|

|

|

|

|||||

|

|

New Feature: See Wall Street analyst ratings directly on Finviz charts for deeper context into price action.

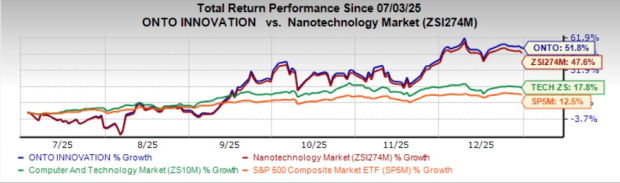

Onto Innovation Inc. ONTO shares have soared 51.8% in the past six months, outperforming the Zacks Nanotechnology industry’s growth of 47.6%. The company has also outpaced the Zacks Computer and Technology sector and the S&P 500 composite’s growth of 17.8% and 12.5%, respectively. The stock has risen 9.8% in the past three months.

The company is gaining from a diversified portfolio and growing foothold in AI-driven advanced packaging against a softer semiconductor backdrop. Successful 3Di and Dragonfly qualifications, product uptake and offshore manufacturing ramp-up position it for solid sequential and long-term growth.

Let’s take a closer look at ONTO’s fundamentals, growth drivers, competitive advantages and potential risks to assess its growth potential in 2026.

Onto is well-positioned to benefit from its significant product range and customer relationships. The company invests in research and development to provide differentiated products and services, which add value to its customers’ manufacturing processes. Backed by its expertise in the core technologies of optics and software, the rapid and ongoing development of new products and enhancements to existing products enables it to quickly respond to dynamic industry trends as well as competitive challenges, leading to continued customer wins. Onto’s packaging customers are signaling up to 20% higher tool demand in 2026 to support expansions and new 2D subsurface and 3Di inspection applications.

Onto Innovation Inc. price-consensus-chart | Onto Innovation Inc. Quote

While quarterly results may fluctuate, the company expects sequential growth in the first half of 2026 and stronger momentum in the second half, driven by new products and capacity expansions. The ramp-up of Onto’s expanded Asian factories is progressing well. More than 30% of third-quarter tools were shipped from these sites, with capacity expected to exceed 60% of total production by first-quarter 2026.

These initiatives will strengthen competitiveness, reduce tariff exposure, enhance flexibility and support gross margin expansion. Management expects approximately 18% revenue growth at the midpoint of its fourth-quarter guidance, driven by nearly doubling of sales to 2.5D packaging customers on strong Dragonfly system demand. Advanced node revenue is also projected to rise with higher DRAM and logic spending.

Onto Innovation has a history of acquiring companies to expand its product offerings. In November 2025, Onto Innovation closed its $495 million acquisition of key Semilab product lines, adding FAaST, CnCV and MBIR tools to strengthen its inline wafer contamination monitoring, materials analysis and surface charge metrology capabilities. Semilab’s materials analysis business has witnessed about 20% CAGR since 2021 and is projected to generate $130 million in revenue by 2025. Its integration into Onto is expected to improve gross margin, operating margin and non-GAAP EPS by more than 10% in the first year and create strong shareholder value at a 10x EBITDA multiple. Management plans to combine its AI Diffract modeling engine with Semilab’s materials and contamination monitoring tools. Along with Onto’s metrology solutions, this will help chipmakers speed up yield learning and improve process optimization for advanced nodes.

The addition of Lumina in 2024 expanded its inspection capabilities into laser-based solutions for unpatterned wafers, advanced packaging and emerging materials, increasing its serviceable market by an estimated $250 million annually and supporting the development of a next-generation inspection platform. Onto also acquired Kulicke and Soffa’s lithography business, gaining valuable intellectual property and deep technical expertise, which enhances its JetStep panel lithography and metrology offerings. Together, these acquisitions are expected to add up to $100 million in annual revenue over the next three years and become earnings accretive within a year.

Onto is facing headwinds such as high customer concentration, dependency on limited suppliers and macroeconomic challenges due to its extensive geographic footprint. The ongoing trade tensions related to U.S. tariffs are an added concern. The ongoing trade restrictions and strained relations between the United States and China are impediments to growth. The company is weighed down by tariffs, mostly from imported components that make up nearly 90% of its costs, along with added pressure from outbound tariffs. Despite avoiding tariffs on tooling sales, the company still faces added costs in the fourth quarter from inbound tariffs. Management expects fourth-quarter gross margin to be at 53.5–55%, pressured by about one percentage point, or roughly $2.5 million, due to inbound tariffs on raw material imports.

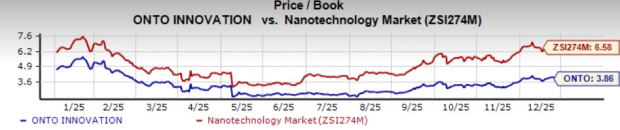

The stock trades at a price-to-book (P/B) ratio of 3.86, below the industry’s average of 6.58.

With synergies from acquisitions, higher demand from several end markets, increased adoption of Dragonfly platforms and margin expansion, ONTO continues to offer attractive upside despite the stock’s near-term headwinds. Hence, investors can consider adding it to their portfolio now.

At present, ONTO carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Some other top-ranked stocks from the broader technology space are Palantir Technologies Inc. PLTR, BlackBerry Limited BB and Five9, Inc. FIVN. PLTR presently sports a Zacks Rank #1, whereas BB & FIVN carry a Zacks Rank #2.

Palantir Technologies’ earnings beat the Zacks Consensus Estimate in each of the trailing four quarters, with the average surprise being 16.27%. In the last reported quarter, PLTR delivered an earnings surprise of 23.53%. Its shares have surged 122.5% in the past year.

BlackBerry’s earnings beat the Zacks Consensus Estimate in three of the trailing four quarters, with the average surprise being 125%. In the last reported quarter, BB delivered an earnings surprise of 25%. Its shares have inched up 3% in the past year.

FIVN’s earnings beat the Zacks Consensus Estimate in each of the trailing four quarters, with the average surprise being 16.09%. In the last reported quarter, Five9 delivered an earnings surprise of 6.85%. Its shares have declined 27.6% in the past six months.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 10 hours | |

| 11 hours | |

| 11 hours | |

| 12 hours | |

| 13 hours | |

| 22 hours | |

| Feb-21 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite