|

|

|

|

|||||

|

|

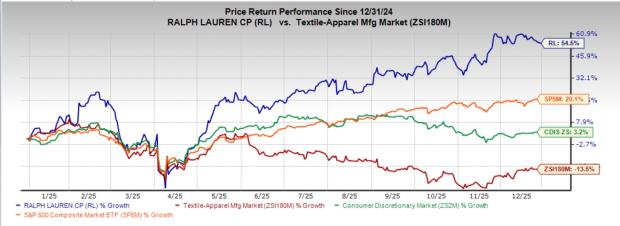

Ralph Lauren Corporation RL has been one of the standout performers in the global apparel and luxury space, delivering a sharp stock rally driven by disciplined brand elevation, strong pricing power and consistent execution across regions. The company’s stock has surged a solid 54.5% this year against the industry’s decline of 13.5%. Meanwhile, the broader Consumer Discretionary sector and the S&P 500 posted gains of 3.2% and 20.2%, respectively, during the same timeframe.

This strong rally raises a crucial question: Should investors take profits now, or is there still room for further upside?

Ralph Lauren’s momentum reflects the company’s disciplined execution of its long-term strategic roadmap, the “Next Great Chapter: Accelerate Plan.” The plan focuses on brand elevation, consumer centricity and operational agility while driving growth through a more balanced global presence. Ralph Lauren continues to expand in high-potential markets like Asia and strengthen its core regions, ensuring diversified revenue streams. By consistently introducing new products and reinforcing its luxury lifestyle positioning, the company has sustained strong brand equity and increased its competitive edge.

Digital transformation remains a central pillar of Ralph Lauren’s growth strategy, with investments in mobile, omnichannel capabilities and fulfillment driving double-digit gains in digital sales across all regions. In the second quarter of fiscal 2026, digital sales jumped 15% in North America, 17% in Europe and an impressive 36% in Asia, further underscoring the brand’s global digital momentum.

Digital sales now represent a growing share of total revenues, supported by continuous investments in personalization, enhanced mobile capabilities and integrated loyalty programs designed to connect with younger and more diverse consumers. These efforts not only expand Ralph Lauren’s reach among younger and more diverse consumers but also reinforce its premium positioning through curated storytelling and seamless shopping experiences.

Ralph Lauren’s retail and wholesale channels continue to show broad-based strength, supporting a diversified revenue base. In the fiscal second quarter, global DTC comps rose 13% on double-digit retail growth across regions, while 38 new owned and partner stores expanded its elevated retail footprint. Wholesale also outperformed, driven by strong European reorders and healthy North American sell-through, even as lower-tier distribution is reduced — reinforcing pricing power and higher-quality sales.

Ralph Lauren issued an upbeat outlook for fiscal 2026, underscoring its confidence in navigating a complex macroeconomic and geopolitical environment. The company expects constant-currency revenue growth of 5%-7% for fiscal 2026, up from its previous low-to-mid single-digit range.

Operating margin is projected to expand 60-80 basis points (bps) in constant currency, reflecting the benefits of expense leverage, strategic pricing initiatives and disciplined discount management. Gross margin is also expected to increase 10-30 bps, aided by a favorable mix, higher AUR and lower cotton costs, despite notable tariff and timing-related pressures that will be most acute in the fiscal fourth quarter.

For the fiscal third quarter, RL expects revenues to grow in mid-single digits, on a constant currency basis, with foreign currency expected to aid revenues by 150-200 bps. Operating margin for the quarter is forecasted to expand by approximately 60-80 bps in constant currency, primarily due to operating expense leverage. Foreign currency is also expected to benefit gross and operating margins by approximately 10 and 20 bps, respectively.

Ralph Lauren faces near-term pressure from a rising cost base, as elevated operating expenses continue to weigh on margin flexibility despite steady revenue growth. Increased spending on brand activations, technology, digital initiatives and store expansion is strengthening long-term brand equity, but it is also pushing operating costs higher and limiting near-term profitability. This heavier cost structure raises execution risk if revenue momentum softens or if returns on these investments take longer than expected to materialize.

In addition, a volatile macro backdrop adds uncertainty to the second half of fiscal 2026. Management remains cautious amid tariff-related headwinds, persistent inflation, supply-chain challenges and currency fluctuations, particularly with pressures expected to intensify in the fiscal fourth quarter. Potential U.S. consumer softness and higher input and logistics costs could temper demand and strain margins, even as the company works to offset these challenges through pricing discipline, diversified sourcing and operational efficiencies.

RL is currently trading at a forward 12-month price-to-earnings (P/E) multiple of 21.73X, higher than the industry average of 16.47X. Such a premium valuation often signals high investor expectations for growth. This premium suggests strong investor confidence and high expectations for future growth. While such a valuation may raise caution for value-focused investors, the key consideration is whether the company’s solid fundamentals and strategic execution support this higher price.

Ralph Lauren remains a compelling investment, driven by its differentiated product offerings, strong brand positioning and expansion strategy. The company’s emphasis on brand elevation and strategic investments has driven increased consumer demand across various channels. However, increasing operating expenses tied to brand investments, technology and store expansion are pressuring near-term margins despite steady revenue growth. With valuation elevated and visibility limited in the near term, some investors may choose to wait for clearer margin stability before adding exposure. However, the long-term narrative remains firmly intact.

Ralph Lauren currently carries a Zacks Rank #3 (Hold).

Crocs, Inc. CROX, which is a leading footwear company, currently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

CROX delivered a trailing four-quarter earnings surprise of 14.3%, on average. The Zacks Consensus Estimate for Crocs’ current financial-year EPS indicates a decline of 7.9% from the year-ago number.

Guess?, Inc. GES, which is a designer and marketer of casual apparel and accessories, currently carries a Zacks Rank #2 (Buy).

GES delivered a trailing four-quarter earnings surprise of 45%, on average. The Zacks Consensus Estimate for GES’ current financial-year sales indicates growth of 8% from the year-ago number.

Kontoor Brands, Inc. KTB, which is an apparel company, currently carries a Zacks Rank of 2.

The Zacks Consensus Estimate for KTB’s current financial-year EPS is expected to rise 12.5% from the corresponding year-ago reported figure. KTB delivered a trailing four-quarter earnings surprise of 14%, on average.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 4 hours | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-21 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-19 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite