|

|

|

|

|||||

|

|

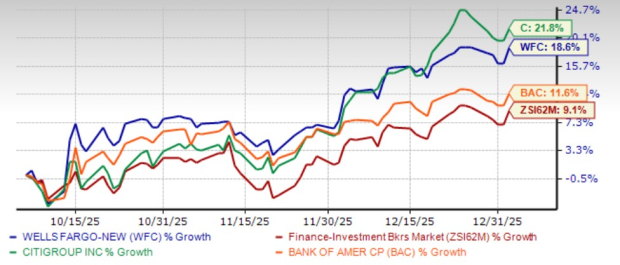

Shares of Wells Fargo & Company WFC have gained 18.6% in the past three months compared with the industry’s rise of 9.1%. Its peers Citigroup C and Bank of America BAC have risen 21.8% and 11.6%, respectively, over the same time frame.

Price Performance

Given WFC’s impressive rally, investors might wonder if the opportunity to add this stock to their portfolio has passed. However, we believe that Wells Fargo has much going in its favor, and this rally is far from over.

Let us find out what is driving WFC’s performance and whether this is the right time to buy the stock.

Wells Fargo reached a milestone in June 2025 when the Federal Reserve lifted the asset cap imposed in 2018 following the bank’s fake account scandal. The removal eliminates a long-standing constraint on balance-sheet expansion, allowing the company to grow deposits, increase loan balances, and expand securities holdings, thereby unlocking its full operating potential.

The regulatory relief also provides WFC with greater flexibility to scale fee-based businesses, including payment services, asset management, and mortgage origination, supporting revenue diversification and long-term top-line growth. In sync with this, WFC is preparing to enter the options clearing business, reflecting rising demand from clients as options trading activity increases across markets.

With greater strategic flexibility and improved earnings visibility, management raised the company’s medium-term return on tangible common equity (ROTCE) target to 17-18% from the earlier 15%, indicating stronger profitability prospects over the next few years.

Over the past few years, Wells Fargo’s net interest income (NII) has shown steady improvement, posting a three-year compounded annual growth rate (CAGR) of 10% ended 2024. In the first nine months of 2025, NII declined 1.9% to $35.15 billion, reflecting some pressure from elevated funding costs.

Following the initial easing in 2024 and three subsequent rate cuts in 2025, interest rates currently stand at 3.50-3.75%. With lower rates, funding costs gradually stabilize, supporting increased borrowing, which means more loan volumes. Thus, WFC is expected to witness decent growth in NII in the quarters ahead, supported by lower funding costs, increased loan volumes, and repricing of maturing assets into higher yields. Wells Fargo expects 2025 NII to be in line with 2024 NII of $47.7 billion.

Wells Fargo has been pursuing a strategic exit from various non-core and lower-return businesses to streamline its focus on consumer banking, commercial lending, and high-return areas. This effort, led by CEO Charlie Scharf since 2019, aims to cut costs significantly (targeting up to $10 billion annually) and reallocate capital to core franchises.

In sync with this, in May 2025, WFC agreed to sell its rail lease portfolio to a joint venture of GATX and Brookfield. Marking a significant step in this transaction, this month, GATX and Brookfield Infrastructure Partners L.P. received all required regulatory approvals to close the deal. In March 2025, the bank completed the sale of its non-agency third-party commercial mortgage servicing business to Trimont, backed by Varde Partners, reducing exposure to operationally complex commercial real estate servicing activities.

In 2023, WFC sold approximately $2 billion of private equity fund investments in Norwest Equity Partners and Norwest Mezzanine Partners to institutional investors, further aligning its portfolio with core banking priorities. The company also pursued strategic simplifications in its Home Lending business by exiting the Correspondent business and reducing the size of its Servicing portfolio, enabling a more focused mortgage operation targeting bank customers.

In 2021, Wells Fargo completed several major divestitures, including the sale of its Asset Management business to GTCR and Reverence Capital Partners, Corporate Trust Services to Computershare, and the Canadian Direct Equipment Finance business to TD Bank, allowing Wells Fargo to concentrate on core consumer and corporate clients. In 2019, Wells Fargo sold its Institutional Retirement & Trust business to Principal Financial Group, and it divested its auto finance segment in Puerto Rico to Popular, Inc. in 2018.

Together, these simplification efforts are expected to reduce operational costs, improve capital efficiency, and enable Wells Fargo to redeploy resources toward higher-return areas, strengthening its long-term growth prospects.

WFC’s prudent expense management initiatives have been supporting its financials. The company has been actively engaged in cost-cutting measures, including streamlining organizational structure and headcount reductions. The company also keeps investing in and optimizing its branch network to reduce costs. By the end of the third quarter of 2025, branches declined 2.1% to 4,108. Although Wells Fargo has reduced its overall footprint over the past decade, it has invested in branch renovations and new locations as part of a broader growth strategy. The ongoing upgrades aim to foster a more growth-oriented culture.

By the end of 2025, slightly more than half of the branch network is expected to be refreshed, with renovations already completed in Charlotte, Miami, Minneapolis, Philadelphia, San Diego, and Washington, DC, whereas Los Angeles, San Francisco, and Atlanta are scheduled for 2026.

The company is also advancing its operational transformation through a phased artificial intelligence (AI) rollout, aimed at improving productivity, streamlining workflows and enhancing customer service. In August 2025, the company expanded its strategic partnership with Google Cloud to deploy generative and agentic AI tools at scale. The bank also plans to introduce AI gradually over the next year and continue expanding its use beyond 2026. Management characterized the transition as a “positive reality,” suggesting that AI-enabled efficiencies will support long-term operational improvements.

Further, WFC’s headcount was reduced by 4.3% year over year in the third quarter of 2025. At the Goldman Sachs 2025 conference, Wells Fargo signaled that its workforce could shrink in 2026 as part of a broader push to improve efficiency and incorporate AI across its operations.

These efforts, along with continued investments in digital infrastructure and process automation, are expected to generate sustained expense savings and enhance overall profitability. By the end of this year, WFC expects to achieve $15 billion in gross expense savings.

Wells Fargo’s strong performance underscores growing investor confidence in the bank’s improving fundamentals and strategic reset. The removal of the long-standing asset cap has unlocked balance-sheet growth, while ongoing business simplification, disciplined expense management, and expanding fee-based initiatives, such as entering options clearing, strengthen the company’s earnings profile. Fed rate cuts and a favorable macroeconomic backdrop heading into 2026 further support the outlook. Also, the bank’s ongoing cost-cutting and branch optimization efforts enhance efficiency.

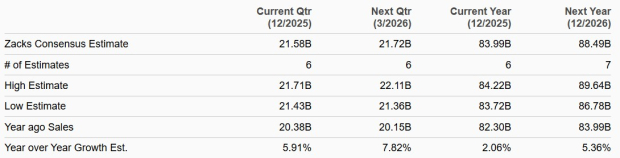

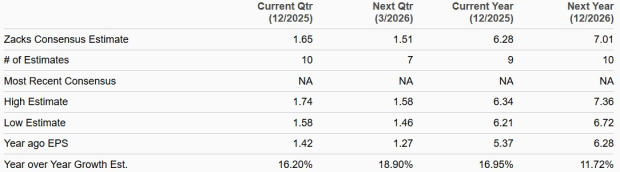

The Zacks Consensus Estimate for WFC’s 2025 and 2026 sales suggests 2.1% and 5.4% growth, respectively. The Zacks Consensus Estimate for WFC’s 2025 and 2026 earnings indicates 16.9% and 11.7% rallies, respectively.

Sales Estimates

Earnings Estimates

WFC has an impressive capital distribution plan as well. The company has raised its dividends six times in the past five years with an annualized growth rate of 29.3%. It also has a share repurchase program in place. As of Sept. 30, 2025, the company had remaining authority to repurchase up to $34.7 billion of common stock. Given its robust capital position and ample liquidity, the company’s capital-deployment activities seem sustainable and will boost investor confidence in the stock.

In terms of valuation, the WFC stock appears inexpensive relative to the industry. The company is currently trading at a 12-month trailing price-to-earnings (P/E) ratio of 13.55X, which is lower than the industry’s 15.24X. Meanwhile, Citigroup holds a P/E ratio of 11.79X, while Bank of America’s P/E ratio stands at 12.89X.

Price-to-Earnings F12M

Hence, given its inexpensive valuation, favorable fundamentals and solid growth trajectory, the WFC stock is worth investing in now for solid long-term returns.

Wells Fargo currently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 2 hours | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite