|

|

|

|

|||||

|

|

As the craze of earnings season draws to a close, here’s a look back at some of the most exciting (and some less so) results from Q3. Today, we are looking at automation software stocks, starting with Microsoft (NASDAQ:MSFT).

The whole purpose of software is to automate tasks to increase productivity. Today, innovative new software techniques, often involving AI and machine learning, are finally allowing automation that has graduated from simple one- or two-step workflows to more complex processes integral to enterprises. The result is surging demand for modern automation software.

The 7 automation software stocks we track reported a strong Q3. As a group, revenues beat analysts’ consensus estimates by 4.4% while next quarter’s revenue guidance was in line.

While some automation software stocks have fared somewhat better than others, they have collectively declined. On average, share prices are down 3.3% since the latest earnings results.

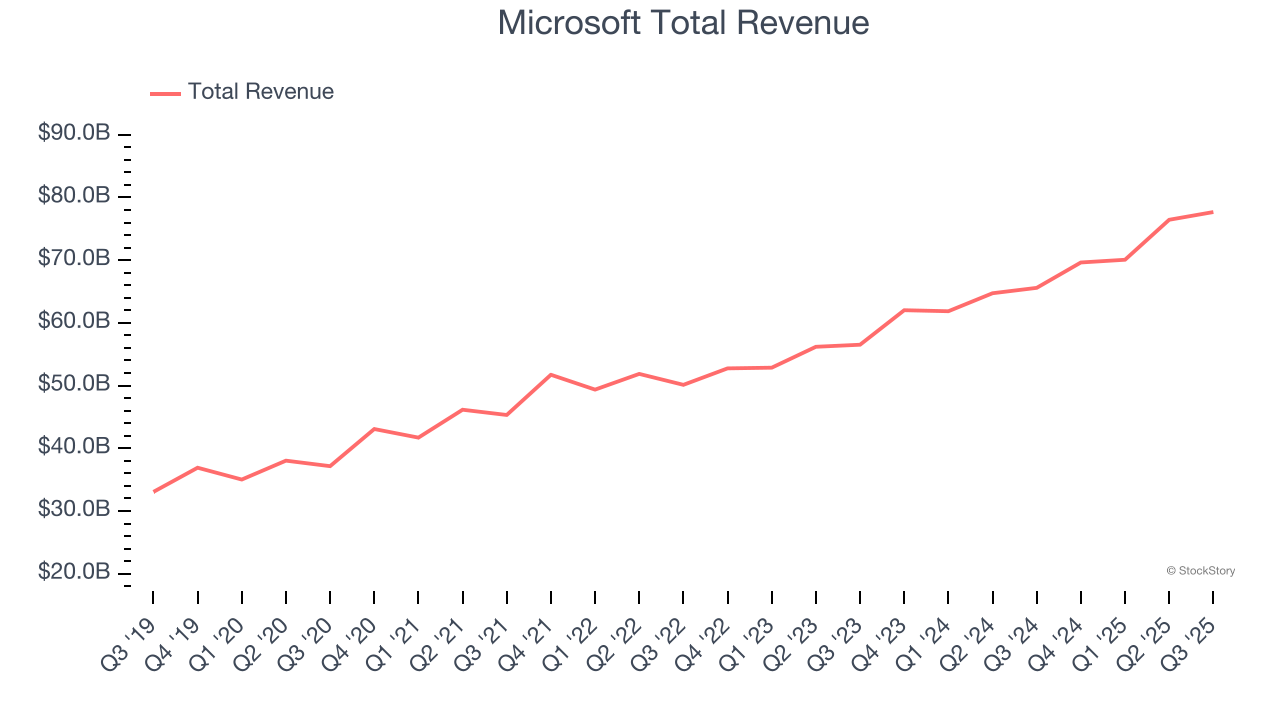

Originally named "Micro-soft" for microcomputer software when founded in 1975, Microsoft (NASDAQ:MSFT) is a global technology company that develops software, cloud services, devices, and AI solutions for consumers, businesses, and organizations worldwide.

Microsoft reported revenues of $77.67 billion, up 18.4% year on year. This print exceeded analysts’ expectations by 2.9%. Overall, it was a very strong quarter for the company with a narrow beat of analysts’ revenue estimates, as the beat in Intelligent Cloud and Business Services trumped the miss in Personal Computing and a solid beat of analysts’ revenue estimates.

"Our planet-scale cloud and AI factory, together with Copilots across high value domains, is driving broad diffusion and real-world impact," said Satya Nadella, chairman and chief executive officer of Microsoft.

The stock is down 11.1% since reporting and currently trades at $483.36.

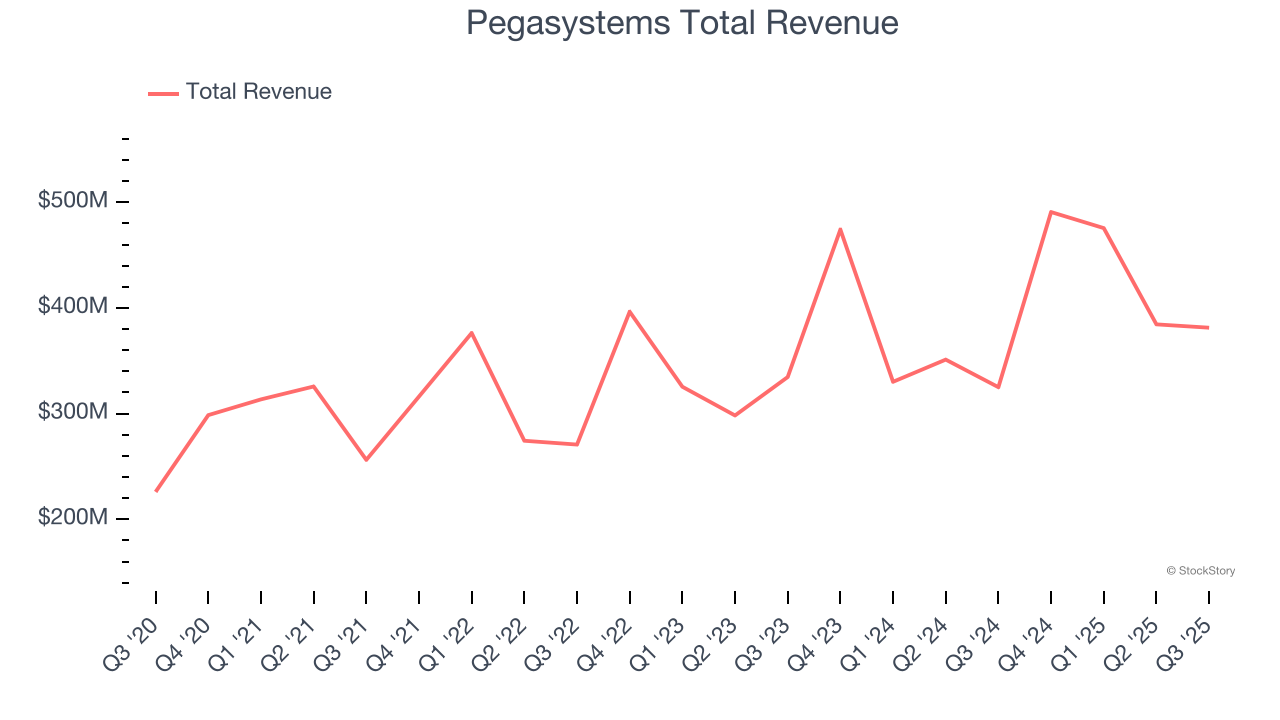

With a "Center-out Business Architecture" approach that transcends organizational silos, Pegasystems (NASDAQ:PEGA) develops software that helps organizations automate workflows and use artificial intelligence to improve customer experiences and business processes.

Pegasystems reported revenues of $381.4 million, up 17.3% year on year, outperforming analysts’ expectations by 8.5%. The business had a stunning quarter with a solid beat of analysts’ billings estimates and an impressive beat of analysts’ EBITDA estimates.

Pegasystems pulled off the biggest analyst estimates beat among its peers. The market seems content with the results as the stock is up 4.7% since reporting. It currently trades at $59.73.

Is now the time to buy Pegasystems? Access our full analysis of the earnings results here, it’s free for active Edge members.

Born from the idea that machines should understand human speech as naturally as people do, SoundHound AI (NASDAQ:SOUN) develops voice recognition and conversational intelligence technology that enables businesses to integrate voice assistants into their products and services.

SoundHound AI reported revenues of $42.05 million, up 67.6% year on year, exceeding analysts’ expectations by 2.7%. Still, it was a softer quarter as it posted a significant miss of analysts’ EBITDA estimates and a miss of analysts’ billings estimates.

As expected, the stock is down 30.8% since the results and currently trades at $9.94.

Read our full analysis of SoundHound AI’s results here.

Starting with robotic process automation (RPA) and evolving into a comprehensive automation powerhouse, UiPath (NYSE:PATH) provides an AI-powered business automation platform that enables organizations to create software robots that mimic human actions to streamline repetitive tasks and processes.

UiPath reported revenues of $411.1 million, up 15.9% year on year. This print beat analysts’ expectations by 4.7%. Aside from that, it was a satisfactory quarter as it also produced an impressive beat of analysts’ EBITDA estimates but a significant miss of analysts’ billings estimates.

The stock is up 8.8% since reporting and currently trades at $16.38.

Read our full, actionable report on UiPath here, it’s free for active Edge members.

Built on a single code base that processes over 4 billion workflow transactions daily, ServiceNow (NYSE:NOW) provides a cloud-based platform that helps organizations automate and digitize workflows across departments, from IT and HR to customer service and security.

ServiceNow reported revenues of $3.41 billion, up 21.8% year on year. This result topped analysts’ expectations by 1.4%. Taking a step back, it was a satisfactory quarter as it also logged a solid beat of analysts’ EBITDA estimates but a significant miss of analysts’ billings estimates.

ServiceNow had the weakest performance against analyst estimates among its peers. The stock is down 16.2% since reporting and currently trades at $152.85.

Read our full, actionable report on ServiceNow here, it’s free for active Edge members.

As a result of the Fed’s rate hikes in 2022 and 2023, inflation has come down from frothy levels post-pandemic. The general rise in the price of goods and services is trending towards the Fed’s 2% goal as of late, which is good news. The higher rates that fought inflation also didn't slow economic activity enough to catalyze a recession. So far, soft landing. This, combined with recent rate cuts (half a percent in September 2024 and a quarter percent in November 2024) have led to strong stock market performance in 2024. The icing on the cake for 2024 returns was Donald Trump’s victory in the U.S. Presidential Election in early November, sending major indices to all-time highs in the week following the election. Still, debates around the health of the economy and the impact of potential tariffs and corporate tax cuts remain, leaving much uncertainty around 2025.

Want to invest in winners with rock-solid fundamentals? Check out our Top 5 Quality Compounder Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory’s analyst team — all seasoned professional investors — uses quantitative analysis and automation to deliver market-beating insights faster and with higher quality.

| 18 min | |

| 53 min | |

| 1 hour | |

| 1 hour | |

| 2 hours | |

| 2 hours | |

| 2 hours | |

| 2 hours | |

| 2 hours | |

| 2 hours | |

| 2 hours | |

| 3 hours | |

| 3 hours | |

| 3 hours | |

| 3 hours |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite