|

|

|

|

|||||

|

|

New Feature: See Wall Street analyst ratings directly on Finviz charts for deeper context into price action.

Chewy may not be a high-growth machine, but it’s an incredibly steady grower.

Silicon carbide specialist Wolfspeed is fiscally regrouped and ready to fully capitalize on its opportunity.

Coffee drive-thru chain Dutch Bros is leveraging its differences with rival Starbucks to drive sustained growth.

Does the start of a new year have you looking for some new picks for your portfolio? It certainly does for me. Even though the calendar-based premise is purely arbitrary, the idea of a clean slate is a powerful one. If it helps inspire action, use it.

With that as the backdrop, here's a closer look at three of my favorite stocks to buy right now. All three have underperformed of late. But, I've got a feeling that's going to change sooner or later, and likely sooner than later. In no particular order...

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Continue »

Image source: Getty Images.

Amazon is the dominant name of North America's e-commerce market, selling a little of everything to most of the continent's consumers. The online shopping powerhouse isn't undefeatable on every front, though. Specialists that solve very specific problems in a very convenient way can chip away at Amazon's deep reach.

Chewy (NYSE: CHWY) is one such specialist.

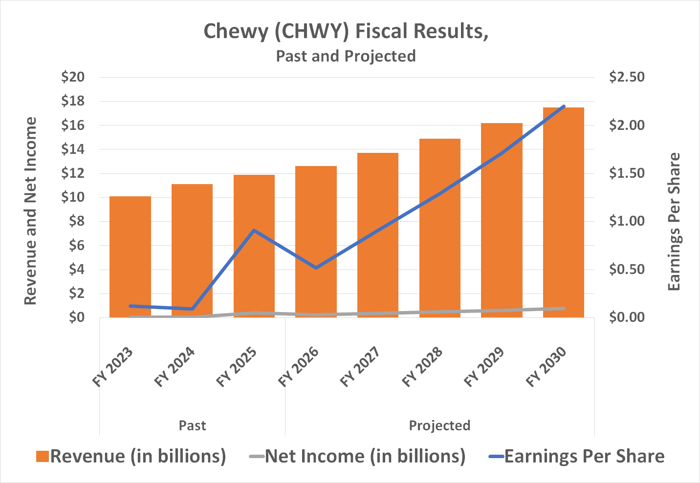

If you're not familiar, Chewy is an online-only pet store. The majority of its revenue comes from sales of pet food and treats, although prescription medications are also part of its repertoire. The company's on pace to do $12.6 billion worth of business this fiscal year (ending in January), up a little more than 6% year over year. Earnings are expected to grow a little more, extending long-lived uptrends that are apt to continue growing at a comparable clip for the next several years.

Data source: Morningstar. Chart by author.

That's admittedly not huge growth. What Chewy lacks in growth, however, it more than makes up for in consistency.

Credit its business model, mostly. An incredible 84% of its revenue comes from customers that subscribe to recurring deliveries of pet food and other consumable pet supplies. And, the company added another 250,000 new customers last quarter alone, bringing its total count up to 21.2 million, each of which spent an average of $595 with Chewy over the course of the past four reported quarters.

While it might be challenging -- and even a little expensive -- to bring a new paying customer into the fold, in the long run it's worth it simply because they usually stick around.

Growth of Chewy's reliably recurring revenue isn't the crux of the reason to make a point of stepping into this stock as soon as possible, though. Rather, this ticker's 33% pullback from the budding recovery effort that started in 2024 may be all the discount you're going to get here.

Wolfspeed's (NYSE: WOLF) backstory is a bit complicated, but worth the digging.

Simply put, Wolfspeed makes silicon carbide, an alternative to the ordinary silicon used in a range of products including electronics, solar power equipment and heavy machinery. Silicon carbide transmits energy more efficiently, but also better tolerates heat and higher amperage loads. That's why it's increasingly being used in electric vehicles' charging components, data center power supplies, industrial HVAC solutions, and more.

Now that it's fully appreciated and cost-effective enough, Global Market Insights believes the worldwide silicon carbide market is set to grow at an average annualized pace of more than 34% through 2034. That's what Wolfspeed saw coming all the way back in 1987, when it was first founded as a company called Cree.

The only problem? The company was way too ahead of its time. By the time the silicon carbide industry really started to gel, Wolfspeed's debt load was overwhelming, making it nearly impossible to fiscally function as it needed.

That all changed this past year, however. In June, the company made the decision to completely reorganize itself, wiping out its stock's value, but also reducing its then-total debt load of a little more than $6.8 billion by about 70% (or $4.6 billion). That's enough to make a major difference in how it navigates its future, inspiring some significant -- even if uneven -- bullish interest in the post-reorganized/newly reissued shares since September.

This volatility isn't likely to abate in the immediate future. Think bigger-picture and longer-term, though. The potential upside is worth the risk. You'll just want to keep this risk in check by limiting the size of any trade.

Finally, I'm adding Dutch Bros (NYSE: BROS) to my list of favorite stocks to buy right now while it's still down 25% from its February peak. This window of opportunity isn't going to remain open forever.

If you've never heard of it, Dutch Bros is a coffee chain. But, while it's frequently compared to much-bigger Starbucks, this comparison is usually made to draw out all the ways it actually contrasts with its massive rival. These contrasts include that Dutch Bros operates drive-thru kiosks, and is much smaller, with only 1,081 locales.

The biggest difference between Dutch Bros and Starbucks (and every other alternative), however, is the authenticity of the personal interactions between its employees and its customers. It's not unusual for the company's "bro-istas" to speak with a customer like a friend, or even a relative, just as it's not unusual for one of its stores to support a local charitable cause.

Indeed, back in 2019, Dutch Bros employees collectively raised more than $6,000 for one of the company's workers to cover unexpected school expenses. And this sort of authenticity is exactly the sort of thing more and more consumers expect of the businesses they buy from.

That's not quite the crux of the reason this stock is such a compelling buy, though; it's only a related sidenote. The chief reason I'm so interested right now is the company's very achievable -- even if very long-term -- growth plans. Dutch Bros now aims to have 2,000 stores up and running by 2029, en route to 4,000 within a decade and 7,000 further down the road.

It will likely need to do some additional fundraising along the way. But, the increasingly profitable, growing company has already proven it can do something constructive with fresh cash injections.

Before you buy stock in Chewy, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Chewy wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $509,470!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,167,988!*

Now, it’s worth noting Stock Advisor’s total average return is 991% — a market-crushing outperformance compared to 196% for the S&P 500. Don't miss the latest top 10 list, available with Stock Advisor, and join an investing community built by individual investors for individual investors.

*Stock Advisor returns as of December 30, 2025.

James Brumley has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Amazon, Chewy, and Starbucks. The Motley Fool recommends Dutch Bros and Wolfspeed. The Motley Fool has a disclosure policy.

| 8 hours | |

| 11 hours | |

| Feb-20 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-18 | |

| Feb-18 | |

| Feb-17 | |

| Feb-17 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite