|

|

|

|

|||||

|

|

Gold Fields Limited GFI and Agnico Eagle Mines Limited AEM are two leading names in the global gold mining industry, each benefiting from elevated bullion prices and shifting investor demand for defensive commodities.

Gold Fields is a South Africa-based gold producer with diversified mining operations across Australia, South Africa, Ghana, Peru, Chile and Canada, and has been focusing on enhancing production, cost efficiencies and shareholder returns, including a planned $500 million return strategy alongside growth projects like Windfall and Salares Norte.

Agnico Eagle is a leading senior gold mining company focused on the production of gold from high-quality assets in Canada, Australia, Finland and Mexico. Operating within the global gold mining industry, the company emphasizes low-risk jurisdictions, cost discipline and long mine life, aligning with industry trends toward operational stability and responsible resource development. Recent project highlights include continued advancement of the Canadian Malartic Odyssey underground project, exploration and optimization at Detour Lake and progress at growth assets such as Upper Beaver and Hope Bay.

Gold Fields delivered a notably strong third quarter, underscoring a compelling operational case driven by higher gold production, attractive realized pricing, meaningful project progress and balance sheet improvements. Group attributable gold-equivalent production rose about 22% year over year to roughly 621,000 ounces, with a 6% quarter-on-quarter increase, reflecting broad execution across its asset base.

A major contributor was the continued ramp-up of the Salares Norte mine in Chile, which produced 112,000 ounces equivalent in the third quarter and saw output increase 53% sequentially as it progressed toward steady-state levels.

Salares Norte is on track to contribute significantly to 2025 guidance and is expected to improve further in 2026. All-in sustaining costs (AISC) declined to about $1,557 per ounce, down roughly 10% quarter over quarter, helping expand margins amidst realized gold prices near multi-year highs.

Gold Fields’ Tarkwa mine in Ghana remains a core, long-life asset, producing about 123,000 ounces in the third quarter of 2025 and typically delivering more than 500,000 ounces annually. In Australia, the Gruyere mine, now fully owned following the acquisition of Gold Road Resources, has produced more than 1.5 million ounces since commissioning, delivered 287,000 ounces in 2024, and is expected to generate 325,000–355,000 ounces in 2025.

At the end of September 2025, GFI’s net debt was $791 million, a significant decrease of $696 million from $1,487 million in the second quarter. The debt to capital was 34.8%. Free cash flow in the third quarter was about $166 million.

Agnico Eagle delivered a strong operational and financial performance in the third quarter, reflecting the strength of its high-quality asset base and favorable gold price environment. During the quarter, AEM produced approximately 867,000 ounces of gold, benefiting from solid output across core operations such as Detour Lake, Canadian Malartic, LaRonde, Macassa and Kittilä, while maintaining competitive costs with all-in sustaining costs (AISC) of around $1,370 per ounce.

Higher realized gold prices of about $3,450 per ounce drove revenue of roughly $3 billion, alongside robust free cash flow of more than $1.1 billion, further strengthening its net cash position.

The company advanced its flagship Odyssey underground project at the Canadian Malartic complex, completing about 4,770 meters of mine development, achieving a ramp breakthrough to the mid-shaft loading station and extending the main ramp to more than 1,050 meters depth, while also approving the extension of the first shaft to roughly 1,870 meters, materially improving long-term mining flexibility and supporting plans to lift Malartic’s production profile toward 1 million ounces annually in the 2030s.

At Detour Lake, Agnico Eagle completed approximately 60,000 meters of exploration drilling in the third quarter (more than 160,000 meters year to date), strengthening confidence in the geological model for a future underground operation that could sustain 1 million ounces of annual production over the long term.

At Hope Bay, the company continued aggressive exploration, drilling nearly 35,000 meters during the quarter across the Madrid and Patch 7 zones, reinforcing the potential for meaningful resource growth and a larger future development scenario.

At the end of September 2025, AEM’s cash and cash equivalents were around $2.355 billion, higher than $977 million a year ago. The debt to capital was 1.2%. Free cash flow in the third quarter was about $1.19 billion.

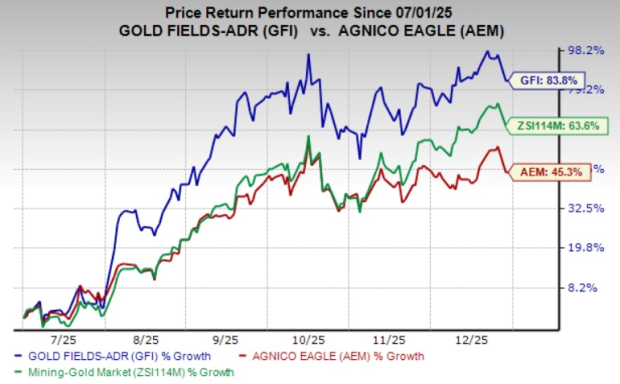

GFI stock is up 83.8% in the past six months, and AEM is up 45.3% compared with the Zacks Mining-Gold industry’s rise of 63.6%.

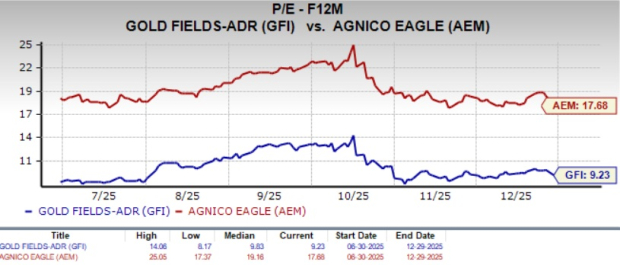

GFI is currently trading at a forward 12-month earnings multiple of 9.23X, while AEM is currently trading at a forward 12-month earnings multiple of 17.68X.

The Zacks Consensus Estimate for GFI’s fiscal 2025 sales implies year-over-year growth of 87%. The same for EPS suggests an 139% year-over-year rise.

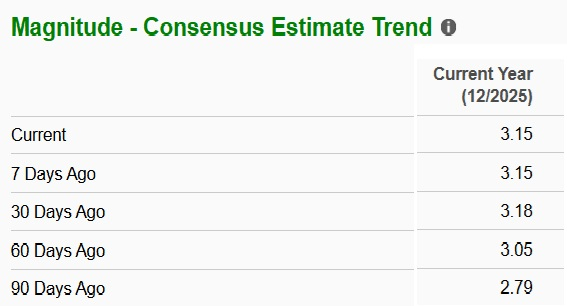

EPS estimates for fiscal 2025 have been trending higher over the past 60 days.

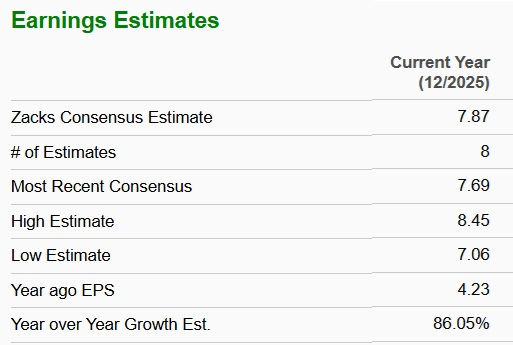

The consensus estimate for AEM’s fiscal 2025 sales and EPS implies a year-over-year rise of 39% and 86%, respectively.

EPS estimates for 2025 have been trending northward over the past 60 days.

Gold Fields and Agnico Eagle Mines offer compelling exposure to gold, but with different risk-reward profiles. GFI provides stronger upside leverage through its globally diversified operations and project-driven growth, though this comes with higher operational and geopolitical risk.

Agnico Eagle stands out as the higher-quality long-term play due to its more consistent execution, lower operational risk and stronger growth visibility. AEM’s asset base is concentrated in top-tier, politically stable jurisdictions such as Canada and Finland, reducing geopolitical uncertainty and supporting reliable cash generation. The company’s disciplined capital allocation and fortress balance sheet allow it to convert production into industry-leading margins and sustainable free cash flow, even during cost inflation cycles. Hence AEM seems to be the better investment option at the moment.

GFI currently has a Zacks Rank of #3 (Hold), while AEM has a Zacks Rank of #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 6 hours | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-16 | |

| Feb-16 | |

| Feb-16 | |

| Feb-16 | |

| Feb-16 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite