|

|

|

|

|||||

|

|

New Feature: See Wall Street analyst ratings directly on Finviz charts for deeper context into price action.

Carnival Corporation & plc CCL and Norwegian Cruise Line Holdings Ltd. NCLH are both entering 2026 with strong demand trends, improving execution and destination-driven strategies that are reshaping their long-term earnings profiles. Carnival has gained notable momentum following a strong finish to 2025, reflecting growing investor confidence in its operational turnaround and balance-sheet progress. Norwegian Cruise, meanwhile, continues to advance a more measured, ROI-focused transformation aimed at enhancing yields and margin durability.

For investors evaluating cruise exposure as the industry moves deeper into its profitability cycle, which company appears better positioned for 2026? Let’s take a closer look.

Carnival’s evolution toward a destination-led cruise model is becoming a defining element of its strategy as it looks toward 2026. The company is investing heavily in exclusive private destinations and experience-driven fleet enhancements designed to differentiate its offerings and support sustained yield growth. Management highlighted that demand remains resilient despite macro uncertainty, with close-in bookings and onboard spending continuing to outperform expectations — reinforcing the durability of cruise demand relative to traditional consumer indicators.

That momentum is evident in Carnival’s financial performance. The company delivered record revenues, EBITDA and operating income in 2025, with yields building on strong prior-year gains. Operating margins expanded meaningfully, while return on invested capital rose above 13%, the highest level in nearly two decades. Importantly, this improvement reflects structural gains from pricing discipline, onboard revenue growth and cost management.

A central pillar of Carnival’s growth strategy is its expanding portfolio of private destinations. Celebration Key, the company’s flagship Caribbean development, alongside enhancements at Half Moon Cay and Mahogany Bay, is expected to deepen customer engagement, increase onboard spending and improve itinerary economics. These destinations give Carnival greater control over the guest experience and pricing environment, creating a more repeatable and scalable source of yield support as the company enters 2026.

That said, Carnival’s outlook is not without pressure points. Management acknowledged that unit costs are expected to rise in 2026, with cruise costs excluding fuel per ALBD guided up roughly 3.25% year over year, reflecting inflation, higher advertising spend, increased dry dock activity and the partial-year operating costs associated with new destination developments. While efficiency initiatives should offset a portion of these pressures, Carnival will no longer benefit from capacity-driven cost absorption in 2026 due to the absence of new ship deliveries. In addition, regulatory headwinds — including higher emissions-related costs and increased global tax exposure under Pillar Two — are expected to weigh modestly on earnings.

Norwegian Cruise continues to execute its “Charting the Course” strategy, which emphasizes balancing return on investment with return on experience. The company is pursuing disciplined capacity growth while investing selectively in high-impact destinations and premium offerings designed to support yield expansion rather than volume-driven growth.

The transformation of Great Stirrup Cay remains a key strategic initiative. Norwegian Cruise is rolling out a multi-year enhancement plan that includes new guest amenities, expanded infrastructure and the upcoming Great Tides Water Park, scheduled to open in 2026. Management expects these investments to support higher load factors and incremental yield uplift as the destination matures.

Norwegian Cruise is also increasing its exposure to the higher end of the market. Its luxury and ultra-luxury brands, Oceania Cruises and Regent Seven Seas, continue to show solid demand trends, with new ship deliveries enhancing fleet mix and long-term margin potential. Management reiterated its focus on maintaining a measured capacity growth profile across brands.

Cost discipline is another positive. Norwegian Cruise remains on track to deliver more than $300 million in cumulative cost savings, helping keep adjusted net cruise cost growth below inflation while supporting margin expansion. These initiatives are likely to have contributed to improvements in adjusted EBITDA margins and operational efficiency.

That said, some caution is warranted. Norwegian Cruise’s leverage remains elevated relative to peers, and management continues to prioritize balance-sheet optimization. FX volatility, itinerary mix shifts and softer demand in certain European markets are likely to have weighed on near-term results. While liquidity is adequate, the company’s earnings profile remains more sensitive to external variables as it moves into 2026.

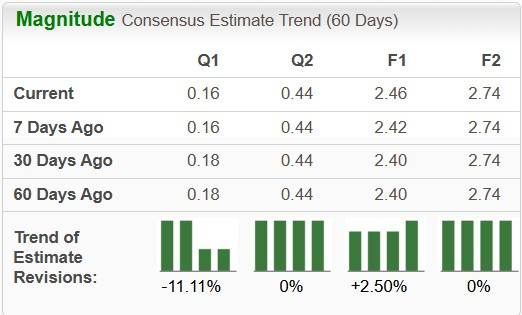

The Zacks Consensus Estimate for Carnival’s fiscal 2026 sales and EPS suggests year-over-year increases of 4.1% and 9.3%, respectively. In the past 60 days, earnings estimates for fiscal 2026 have risen 2.5%.

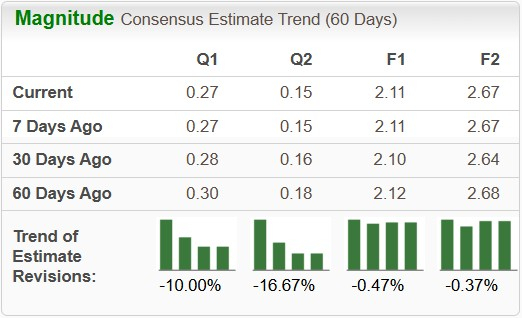

The Zacks Consensus Estimate for Norwegian Cruise’s 2026 sales and EPS suggests year-over-year increases of 10.2% and 26.9%, respectively. In the past 60 days, earnings estimates for 2026 have declined 0.4%.

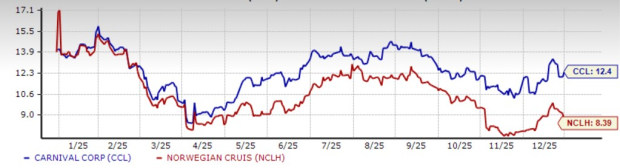

Carnival stock has gained 23.6% in the past year, outperforming the industry’s rise of 5.9% and the S&P 500’s growth of 19.7%. Meanwhile, Norwegian Cruise shares have declined 12.9% in the same time.

Carnival is trading at a forward 12-month price-to-earnings (P/E) ratio of 12.40, below the industry average of 17.17 over the last year. NCLH’s forward 12-month P/E multiple sits at 8.39 over the same time frame.

Overall, the analysis suggests that Carnival holds a modest positioning advantage over Norwegian Cruise as the industry moves into 2026. Both companies are entering the next phase with solid demand, improving execution and clearer strategic focus, but Carnival’s stronger cash flow momentum, expanding private-destination footprint and materially improved balance sheet provide greater earnings visibility as growth moderates.

Norwegian Cruise’s yield-focused strategy, premium brand exposure and destination investments offer meaningful long-term potential, yet elevated leverage and greater sensitivity to external variables temper near-term flexibility. While valuation appears more compelling on a headline basis for NCLH, estimate revisions and recent price performance point to a more cautious stance as the company continues to work toward balance-sheet normalization.

With both stocks currently carrying a Zacks Rank #3 (Hold), Carnival stands out slightly heading into 2026, supported by clearer execution trends and a business model increasingly aligned with sustaining profitability as the cruise industry transitions from recovery to a more normalized growth environment.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 44 min | |

| 2 hours | |

| 5 hours | |

| 7 hours | |

| 7 hours | |

| 7 hours | |

| 8 hours | |

| 10 hours | |

| 15 hours | |

| 15 hours | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite