|

|

|

|

|||||

|

|

New Feature: See Wall Street analyst ratings directly on Finviz charts for deeper context into price action.

As investors look ahead to 2026, the gaming sector is shifting from hype-driven narratives to a sharper focus on execution, monetization and earnings visibility, setting up a timely faceoff between Roblox Corporation RBLX and Take-Two Interactive Software, Inc. TTWO.

Roblox represents a long-duration platform story built on user-generated content, global engagement and expanding monetization tools. At the same time, Take-Two relies on premium franchises, blockbuster release cycles and increasingly diversified publishing assets. With both companies exposed to very different demand drivers and cash flow profiles, the debate heading into 2026 centers on which model offers the more durable growth setup as investors prioritize sustainability over short-term excitement.

Roblox’s 2026 setup is anchored by exceptional platform momentum and expanding scale. In third-quarter 2025, daily active users surged to more than 151 million, with engagement hours up over 90% year over year, signaling that growth is being driven by usage intensity rather than one-off hits. Importantly, bookings growth outpaced user growth, supported by a sharp rise in monthly unique payers and strong monetization across regions. This combination suggests Roblox is still early in penetrating the global gaming market, with management estimating just more than 3% share today, leaving a long runway for expansion into 2026.

A key positive for 2026 is Roblox’s accelerating evolution beyond its historical core audience. Older users are becoming a larger and more engaged part of the platform, with the 13-and-over cohort now representing the majority of both DAUs and total hours. This demographic shift broadens monetization potential and aligns Roblox more closely with mainstream gaming categories. Management also emphasized that new viral experiences are increasingly attracting older players organically, reinforcing the idea that Roblox is transitioning from a niche youth platform into a multi-genre, all-ages gaming ecosystem.

Technology and creator ecosystem investments further strengthen the long-term thesis. Roblox is rolling out server authority, advanced matchmaking, higher-fidelity avatars and AI-driven creation tools designed to unlock genres like shooters, sports, racing and RPGs, areas where the platform has historically been underrepresented. At the same time, higher DevEx payouts and new IP-licensing infrastructure are improving creator economics, which should help attract higher-quality content and sustain innovation. These initiatives position Roblox to compound growth into 2026 by expanding both the breadth and depth of experiences available on the platform.

The primary risk in the 2026 outlook is margin pressure tied to heavy reinvestment. Management has been clear that higher creator payouts, infrastructure spending, safety initiatives and elevated CapEx will likely result in modest margin compression next year. Tough year-over-year comparisons and potential short-term friction from new safety policies could also temper reported growth rates. While these investments are framed as necessary to support long-term scale and trust, they may weigh on near-term profitability and investor sentiment as Roblox works through 2026.

Take-Two enters 2026 with rare visibility and momentum, anchored by a portfolio of enduring franchises and a clearly defined release cadence. Management raised fiscal 2026 net bookings guidance to $6.4-$6.5 billion after delivering record second-quarter bookings, underscoring strong execution across console, PC and mobile. Importantly, recurrent consumer spending now represents most bookings, reflecting the company’s ability to monetize engagement over time rather than relying solely on hit-driven launch cycles.This mix shift gives Take-Two a sturdier earnings base heading into a critical release year.

A major pillar of the 2026 setup is franchise depth and lifecycle management. NBA 2K26 delivered record unit sales, higher average selling prices and sharp growth in engagement metrics, translating into outsized growth in in-game spending. At the same time, Grand Theft Auto V and GTA Online continue to defy age, with rising GTA+ subscriptions and sustained player activity helping bridge the gap to Grand Theft Auto VI. This ability to extend monetization across long-running titles reduces execution risk and helps smooth results ahead of the largest launch in the company’s history.

Mobile is another underappreciated driver of Take-Two’s 2026 outlook. Zynga-led franchises such as Toon Blast, Match Factory! and Color Block Jam are delivering consistent double-digit growth, while direct-to-consumer initiatives are improving conversion and margins. Management highlighted that changes in payment ecosystems and distribution economics should further expand profitability over time. With mobile now accounting for a meaningful share of bookings, Take-Two benefits from diversification that many console-focused peers lack.

The most notable risk in Take-Two’s 2026 setup is execution concentration around Grand Theft Auto VI. While management emphasized that the November 2026 release date allows for additional polish and long-term value creation, any further delays would test investor patience and compress near-term expectations. In addition, recent examples such as Borderlands 4 show that even strong franchises can face launch-related issues, particularly on PC, which can weigh on early momentum. With expectations extremely high, Take-Two’s margin for error into 2026 is narrower than usual.

The Zacks Consensus Estimate for RBLX’s 2026 sales implies year-over-year increases of 22.1%. The consensus estimate for the loss per share in the year is pegged at $1.88, whereas it is expected to incur a loss of $1.59 in 2025. Moreover, in the past 30 days, loss estimates have narrowed for 2026.

The Zacks Consensus Estimate for TTWO’s fiscal 2026 sales and EPS implies year-over-year growth of 14.8% and 60%, respectively. Earnings estimates for fiscal 2026 have decreased in the past 30 days.

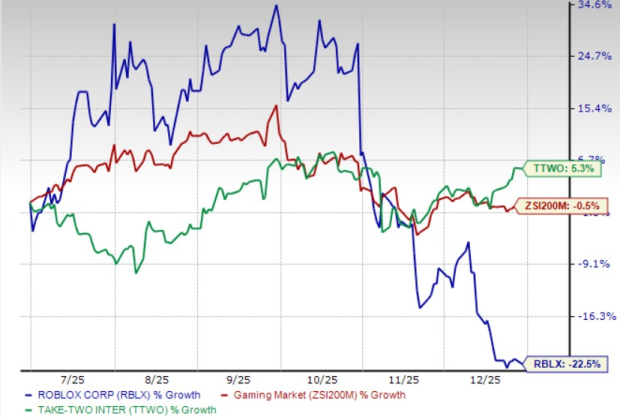

RBLX stock has lost 22.5% in the past six months compared with its industry’s fall of 0.5%. Conversely, TTWO’s shares have risen 5.3% in the same time frame.

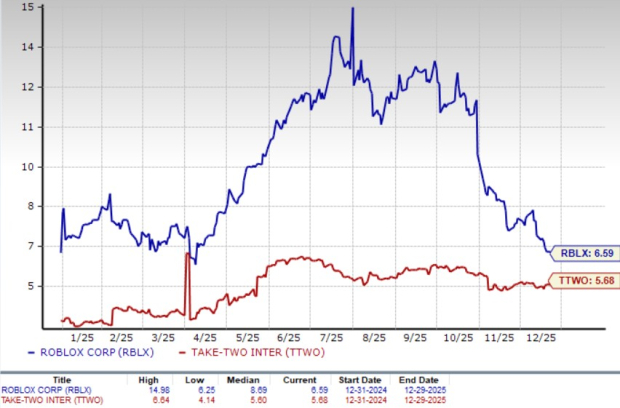

RBLX is trading at a forward 12-month price-to-sales ratio of 6.59X, below its median of 8.69X over the last year. TTWO’s forward sales multiple sits at 5.68X, above its median of 5.60X over the same time frame.

Overall, the setup favors Take-Two heading into 2026, even though both RBLX and it carry a Zacks Rank #3 (Hold). Take-Two offers stronger earnings visibility and a more balanced growth profile, driven by durable franchises, recurring spending and diversified exposure across console, PC and mobile. Roblox still has long-term appeal, but its outlook relies more on sustained reinvestment and margin patience, making Take-Two’s model look more resilient as investors prioritize execution and predictability.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 13 hours | |

| 13 hours | |

| Feb-18 | |

| Feb-18 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-15 | |

| Feb-14 | |

| Feb-14 | |

| Feb-14 | |

| Feb-13 | |

| Feb-12 | |

| Feb-12 | |

| Feb-11 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite