|

|

|

|

|||||

|

|

KORU Medical Systems, Inc.KRMD recently announced that it has submitted a 510(k) premarket notification for FDA clearance to use its FreedomEDGE infusion system to deliver PHESGO, a breast cancer treatment, under the skin instead of through a vein. PHESGO is already an approved HER2-positive breast cancer drug. The filing represents a significant regulatory and strategic milestone for the company to expand the use of its infusion system to support patients with HER2-positive breast cancer by offering a simpler and patient-friendly way to deliver the therapy.

Per management, the submission for FDA clearance of the FreedomEDGE with a subcutaneous oncology biologic supports KRMD’s long-term growth plans and aligns with its broader strategy to transition from intravenous to subcutaneous drug delivery in oncology treatment settings. Upon FDA clearance, the FreedomEDGE system could make drug administration easier for nurses and help cancer infusion centers operate more efficiently.

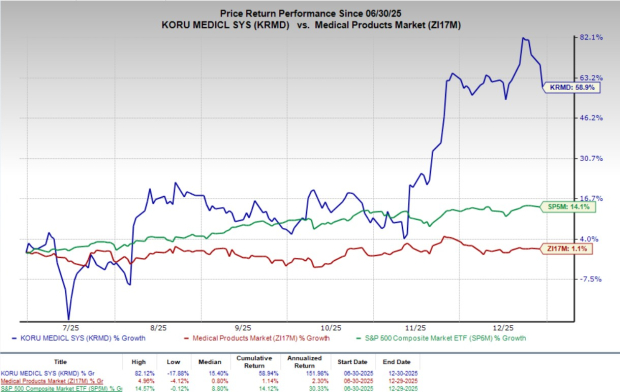

Following the announcement, shares of KORU Medical declined 6.1% at yesterday’s close. Over the past six months, shares of the company have climbed 58.9% compared with the industry’s 1.1% growth and the S&P 500’s 14.1% rise.

In the long run, successful clearance and commercialization of KRMD’s FreedomEDGE system expands the company’s addressable market by establishing a safe and effective subcutaneous delivery platform for oncology biologics. Until now, FreedomEDGE has mainly been used for traditional immunology treatments, but with the FDA clearance to deliver medicines under the skin, the company seeks to enter a much larger cancer care market, improve workflow and make cancer treatment more efficient for infusion centers, nurses and patients.

KRMD currently has a market capitalization of $280.71 million.

The 510(k) filing marks a crucial step for KRMD to validate its FreedomEDGE platform for subcutaneous oncology therapies rather than just immunoglobulin treatments and to enter the larger cancer infusion market. As cancer treatments are now moving away from traditional intravenous toward subcutaneous injections, utilizing this system helps deliver treatment faster, reduces the time patients spend in chairs, making it more comfortable for patients and supports a more efficient healthcare process.

The FreedomEDGE system is designed to address difficulties that infusion centers face, such as complicated treatment steps, time constraints and physical strain for both nurses and patients during long infusion treatments, by delivering larger doses under the skin in a controlled way and making the overall treatment process simpler and smoother. The FDA clearance would demonstrate the system’s ability to meet the demanding requirements of oncology drugs, including controlled flow rates, larger volumes and consistent delivery performance.

With over 15 years of market experience, more than 45,000 patients served annually and a strong adherence profile, KORU Medical enters the oncology space with a proven delivery platform. Pending FDA clearance, the company expects to begin commercial entry into oncology infusion centers, allowing it to scale the FreedomEDGE system and expand its leadership in patient-centric subcutaneous drug delivery.

Going by data provided by Precedence Research, the subcutaneous drug delivery devices market is valued at $33.56 billion in 2025 and is expected to witness a CAGR of 7.62% through 2034. Factors like the growing prevalence of chronic diseases, such as cancer, autoimmune diseases, respiratory disorders, cardiovascular diseases, diabetes and the rising adoption of the various subcutaneous drug delivery devices to control and manage chronic health conditions are driving the market growth.

KORU Medical announced a development partnership with a global pharmaceutical company to collaborate on next-generation infusion systems for subcutaneous immunoglobulin therapy. The company’s Freedom60 and FreedomEDGE infusion pumps were the first devices to be 510(k) cleared for use with prefilled syringes. The agreement focuses on creating a system compatible with both vials and prefilled syringes, using KORU’s infusion technology and SCHOTT TOPPAC polymer syringes.

KORU Medical has partnered with ForCast Orthopedics to use the FreedomEDGE infusion system in treating periprosthetic joint infections. The pump will support ForCast’s Wearable Intra-Articular Infusion System ahead of a planned 2026 clinical trial. ForCast’s lead program has received both an Orphan Drug Designation and a Qualified Infectious Disease Program designation from the FDA to speed development and review.

KORU Medical Systems, Inc. price | KORU Medical Systems, Inc. Quote

Currently, KRMD carries a Zacks Rank #2 (Buy).

Some other top-ranked stocks from the broader medical space are Omnicell OMCL, CareCloud CCLD and Schrodinger SDGR.

Omnicell, sporting a Zacks Rank #1 (Strong Buy) at present, reported third-quarter 2025 adjusted earnings per share (EPS) of 51 cents, which surpassed the Zacks Consensus Estimate by 41.7%. Revenues of $311 million beat the Zacks Consensus Estimate by 5.6%. You can see the complete list of today’s Zacks #1 Rank stocks here.

OMCL has an estimated long-term earnings growth rate of 9.4% compared with the industry’s 27.9% rise. The company beat earnings estimates in the trailing four quarters, the average surprise being 38.65%.

CareCloud, currently carrying a Zacks Rank #2, reported a third-quarter 2025 adjusted EPS of 10 cents, which surpassed the Zacks Consensus Estimate by 25%. Revenues of $31.1 million beat the Zacks Consensus Estimate by 8.3%.

CCLD has an estimated earnings recession rate of 45.3% for 2025 against the industry’s 20.1% growth. The company missed earnings estimates in the trailing four quarters, the average surprise being 2.88%.

Schrodinger, currently carrying a Zacks Rank #2, reported a third-quarter 2025 loss per share of 45 cents, which surpassed the Zacks Consensus Estimate by 40%. Revenues of $54.3 million beat the Zacks Consensus Estimate by 8.7%.

SDGR has an estimated long-term earnings growth rate of 37.8% compared with the industry’s 27.9% growth. The company’s earnings have missed estimates in the trailing four quarters, the average surprise being 0.93%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-12 | |

| Feb-12 | |

| Feb-12 | |

| Feb-11 | |

| Feb-11 | |

| Feb-06 | |

| Feb-05 | |

| Feb-05 | |

| Feb-05 | |

| Feb-05 | |

| Feb-05 | |

| Feb-05 | |

| Feb-05 | |

| Feb-03 | |

| Feb-03 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite