|

|

|

|

|||||

|

|

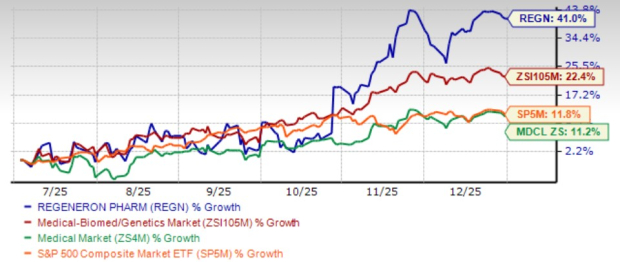

The going has been strong for Regeneron Pharmaceuticals REGN over the past six months. Shares of this biotech giant have surged 41% in this time frame, outpacing the industry’s growth of 22.4%. The stock has also outperformed the sector and the S&P 500 Index during this time.

In fact, the stock touched a 52-week high of $792.77 on Dec. 24, 2025.

REGN’s robust rally has been driven by a series of positive pipeline and regulatory developments, which have improved investor sentiment. The recent surge has also pushed the stock’s one-year return into positive territory.

Against this backdrop, a closer evaluation of the company’s strengths and weaknesses can help assess its attractiveness as an investment opportunity.

Regeneron recently announced that the FDA has approved Eylea HD (aflibercept) injection 8 mg for the treatment of macular edema following retinal vein occlusion (RVO), with dosing of up to once every eight weeks after an initial monthly dosing phase.

The FDA also approved a monthly dosing option for certain patients who may benefit from resuming this dosing schedule across all currently approved indications, including wet age-related macular degeneration (wAMD), diabetic macular edema (DME), diabetic retinopathy (DR) and RVO.

Eylea, Regeneron’s lead product, is an anti–vascular endothelial growth factor (VEGF) therapy approved for multiple ophthalmology indications and remains a key driver of the company’s revenues. However, the drug has been facing increasing competitive pressure from Roche’s RHHBY Vabysmo, which has gained significant market traction.

Given that Eylea contributes a substantial portion of Regeneron’s overall sales, the competitive impact has weighed on the company’s top-line performance. To address this challenge, Regeneron introduced Eylea HD, a higher-dose formulation designed to improve durability and help retain market share.

Eylea HD sales in the United States rose 10% in the third quarter of 2025, driven by higher volumes and growing demand. Further label expansions could provide additional upside and support continued growth of the franchise.

It is worth noting that Eylea and Eylea HD were co-developed with Bayer AG’s BAYRY HealthCare unit. Regeneron records net product sales in the United States, while Bayer records sales outside the country.

Meanwhile, Roche’s Vabysmo continues to see strong uptake. The drug is designed to inhibit both angiopoietin-2 (Ang-2) and VEGF-A pathways, contributing to its competitive positioning in the retinal disease market.

Regeneron’s oncology franchise is anchored by its PD-1 inhibitor Libtayo (cemiplimab-rwlc), which is approved for use in certain patients with advanced basal cell carcinoma (BCC), advanced cutaneous squamous cell carcinoma (CSCC) and advanced non-small cell lung cancer (NSCLC).

Libtayo has delivered a solid performance, generating $1.03 billion in sales during the first nine months of 2025, representing a 21% year-over-year increase. Regeneron records global net product sales of Libtayo and pays royalties to partner Sanofi SNY on these sales.

The drug recently benefited from a label expansion in Europe, with the European Commission (EC) approving Libtayo as an adjuvant treatment for adult patients with CSCC at high risk of recurrence following surgery and radiation. This approval broadens Libtayo’s existing indication in advanced CSCC to include patients with high recurrence risk. The FDA granted approval for the same indication in October.

Beyond its current approvals, Regeneron continues to evaluate Libtayo both as a monotherapy and in combination with standard and novel treatment approaches across a range of solid tumors and hematologic malignancies, supporting its long-term oncology growth strategy.

The oncology portfolio received an additional boost with the FDA’s accelerated approval of linvoseltamab-gcpt for the treatment of relapsed or refractory multiple myeloma under the brand name Lynozyfic. The drug is also approved in the European Union for adults with relapsed or refractory multiple myeloma who have received at least three prior lines of therapy, including a proteasome inhibitor, an immunomodulatory agent and an anti-CD38 monoclonal antibody.

Further strengthening the franchise, the EC approved Ordspono (odronextamab) for the treatment of adult patients with relapsed or refractory follicular lymphoma or diffuse large B-cell lymphoma following two or more lines of systemic therapy.

REGN’s top line also comprises its share of profits/losses in connection with the global sales of Dupixent. Partner Sanofi records global net product sales of Dupixent.

Solid sales of Dupixent (approved for use in certain patients with atopic dermatitis, asthma, chronic rhinosinusitis with nasal polyposis and eosinophilic esophagitis) have fueled the top line for Sanofi and Regeneron.

The EC recently approved a label expansion of Dupixent for the treatment of moderate-to-severe chronic spontaneous urticaria (CSU) in adult and adolescent patients 12 years and above with inadequate response to histamine-1 antihistamines (H1AH) and who are naïve to anti-immunoglobulin E (IgE) therapy for CSU.

Going by the price/earnings ratio, REGN is expensive at this moment. Shares currently trade at 22.21X forward earnings, higher than its mean of 19X and the large-cap pharma industry’s value of 19.26X.

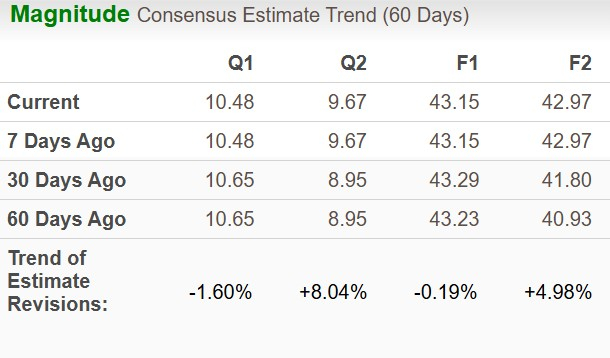

The bottom-line estimate for 2025 has moved south over the past 60 days but the same for 2026 has increased $1.97.

REGN is one of the largest biotechs in the sector that are considered safe havens for investors interested in this sector.

Progress across its oncology portfolio should support greater diversification of revenues and reduce reliance on any single franchise.

Ongoing label expansions for Dupixent continue to drive strong sales growth and contribute meaningfully to profitability. At the same time, the launch of Eylea HD is helping Regeneron mitigate the impact of declining sales of the Eylea amid rising competition.

Regeneron also has a deep pipeline of clinical-stage candidates, and additional positive regulatory or clinical updates could provide further upside. The company is also taking steps to enter the highly attractive obesity market, having previously entered into an in-licensing agreement with Hansoh Pharmaceuticals Group Company Limited to expand its obesity-focused pipeline.

Although the stock faced pressure earlier last year, the recent pipeline momentum and favorable regulatory developments have improved the outlook. We remain constructive on the shares and believe Regeneron represents an attractive investment opportunity at current levels. Investors already holding the stock may find it prudent to stay invested.

REGN currently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-16 | |

| Feb-16 | |

| Feb-15 | |

| Feb-14 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-12 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite