|

|

|

|

|||||

|

|

The fintech sector’s transformation is being fueled by innovations in digital payments, credit underwriting and user experience. Among the notable players, Block, Inc. XYZ and Upstart Holdings UPST stand out for their disruptive business models and strategic growth initiatives.

Block is building a comprehensive payments ecosystem through Square and Cash App, whereas Upstart is reinventing consumer lending using artificial intelligence. As both companies navigate economic uncertainty and rising competition, investors are evaluating which stock is poised to perform better in the coming period.

The following analysis breaks down the strengths and weaknesses of each to uncover the more compelling long-term investment opportunity.

Block continues to grow its comprehensive fintech platform, with its Square, Cash App and Afterpay ecosystems offering end-to-end solutions across payments, commerce, banking, investing and lending. Block’s Square segment continues to operate as a merchant-facing business, while Cash App serves as a financial hub for younger customers, expanding into P2P, commerce, banking and bitcoin. In the third quarter of 2025, net revenues increased 2.3% year over year, while the gross profit rose 18.3%, with Cash App rising 24.3% and Square increasing 9.2%.

The company introduced new products like Cash App Pools for group payments, Afterpay integrations and enhanced borrowing features, all deepening engagement. Cash App launched Tap to Pay on iPhone for Cash App Business sellers, enabling them to accept contactless payments. Meanwhile, Square announced enhancements to its conversational AI assistant, Square AI and launched Square Cash Advance in the U.K. to fund businesses. Together, these ecosystems reinforce Block’s ambition to be a comprehensive financial operating system.

Block is investing aggressively to expand its partner base for sustainable growth. Square deepened its partnership with Thrive to help sellers sync catalogs, sales and inventory across both in-store and online. Square also partnered with Blackbird Bakery to upgrade Blackbird’s outdated till system with Square’s POS and Kitchen Display System. Additionally, Afterpay formed new partnerships before the holiday season, offering greater payment flexibility across fashion, lifestyle and home categories. These partnerships highlight Block's strategy to diversify its offerings and strengthen its position in the market.

While Block has solid momentum and diversified revenue streams, its performance remains sensitive to shifts in consumer spending behavior and macroeconomic conditions. Intensifying competition from fintech peers, such as PayPal and Shopify, threatens market share. Although Block is very innovative, most of its growth is centered in the United States and depends heavily on Cash App’s younger users.

Upstart operates as a leading AI-driven lending marketplace that connects with consumers with more than 100 banks and credit unions, using AI models for underwriting. The company earns revenues through platform/referral fees from lending partners, loan servicing fees and income from loan sales and securitization. In the third quarter of 2025, it reported a 71% revenue increase year over year, while loan originations climbed 80%.

Upstart has diversified beyond personal loans into auto lending, home equity lines of credit (HELOCs), and small-dollar loans. These newer verticals remain smaller than personal loans but are growing rapidly. In the third quarter of 2025, these newer businesses collectively accounted for nearly 12% of total originations and 22% of new borrowers on the Upstart platform, highlighting how diversification has become central to Upstart’s next growth phase.

Upstart enables lending partners to originate credit through its AI lending marketplace. Upstart has partnered with Tech CU to provide personal loans and auto refinance loans to more consumers. It also teamed with Peak Credit Union to offer personal loans via its platform, while Corporate America Family Credit Union uses the platform for personal loans, auto refinancing and HELOCs. As of Sept. 30, 2025, Upstart had more than 100 lending partners participating on its marketplace, and the company expects to continue to expand its lending partnerships to new participants.

Upstart's AI automation powered 91% of the third-quarter 2025 loans, eliminating human intervention and boosting scalability for faster approvals at lower rates. Moreover, Upstart launched a new machine learning model to optimize take rates. Over time, this framework will unlock significant improvements in its ability to monetize model wins that benefit borrowers.

Yet, Upstart’s story is not without challenges. Upstart AI lending carries risk, and its exposure to credit-sensitive borrowers makes it vulnerable to economic downturns. The market remains cautious about AI-driven models’ volatility, notably due to tightening approvals and raising interest rates in response to elevated macro signals. However, management pointed to calibration upgrades initiated in the third quarter of 2025 to reduce month-to-month conversion volatility by about 50%.

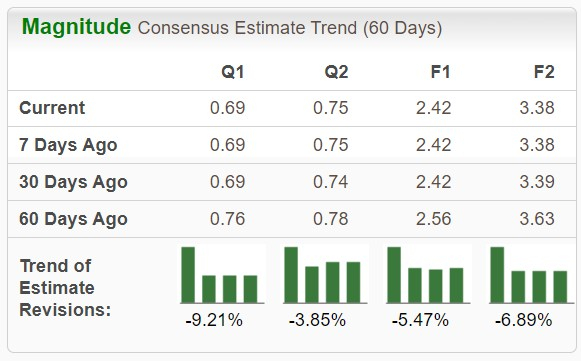

The Zacks Consensus Estimate for Block’s 2025 sales and EPS implies year-over-year growth of 0.8% and a decline of 28.2%, respectively. EPS estimates for 2025 have been southbound over the past 60 days.

For Block:

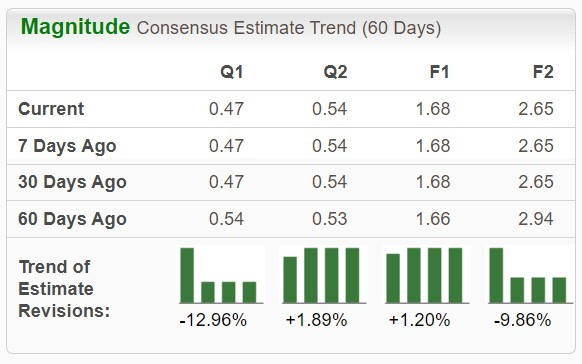

The Zacks Consensus Estimate for Upstart’s 2025 sales implies year-over-year growth of 62.8%, while the 2025 EPS indicates significant growth. What is also encouraging is that EPS estimates for 2025 have been trending northward over the past 60 days.

For Upstart:

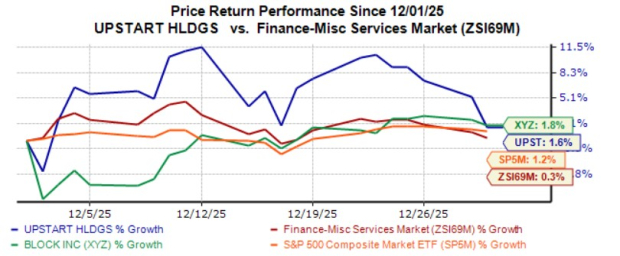

Over the past month, both XYZ and UPST shares have increased 1.8% and 1.6%, respectively, outperforming the S&P 500 composite.

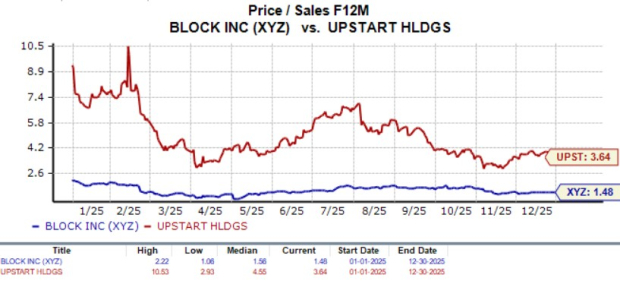

From a valuation perspective, XYZ is trading at a forward 12-month Price/Sales (P/S) of 1.48X, below its one-year median of 1.56X. Meanwhile, UPST is presently trading at a forward 12-month P/S of 3.64X, below its one-year median of 4.55X.

Block maintains a robust payments ecosystem with strong historical foundations, but faces short-term challenges from weak consumer spending and intense competition. In contrast, Upstart demonstrates clearer operating leverage, smartly expanding into new credit categories via enhanced AI and better funding structures. Backed by solid revenue growth and increasing profits, Upstart stands out as the fintech offering greater near-term upside potential for long-term investors seeking innovation-driven growth.

XYZ and UPST carry a Zacks Rank #3 (Hold) each. However, UPST’s sales and earnings estimates and near-term growth prospects place it ahead of XYZ. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 6 hours | |

| 8 hours | |

| 9 hours | |

| 9 hours | |

| 10 hours | |

| 11 hours | |

| 17 hours | |

| 17 hours | |

| 20 hours | |

| Feb-16 | |

| Feb-16 | |

| Feb-16 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite