|

|

|

|

|||||

|

|

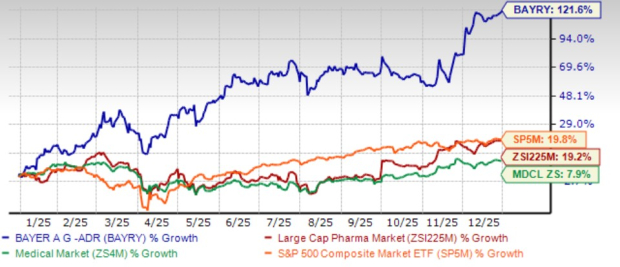

2025 has proved to be a turnaround for the German pharmaceutical giant Bayer BAYRY. Shares have skyrocketed 121.6% over the past year compared with the industry’s gain of 19.2%. The stock has also outperformed the sector and the S&P 500 Index in this time frame.

The stupendous performance can be attributed new drug approvals, encouraging pipeline progress, improved performance of the Crop Science business and positive updates on the ongoing litigations.

However, investors may now be questioning whether this momentum can be sustained in 2026. Let’s take a closer look at BAYRY’s strengths and weaknesses to assess how the stock should be positioned at current levels.

Bayer’s new products, such as prostate cancer drug Nubeqa and kidney disease drug Kerendia (finerenone), continue to maintain their impressive momentum in the Pharmaceutical division and offset the negative impact of a decline in Xarelto sales.

Earlier in 2025, the FDA approved a label expansion of Kerendia for the treatment of adult patients with heart failure (HF) and a left ventricular ejection fraction (LVEF) of ≥40%.

With the latest FDA approval, Kerendia has become the only non-steroidal mineralocorticoid receptor antagonist approved in the United States for chronic kidney disease associated with type 2 diabetes and for HF with LVEF of ≥40%.

The regulatory body also expanded Nubeqa’s label for a third indication for patients with advanced prostate cancer. Following this approval, Nubeqa has become the first FDA-approved androgen receptor inhibitor for the treatment of patients with hormone-sensitive prostate cancer, in combination with androgen deprivation therapy, with or without chemotherapy.

In addition, Nubeqa is approved for the treatment of adult patients with non-metastatic castration-resistant prostate cancer, who are at high risk of developing metastatic disease.

Nubeqa generated sales of €1.68 billion in the first nine months of 2025.

The strong performance of these drugs makes up for the decline in sales of oral anticoagulant Xarelto, which is co-developed with Johnson & Johnson JNJ.

Xarelto is marketed by Johnson & Johnson in the United States. Bayer earns license revenues from JNJ for Xarelto sales in the United States.

Eylea sales continue to face pressure from generics; however, the introduction of Eylea 8 mg, with its extended dosing intervals, has partially offset the decline and supported overall performance.

Please note that Bayer’s HealthCare unit co-develops Eylea with Regeneron REGN, which records net product sales of Eylea in the United States. BAYRY records net product sales of Eylea outside the country. REGN records its share of profits/losses in connection with the sales of Eylea outside the United States.

Meanwhile, Bayer recently obtained FDA approval of elinzanetant for the treatment of moderate to severe menopause-related vasomotor symptoms (VMS, also known as hot flashes) under the brand name Lynkuet.

The drug was also approved by the European Commission. Lynkuet is already approved in the UK.

The approval of elinzanetant is a significant boost for the company.

The FDA recently granted accelerated approval to Hyrnuo (sevabertinib) for the treatment of adult patients with locally advanced or metastatic non-squamous non-small cell lung cancer whose tumors have human epidermal growth factor receptor 2 tyrosine kinase domain activating mutations, as detected by an FDA-approved test, and who have received a prior systemic therapy.

Label expansion of key drugs and approval of additional drugs will further boost sales from this business.

Bayer is making good pipeline progress as well. The new drug application for investigational contrast agent, gadoquatrane, had been accepted for review in both the United States and China. Gadoquatrane is being developed for use in contrast-enhanced magnetic resonance imaging of the central nervous system and other body regions in adults and pediatric patients, including term neonates.

Bayer also received a boost recently as pipeline candidate asundexian met primary efficacy and safety endpoints in late-stage OCEANIC-STROKE Study in secondary stroke prevention. Bayer will work with health authorities worldwide to submit marketing authorization applications seeking approval for the candidate.

In 2021, Bayer acquired the clinical-stage biopharmaceutical company Vividion Therapeutics to expand its presence in precision small-molecule therapeutics, with a primary focus on oncology and immunology.

BAYRY has expanded its pipeline in new modalities of cell therapy through the acquisition of BlueRock, and in gene therapy, through the AskBio buyout.

Bayer, together with its subsidiaries, BlueRock and AskBio, is developing cell and gene therapies for treating various diseases, including retinal disorders, congestive heart failure and Parkinson's disease.

Bayer stock recently got a boost after the Solicitor General supported a Supreme Court review of its Roundup weedkiller case in the United States.

Bayer believes that the backing of the government in the United States will be important to the court’s consideration of its petition.

Bayer acquired Roundup weedkiller through Monsanto’s buyout in 2018. However, several lawsuits have been filed by people for the same, alleging that Monsanto’s herbicide caused them to develop cancers. Glyphosate is the active ingredient in Roundup weedkiller.

It has also been alleged that people were not made aware of the cancer risks by either Monsanto or Bayer. Consequently, Bayer has incurred significant litigation costs due to these lawsuits.

As of Sept. 30, 2025, Bayer reserved $7.6 billion (€6.5 billion) for glyphosate litigation, including adjustments for possible settlements of first-instance verdicts currently on appeal or in post-trial review.

As of Oct. 15, 2025, roughly 132,000 of the nearly 197,000 claims had been resolved, either through settlement or by being deemed ineligible.

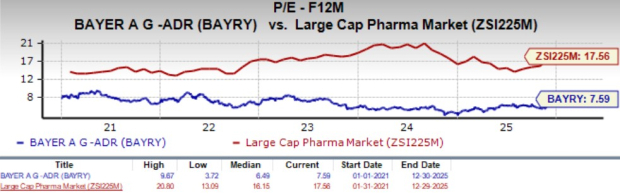

From a valuation perspective, BAYRY is currently quite inexpensive. Going by the price/earnings ratio, the company’s shares currently trade at 7.59X forward earnings, quite below 17X for the industry. The stock is trading higher than its five-year mean of 6.49X.

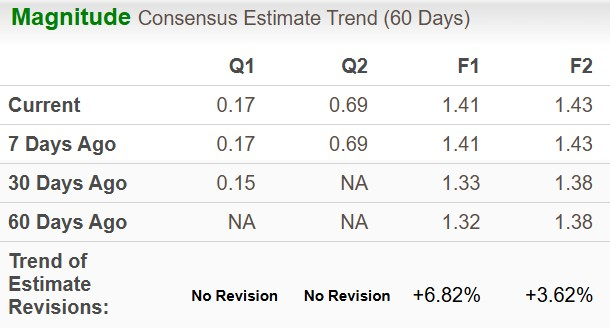

The Zacks Consensus Estimate for 2025 earnings per share has risen from $1.32 to $1.41 while that for 2026 EPS has increased from $1.38 to $1.43 over the past 60 days.

BAYRY has a large diversified portfolio. The company’s pharma business continues to maintain momentum. Newer drugs pave the way for growth, and the approval of additional new drugs should further bolster the portfolio.

While we are impressed by the remarkable turnaround by the company this year, the Crop Science business still has a few challenges to wade through and significant Roundup litigation charges continue to be a headwind.

The stock is trading near its 52-week high of $10.85 at present. Hence, we recommend existing investors to stay invested for now.

On the other hand, prospective investors can keep an eye on the stock and wait for better entry levels. Any positive updates on the regulatory front will be a significant boost.

BAYRY currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 6 hours | |

| 7 hours |

Johnson & Johnson to Invest More Than $1 Billion in Pennsylvania Cell Therapy Factory

JNJ

The Wall Street Journal

|

| 7 hours | |

| 8 hours | |

| 8 hours | |

| 9 hours | |

| 10 hours | |

| 12 hours | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite