept. 30, 2025, the company had cash and due from banks of $66.6 billion, comfortably exceeding its short-term borrowings of $15.4 billion, while long-term debt stood at $62.5 billion.

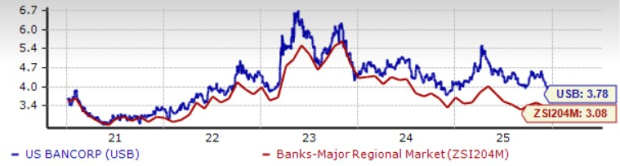

U.S. Bancorp’s strong liquidity profile allows the company to maintain dividends and share repurchases. In September 2025, the company increased its quarterly dividend by 4% to 52 cents per share. The company has raised its dividend five times over the past five years, delivering an annualized dividend growth rate of 3.9%. Its current dividend yield stands at an attractive 3.78%, exceeding the industry’s average yield of 3.08%. Notably, the company’s dividend yield is also far better than Fifth Third Bancorp's 3.31% and M&T Bank’s 2.90%.

Also, USB continues to execute its share repurchase strategy. In September 2024, the board authorized a $5 billion common stock repurchase plan, with $4.8 billion remaining available as of Sept. 30, 2025.

Betting on AI & Digital Infrastructure to Drive Profitability: The company is also advancing its growth strategy through significant investments in artificial intelligence (AI) and digital infrastructure. In November 2025, the bank introduced the U.S. Bank Liquidity Manager, an AI-driven cash forecasting and visibility solution developed with Kyriba, aimed at mid-sized and large enterprises. The tool combines traditional forecasting methods with advanced AI to enhance accuracy, automate daily cash positioning, and manage liquidity across multiple accounts, entities, and currencies.

In October 2025, the next-generation SinglePoint platform was launched, offering more automation, enhanced dashboards, and smoother workflows for daily treasury tasks. Earlier, in June 2025, the company also expanded its Embedded Payment Solutions, adding a for-benefit-of feature and real-time payments, enabling businesses to automate transactions and improve liquidity and fund tracking. The same month, USB partnered with Fiserv to integrate its Elan Financial Services credit card program into Fiserv’s Credit Choice platform, improving digital card issuance and streamlining the experience for financial institutions.

Together, these initiatives are expected to lower operational costs, improve forecasting and cash management, and enhance overall productivity. For 2025, management anticipates generating more than 200 basis points of positive operating leverage, supporting stronger profitability and long-term growth.

Rising Expenses: The company has continued to face increasing costs. Non-interest expenses expanded at a CAGR of 6.1% between 2019 and 2024, driven primarily by higher merger and integration charges, compensation and employee benefits, net occupancy and equipment expenses, and technology and communications investments. Although expenses declined in the first nine months of 2025, further technology-led initiatives could elevate the cost base, potentially pressuring the company’s bottom-line growth.

Loan Concentration Risk: As of Sept. 30, 2025, 51.4% of U.S. Bancorp’s loan portfolio comprised commercial loans, including commercial real estate. Given the rapidly changing macroeconomic environment, this concentration may pose asset quality risks if economic conditions deteriorate. Consequently, the lack of diversification in the loan portfolio could affect the company’s financial performance during adverse economic periods.

USB’s diversified revenue mix, inorganic growth initiatives, solid liquidity position, and investments in digital platforms are likely to support long-term performance. These strengths, combined with stabilizing funding costs and ongoing operational improvements, reinforce the company’s ability to sustain revenue growth and profitability in the coming years.

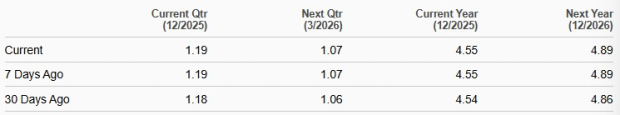

Over the past month, the Zacks Consensus Estimate for earnings for 2025 and 2026 has been revised upward. The anticipated estimates imply growth of 14.3% and 7.8% for 2025 and 2026, respectively.

However, rising expenses and loan concentration in commercial lending represent notable near-term challenges. The company’s ability to manage these risks effectively will be critical to maintaining margins and asset quality.

Thus, USB remains a cautious bet at the moment. Those who own it can continue holding it for long-term gains.

Currently, the company carries a Zacks Rank #3 (Hold). You can seethe complete list of today's Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-24 | |

| Feb-24 | |

| Feb-23 | |

| Feb-23 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite