|

|

|

|

|||||

|

|

New Feature: See Wall Street analyst ratings directly on Finviz charts for deeper context into price action.

McKesson Corporation MCK has delivered a strong fiscal second quarter, reinforcing confidence in management’s full-year outlook and longer-term strategic repositioning. The company reported consolidated revenues of $103 billion, representing 10% year-over-year growth, while adjusted earnings per diluted share rose 39% to $9.86.

Operating profit expanded 26%, supported by broad-based execution across segments and meaningful operating leverage. On the back of this performance and improved visibility into the remainder of the fiscal year, management raised full-year adjusted EPS guidance to $38.35-$38.85, implying 16-18% growth year over year. The results underscore McKesson’s ongoing transformation from a traditional pharmaceutical distributor into a higher-margin, specialty-focused healthcare services platform.

In the near term, McKesson’s growth is expected to be driven by continued strength in North American Pharmaceutical distribution, accelerating specialty volumes and rising contributions from prescription technology services. The North American Pharmaceutical segment posted revenue growth of 8% in the fiscal second quarter, supported by solid utilization trends, increased specialty distribution, and continued expansion of GLP-1 medications, which generated $13.2 billion in quarterly revenues.

Importantly, management emphasized that operating profit growth in this segment is being driven by volume, mix, and operating efficiencies rather than pricing volatility, reinforcing the durability of earnings expansion.

The Oncology and Multispecialty segment remains the most powerful near-term catalyst. Segment revenues grew 32% year over year, while operating profit surged 71%, reflecting strong organic provider growth and contributions from the PRISM Vision and Core Ventures acquisitions.

Even excluding acquisition-related benefits and nonrecurring gains, organic operating profit growth remained in the low-teens, consistent with long-term targets. Prescription Technology Solutions delivered 9% revenue growth, with operating profit rising 20% as demand increased for access solutions, particularly prior authorization services tied to specialty and GLP-1 drugs. These trends underpin management’s confidence in sustaining elevated earnings growth through the remainder of fiscal 2026.

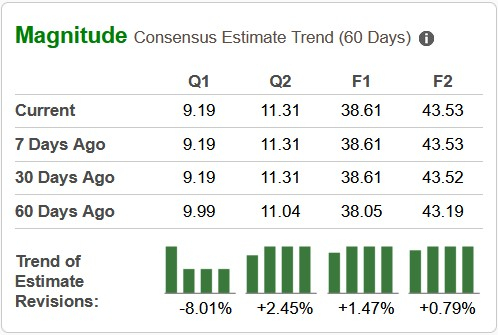

Earnings Estimate Trend

Looking beyond the current fiscal year, McKesson’s long-term investment thesis rests on its ability to scale differentiated specialty platforms and embed itself deeper into the biopharma and provider ecosystem.

Management highlighted oncology, multispecialty care, and biopharma services as structurally attractive markets benefiting from rising drug complexity, higher specialty penetration and increased demand for integrated solutions. The U.S. Oncology Network now supports more than 3,300 providers across over 700 sites, providing a powerful foundation for distribution, data, clinical research and practice management services.

Technology and automation represent another critical long-term lever. McKesson continues to invest aggressively in distribution automation, AI-enabled workflows, and cloud-based platforms to drive efficiency and margin expansion.

Management noted that operating expenses as a percentage of gross profit declined 570 basis points year over year in the fiscal second quarter, reflecting the cumulative impact of these initiatives. Over time, these investments are expected to enhance scalability, improve service levels, and support higher returns on invested capital, reinforcing McKesson’s competitive positioning across multiple healthcare cycles.

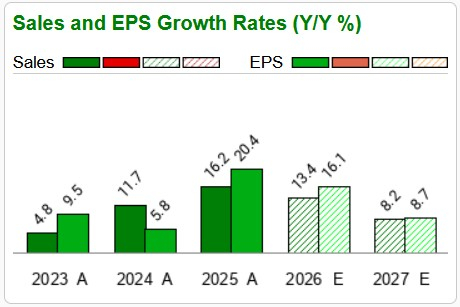

Growth Estimates

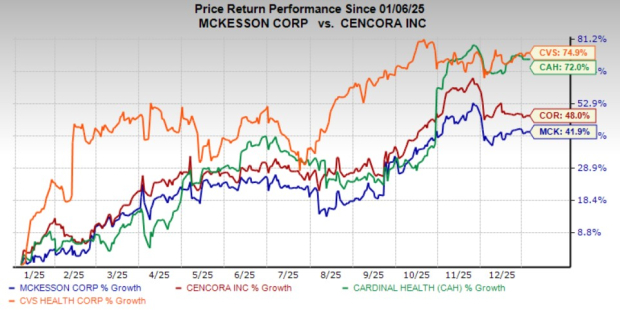

Cardinal Health CAH continues to focus on diversification beyond core distribution, and it is progressing faster in its transition toward platform-based specialty services compared with McKesson. Although Cardinal Health is investing in managed services and specialty care, it lacks McKesson’s scale in oncology networks and prescription technology.

Cencora COR, formerly AmerisourceBergen, is also pursuing higher-margin specialty solutions, and it has expanded its presence in oncology-focused services. COR remains more focused on manufacturer-facing services, while its provider integration is less extensive than McKesson’s oncology and multispecialty footprint.

CVS Health CVS participates in specialty distribution through its pharmacy services arm, but it operates within a more diversified payer-provider model. CVS Health’s structure introduces different capital and strategic priorities, whereas McKesson remains more singularly focused on scaling specialty distribution, data and biopharma services.

YTD Performance: MCK vs. CAH vs. COR vs CVS

Key Challenges and Risks

Despite strong momentum, McKesson faces several execution risks. The planned separation of the Medical-Surgical Solutions business introduces operational complexity and requires disciplined execution to avoid disruption. Management also acknowledged variability tied to illness-season demand, which pressured Medical-Surgical revenues in the fiscal second quarter.

In addition, ongoing investment in technology, acquisitions, and automation may temper near-term margin expansion, even as these initiatives support long-term growth. Regulatory and policy uncertainty, while not currently viewed as a material headwind, remains an inherent risk given McKesson’s central role in the pharmaceutical supply chain.

Conclusion: A Compounding Specialty Platform Story

McKesson’s fiscal second-quarter performance strengthens the case for the stock as a high-quality compounder within healthcare services. Strong near-term execution, rising earnings guidance, and robust free cash flow provide visibility through fiscal 2026, while long-term investments in oncology, multispecialty platforms, and technology position the company for durable growth beyond the current cycle. While portfolio separation and regulatory complexity warrant monitoring, McKesson’s scale, operating discipline, and specialty-focused strategy support a compelling long-term investment thesis.

McKesson currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 2 hours | |

| 3 hours | |

| 5 hours | |

| 10 hours | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-18 | |

| Feb-18 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite