|

|

|

|

|||||

|

|

New Feature: See Wall Street analyst ratings directly on Finviz charts for deeper context into price action.

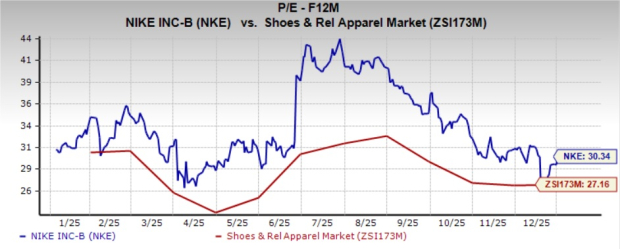

NIKE Inc. NKE continues to demonstrate fundamental strength, driven by moves to support sustainable profitability. However, its current forward 12-month price-to-earnings (P/E) ratio of 30.34X raises valuation concerns. This multiple exceeds the Zacks Shoes and Retail Apparel industry average of 27.16X, making NIKE’s stock appear relatively expensive.

Adding to investor caution, the company’s elevated price-to-sales (P/S) ratio affects enthusiasm. The Beaverton, OR-based athletic giant trades at a forward 12-month P/S of 1.95X, above the industry’s 1.79X. Together with its Value Score of D, this suggests NIKE may not present a compelling value opportunity at current levels despite its strong fundamentals and brand leadership.

At 30.34X P/E, the Swoosh brand owner is trading at a much higher valuation than its competitors. Its peers, such as adidas AG ADDYY, Steven Madden SHOO and Wolverine World Wide WWW, are delivering solid growth and trade at more reasonable multiples. adidas, Steven Madden and Wolverine have forward 12-month P/E ratios of 16.2X, 19.9X and 13.37X — all significantly lower than that of NIKE. At such levels, NKE’s valuation seems out of step with its growth trajectory, especially given the recent decrease in its stock price.

NIKE’s elevated valuation underscores investors’ high growth expectations. However, compared with key competitors, the company appears increasingly vulnerable as market participants turn cautious toward overpriced Consumer Discretionary stocks. NKE’s ability to consistently deliver on or exceed these expectations will be critical to sustaining its premium valuation.

NIKE shares have fallen 17.3% in the past six months compared with a 15.4% decline in the broader industry. The stock has also underperformed the Consumer Discretionary sector’s 7.6% decline and the S&P 500’s 12.9% growth in the same period.

Among peers, NIKE’s performance has been relatively dismal. Shares of Wolverine World Wide have fared better with a smaller 6.8% decline, while Steven Madden has surged 68.8% in the past six months. Meanwhile, shares of adidas have underperformed with a 19.8% decline.

At the current price of $63.28, the NKE stock trades 23.2% below its 52-week high of $82.44. The current stock price is 21% above its 52-week low mark of $52.28. NKE trades below its 50 and 200-day moving averages, indicating a bearish sentiment.

NIKE’s stock performance has been weighed down by a combination of near-term operational pressures and a slower-than-expected reset of its growth engine, as outlined in its second-quarter fiscal 2026 earnings discussion. Management acknowledged that revenue trends remain uneven, particularly in key categories and geographies, as NIKE works through the effects of prior channel resets and softer discretionary demand. Wholesale softness and cautious partner ordering continue to pressure top-line visibility, limiting near-term investor confidence.

Margins have also been a notable overhang. NIKE highlighted elevated promotional activity and markdowns as it clears aged inventory, especially in lifestyle footwear, which has weighed on the gross margin performance. While progress has been made in normalizing inventory levels, management signaled that promotional pressure will persist in the near term, delaying a full margin recovery. Higher input and logistics costs, along with continued investments in brand marketing and product innovation, are further constraining earnings leverage.

Additionally, the pace of innovation and category momentum has been concerning for the market. Management conceded that certain franchises have underperformed expectations, prompting a sharper pivot to sport-led innovation, athlete storytelling and performance-driven product launches. Although these actions are intended to strengthen NIKE’s competitive position in the long term, the benefits are expected to materialize gradually. This mismatch between near-term financial pressure and longer-term strategic payoff has been a key factor hindering NKE’s stock performance despite its underlying brand strength.

The Zacks Consensus Estimate for NIKE’s fiscal 2026 and 2027 earnings per share (EPS) have southbound, with estimates for both periods moving down by a penny in the past seven days. For fiscal 2026, the Zacks Consensus Estimate for NKE’s revenues implies 0.7% year-over-year growth, while the same for EPS suggests a 27.8% decline. The consensus mark for fiscal 2027 revenues and EPS indicates 4.9% and 55.7% year-over-year growth, respectively.

NIKE’s long-term fundamentals remain largely intact despite near-term pressures highlighted in its second-quarter fiscal 2026 earnings discussion. Management reiterated confidence in the brand’s global strength, scale and deep connection with athletes and consumers, which continue to differentiate NIKE across performance categories. The company is deliberately repositioning its portfolio toward sport-led innovation, refocusing on performance franchises and renewing product pipelines that historically powered growth.

While revenue and margins are currently constrained by inventory cleanup, promotional intensity and cautious wholesale demand, these issues appear cyclical rather than structural. Management emphasized that inventory normalization is progressing, and foundational investments in product innovation, marketing and digital capabilities remain intact. Additionally, NIKE’s balance sheet strength and global distribution network provide flexibility to absorb near-term volatility.

Overall, although execution risks and timing uncertainties persist, NIKE’s core brand equity, innovation engine and strategic reset suggest its long-term fundamentals are sound, with improved growth and profitability potential once transitional headwinds ease.

NIKE remains a fundamentally strong franchise, supported by unmatched brand equity, global scale and a renewed focus on sport-led innovation. However, near-term headwinds, uneven demand, wholesale softness, elevated promotions and margin pressure continue to weigh on the company’s performance, as reflected in recent stock decline and downward estimate revisions. While NIKE’s premium valuation highlights confidence in its long-term earnings power and strategic reset, it limits near-term upside amid execution risks.

A neutral stance appears appropriate at current levels. Investors with existing positions can continue to hold the stock for long-term gains, backed by NIKE’s strong fundamentals and recovery potential. Meanwhile, prospective investors may prefer to wait for a more attractive entry point, supported by clearer growth acceleration or margin recovery. The company currently has a Zacks Rank #3 (Hold).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-19 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite