|

|

|

|

|||||

|

|

New Feature: See Wall Street analyst ratings directly on Finviz charts for deeper context into price action.

Masimo Corporation MASI is well-poised for growth in the coming quarters, courtesy of its strong underlying demand for innovative technology and research and development (R&D) efforts. The optimism, led by a solid third-quarter 2025 performance and a solid product portfolio, is expected to contribute further. However, concerns regarding overdependence on its Signal Extraction Technology (SET) unit and reimbursement headwinds persist.

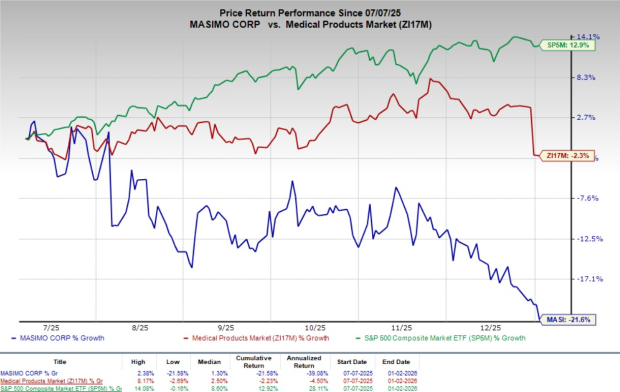

Over the past six months, this Zacks Rank #3 (Hold) company’s shares have lost 21.6% compared with the industry’s 2.3% decline. However, the S&P 500 has witnessed 12.9% growth in the said time frame.

The renowned global provider of non-invasive monitoring systems has a market capitalization of $6.84 billion. The company projects 6.28% earnings growth year over year for 2026 and expects to maintain its strong performance going forward. Masimo’s earnings surpassed the Zacks Consensus Estimate in each of the trailing four quarters, the average surprise being 12.39%.

Let’s delve deeper.

Product Portfolio: We are encouraged by Masimo’s healthcare business, which develops, manufactures and markets a variety of non-invasive patient monitoring technologies, hospital automation and connectivity solutions, remote monitoring devices and consumer health products.

In August, Masimo announced that it had received FDA 510(k) clearance to expand the uses of the delta hemoglobin measurements included with its O3 Regional Oximetry technology. These measurements are likely to track changes in different types of hemoglobin parameters and help better understand why tissue oxygen levels are rising or falling. With this expanded approval, the technology can now be used for both cerebral and somatic monitoring and is approved for patients of all ages, including newborns and children.

Intelligent Monitoring and Strategic Partnerships Hold Potential: We remain optimistic about Masimo’s long-term growth prospects, driven by innovation and partnerships. The company highlighted three strategic growth waves — elevating commercial excellence, accelerating intelligent monitoring and innovating wearables. Masimo continues to gain traction in advanced monitoring categories such as capnography and hemodynamics.

In September, Masimo finalized the sale of its Sound United consumer audio business to HARMAN International, a wholly owned subsidiary of Samsung Electronics Co., Ltd.

During the same month, Masimo announced that it had renewed and expanded its long-term strategic partnership with Royal Philips. The expanded agreement aims to accelerate the adoption of the company’s monitoring technologies, including SET pulse oximetry, across a wide range of Philips patient monitors through 2026 and beyond. This will add Masimo’s Radius PPG and other next-generation wearable monitoring solutions to Philips monitors, while integrating Masimo sensors across Philips bedside monitors and central monitoring systems. In addition, both companies will work on the development, manufacturing and promotion of next-generation AI-based monitoring solutions, with the goal of bringing the benefits of their combined innovations to millions of patients worldwide in the coming years.

Research and Product Development: We are upbeat about Masimo’s ongoing R&D efforts, which it believes are essential to its success. The company’s R&D efforts focus on using AI and machine learning to upgrade its sensors and create next-generation monitors. In addition, MASI continues to collaborate with Willow on R&D activities related to advancing rainbow technology and other technologies.

In October, the company announced results from an exploratory analysis for a unique feasibility study published in CHEST Critical Carein. In the study, researchers found that Masimo’s SET pulse oximetry was accurate in critically ill adult patients across all skin tones, including patients with low blood flow who needed vasopressors, and detected zero occult hypoxemic events. However, R&D expenses declined 18.2% year over year to $30.5 million during the third quarter.

Overdependence on Masimo SET: The company earns most of its revenues from its Masimo SET and Masimo Rainbow SET monitoring platforms, and its business therefore depends heavily on the continued performance and market acceptance of these products. To keep growing, Masimo must provide evidence to healthcare providers that its products are more accurate, reliable and cost-effective than traditional pulse oximeters. However, hospitals that have already invested in competing pulse oximetry systems may be slow to switch to Masimo’s products. If healthcare providers doubt the safety, accuracy or cost-effectiveness of Masimo’s products, sales and revenue growth could be affected.

Reimbursement Headwinds: Sales of Masimo’s products partly depend on whether government and private insurers agree to cover and reimburse their use. Due to the lack of adequate coverage and reimbursement for the company’s products, customers may be less willing to purchase these products. Masimo cannot be sure that governmental or private insurers will approve or continue covering its products or related procedures. Ongoing reviews by payers could lead to lower reimbursement rates, price pressure, slower adoption or increased competition. In addition, many insurers are focused on controlling healthcare costs, which could affect coverage and payment levels in the United States and internationally, where reimbursement rules vary by country, thereby affecting Masimo’s business.

Masimo Corporation price | Masimo Corporation Quote

MASI has been witnessing a positive estimate revision trend for 2026. In the past 60 days, the Zacks Consensus Estimate for its earnings per share (EPS) has moved north 1.2% to $5.75.

The Zacks Consensus Estimate for the company’s first-quarter revenues is pegged at $1.62 billion, implying a 6.6% improvement from the year-ago quarter’s reported number.

Some better-ranked stocks in the broader medical space are Tactile Systems Technology TCMD, Veracyte VCYT and Artivion AORT.

Tactile Systems Technology, sporting a Zacks Rank #1 (Strong Buy) at present, has an estimated growth rate of 14.3% for 2025. TCMD’s earnings surpassed estimates in each of the trailing four quarters, with the average surprise being 29.02%. You can see the complete list of today’s Zacks #1 Rank stocks here.

Tactile Systems Technology’s shares have soared 177.7% in the past six months.

Veracyte, presently flaunting a Zacks Rank #1, has an estimated growth rate of 38.7% for 2025. VCYT’s earnings surpassed estimates in each of the trailing four quarters, with the average surprise being 45.12%.

Veracyte’s shares have surged 60.9% in the past six months.

Artivion, carrying a Zacks Rank #2 (Buy) at present, has delivered a negative average earnings surprise in the trailing four quarters, with the average surprise being 4.38%.

AORT’s shares have gained 46.8% in the past six months.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-21 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite