|

|

|

|

|||||

|

|

U.S. managed healthcare insurers are currently going through a significant transformation, driven by rising medical costs, increased regulatory scrutiny and a surge in investments focused on data, analytics and value-based care. At the same time, scale, diversification across insurance and services, and disciplined capital allocation are becoming increasingly important as payers look to protect margins while sustaining long-term growth. Against this backdrop, UnitedHealth Group UNH and Elevance Health, Inc. ELV stand out as two of the largest players in the health insurance and managed care space.

Both companies have a strong presence in the commercial, Medicare and Medicaid sectors, making them key players in the U.S. healthcare landscape. Although UNH and ELV target similar markets, they take different paths in terms of strategy, business composition and how they integrate care delivery, services and technology. These differences shape their revenue streams, cost management strategies and the risks they face from regulations and reimbursements.

Let’s dive deep and closely compare the fundamentals to determine which stock offers greater upside right now.

UNH, with a market cap of nearly $298 billion, stands as the largest health insurer in the United States, but its business model goes far beyond just traditional insurance. Alongside its core UnitedHealthcare segment, it operates Optum, a comprehensive healthcare services unit that covers everything from pharmacy benefits to care delivery and health analytics. This setup enables UNH to engage at various stages of the healthcare value chain, providing a level of diversification and operational leverage that few competitors can rival.

Scale is a key part of UNH’s strategy. With its large member base and extensive reach across the country, the company gathers valuable data insights and has a strong operational presence throughout the healthcare landscape. This wide-ranging approach allows for ongoing investments in technology, analytics and artificial intelligence, which will help the company streamline claims processes, improve care coordination and gain better visibility into medical cost trends across its various operations. Its UnitedHealthcare business catered to 50.1 million people as of Sept. 30, 2025, which grew 1.6% year over year.

The company’s total revenues rose 11.6% year over year in the first nine months of 2025, with 15% growth at UnitedHealthcare and 6.6% growth at Optum, driven by growth in domestic commercial membership and strength witnessed in Optum Rx. The Optum brand continues to be a long-term growth driver. However, the Department of Justice (DOJ) is reportedly investigating the company for Medicare billing practices, reimbursement policies and OptumRx pharmacy benefits operations.

UnitedHealth has been actively reshaping its portfolio through a series of divestitures and proposed asset sales as part of a broader effort to sharpen its strategic focus and address regulatory challenges. To streamline operations, it is pressing ahead with its exit from Latin America. Per Reuters, the company recently agreed to sell its final South American operation, Banmedica, to Patria Investments for $1 billion. This move follows earlier divestitures in Brazil and Peru, marking another step in narrowing the company’s strategic focus. Also in the United States, the push to finalize its merger with Amedisys has led to the need to sell off some healthcare facilities to address antitrust issues. As part of a settlement with the DOJ, the companies plan to offload at least 164 home health and hospice locations across 19 states.

Financially, UnitedHealth is in a solid position. The company ended the third quarter of 2025 with $30.6 billion in cash and short-term investments — sufficient to cover its short-term borrowings and current maturities of long-term debt, which stands at $7.7 billion. Its total debt-to-capital of 41.6% is below ELV’s 42% and the industry’s 44.3%. UNH missed earnings estimates twice in the past four quarters and beat on the other occasions.

UnitedHealth Group Incorporated price-consensus-eps-surprise-chart | UnitedHealth Group Incorporated Quote

However, rising medical utilization has squeezed profit margins, especially in the MA business. In the third quarter of 2025, the company’s medical care ratio rose to 88.1% compared with 84.9% the previous year, indicating that rising medical costs are eating into the premiums collected. Medical costs surged 17.7% year over year in the first three quarters; we expect them to rise 18.5% in 2025.

ELV, with a market cap of $77.4 billion, has positioned itself as a diversified managed care organization, focusing on growth and running its operations smoothly. In addition to core health coverage, the company provides a wide array of healthcare solutions, including pharmacy, dental, vision and behavioral health services, all while continuously enhancing its integrated care offerings.

A central pillar of Elevance Health’s strategy is its Carelon division, which integrates care delivery, data analytics and digital health services. The company aims to enhance efficiency and outcomes by coordinating care across hospitals, clinics, home-based services, behavioral health providers and virtual care channels. Carelon’s operating revenues rose 35.4% year over year, driven largely by buyouts and risk-based solutions scaling. Carelon platform is driving digital and AI-enabled solutions to personalize care, cut costs and sharpen margins.

ELV’s total revenues rose 13.9% year over year in the first nine months of 2025, aided by strong growth in premiums, product revenues and net investment income. The favorable top-line trend is likely to continue in the long run, given its strong business, membership growth and significant new contracts in its government business. It beat earnings estimates in three of the past four quarters and missed once, with an average surprise of 6.4%.

Elevance Health, Inc. price-consensus-eps-surprise-chart | Elevance Health, Inc. Quote

Strategic acquisitions and partnerships position the company for long-term growth. Acquisitions, such as Beacon Health, Paragon Healthcare, Inc. and Kroger’s Specialty Pharmacy, have strengthened ELV’s portfolio. The divestment of its Life and Disability business to StanCorp allowed the reallocation of resources to more profitable areas. Also, ELV is reshaping its Medicare strategy by stepping away from certain underperforming Medicare Advantage markets and fully exiting the standalone Part D segment.

However, Elevance Health is contending with elevated costs, primarily from higher medical benefit expenses and product costs. Total expenses rose 15% year over year in the first nine months of 2025. The company’s benefit expense ratio deteriorated to 88.9% in the first nine months of 2025 from 87.2% a year earlier, and is expected to reach 90% in 2025, reflecting pressure from unfavorable cost trends in ACA and Medicaid businesses amid insufficient rate adjustments.

Both companies are contending with unfavorable estimates from analysts for 2025 earnings due to the rising cost trend. The Zacks Consensus Estimate for UNH’s 2025 revenues indicates 11.9% year-over-year growth, but the same for EPS signals a massive 41.1% decline. On the other hand, the consensus estimate for ELV’s 2025 earnings indicates a 9.2% decline from a year ago, while the same for revenues suggests 12.9% growth.

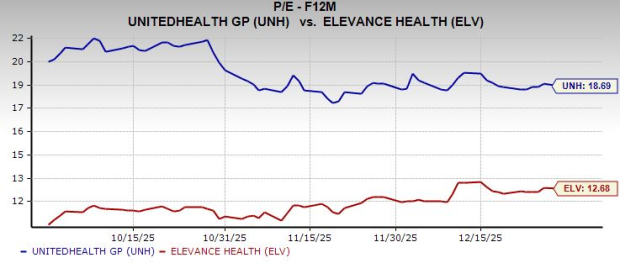

Valuation favors ELV. In comparison, UNH trades at a forward P/E of 18.69X, above the industry average of 15.54X and ELV’s 12.68X. This valuation gap gives ELV a more attractive risk-reward profile. In contrast, UNH’s premium pricing could limit near-term upside unless it delivers clear margin improvements. Both companies currently carry a Value Score of A.

In the past three months, UNH faced sell-offs tied to medical costs and investigation concerns. Its shares declined 4.8% during the same time. Meanwhile, ELV shares have jumped 7.8%, outperforming the S&P 500 Index.

UnitedHealth and Elevance Health are currently navigating a tough managed care environment, facing challenges like rising medical costs and regulatory pressures. While UnitedHealth boasts an impressive scale and the Optum platform, which offers significant long-term strategic benefits, it is still grappling with short-term margin pressures and ongoing regulatory concerns that are impacting its outlook.

On the other hand, Elevance Health seems to be in a better position right now, supported by strategic exits from underperforming markets, the growing Carelon platform and a more appealing valuation. Even though both companies currently carry a Zacks Rank #3 (Hold), ELV offers a relatively stronger near-term risk-reward profile.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-16 | |

| Feb-16 | |

| Feb-15 | |

| Feb-13 | |

| Feb-12 | |

| Feb-12 | |

| Feb-11 | |

| Feb-11 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite