|

|

|

|

|||||

|

|

New Feature: See Wall Street analyst ratings directly on Finviz charts for deeper context into price action.

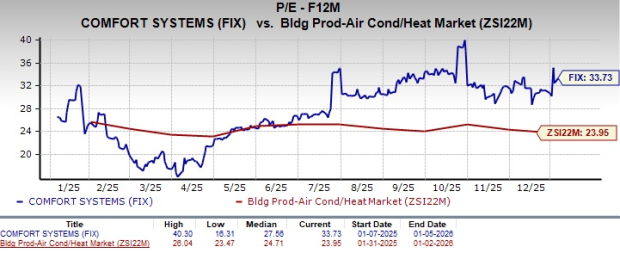

Comfort Systems USA, Inc. FIX is currently trading at a premium compared with the Building Products - Air Conditioner and Heating industry peers and the broader Construction sector, with a forward 12-month price-to-earnings (P/E) ratio of 33.73. The industry’s average currently is 23.95, while the sector’s valuation is 19.61.

The premium valuation of the stock might be intimidating for investors. Still, it is exhilarating at the same time, given the benefits the company is reaping from the robust market fundamentals. The market’s inclination toward AI-related products and services, alongside the use of advanced tools, bodes well for FIX. Moreover, declining Fed interest rates, a favorable public spending environment and in-house efforts on margin expansion are boosting the growth prospects.

However, despite favorable trends, the company is exposed to several vulnerabilities, such as project delays, labor inflation, increased competition and project execution risks. These factors are liable to hurt margin expansion and reduce profitability prospects.

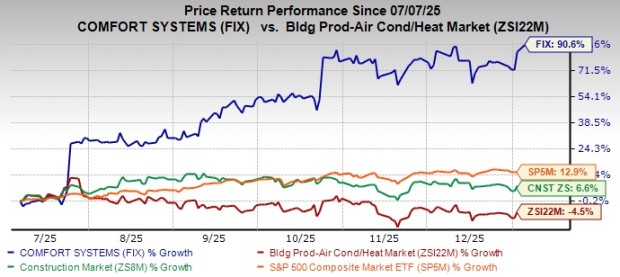

Shares of this Texas-based heating, ventilation, air conditioning and electrical contracting service provider have surged 90.6% in the past six months, notably outperforming the industry, the sector and the S&P 500 Index.

FIX's Price Performance

Favorable Market Trends & Backlog Growth: Comfort Systems is witnessing incremental growth because of broad-based strength across technology, industrial and institutional markets, with data centers emerging as the dominant engine of growth. Its high concentration of work is tied to hyperscale data centers, AI facilities and advanced manufacturing among U.S. MEP contractors, which is contributing to robust growth amid favorable fundamentals. As of the third quarter of 2025, FIX’s backlog of $9.38 billion grew 65% year over year from $5.68 billion and jumped 15.5% sequentially.

Amid a favorable federal and state funding environment, the three back-to-back Fed rate cuts in late 2025 are acting as a catalyst in boosting prospects further. On Dec. 10, 2025, the Federal Reserve slashed its interest rates by another 0.25 percentage points, setting the benchmark between 3.5% and 3.75%. After these cuts, the Federal Open Market Committee or FOMC now expects only one rate cut in 2026, with another one in 2027.

Margin Expansion Efforts: The primary driver of FIX’s margin expansion is its growing exposure to technology and advanced manufacturing projects, which also account for the majority of its backlog. Year to date, the Technology sector accounted for about 42% of revenues, up from 32% reported last year, as hyperscale and AI-driven infrastructure projects continue to scale in size and urgency. These projects tend to be larger, more complex and less price-sensitive, allowing Comfort Systems to bid selectively and protect pricing when compared to traditional commercial HVAC or institutional work.

For the first nine months of 2025, its gross margin expanded year over year by 340 basis points (bps) to 23.6%, with the metric increasing 370 bps in the third quarter. The sustained improvement has been driven by a favorable project mix, execution discipline and strong end-market demand. Management has emphasized disciplined bidding and walking away from low-return work, which has supported higher gross profit per dollar of revenue.

Stable Liquidity & Shareholder Returns: Owing to the strong leverage from top-line growth and favorable market trends, Comfort Systems ended the third quarter of 2025 with cash and cash equivalents of $860.5 million, up from $549.9 million as of 2024. Apart from maintaining a stable liquidity position, FIX ensures its shareholders are satisfied through share repurchases and dividend payments. During the first nine months of 2025, it repurchased 0.3 million shares for approximately $125.4 million under the buyback program. Also, on Oct. 23, 2025, Comfort Systems’ board of directors hiked the quarterly dividend payment by 20% to 60 cents per share ($2.40 per share annually).

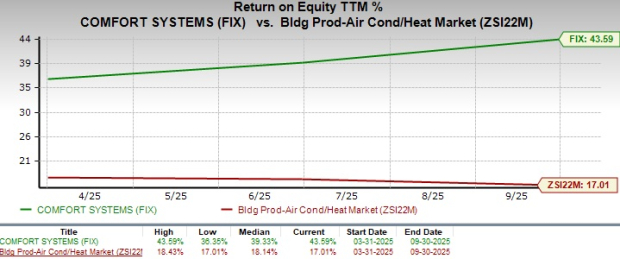

Comfort Systems’ trailing 12-month return on equity (ROE) of 43.6% significantly exceeds the industry’s average, underscoring its efficiency in generating shareholder returns.

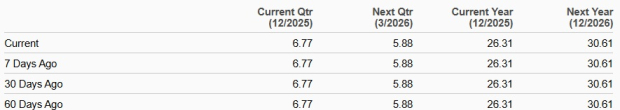

FIX’s earnings estimates for 2025 and 2026 have remained stable over the past 60 days at $26.31 and $30.61 per share, respectively. However, the estimated figures for 2025 and 2026 imply year-over-year growth of 80.2% and 16.4%, respectively.

Comfort Systems’ growing exposure to hyperscale data centers is a double-edged sword. Any slowdown in AI-driven capital expenditures, project deferrals by cloud providers, or power availability constraints could compress backlog growth and utilization. Although the backlog (as of the third quarter of 2025) reached a record level, the company highlighted that it does not guarantee revenue or profit realization. Project delays, scope changes, customer funding issues or cancellations, particularly in large and complex projects, could result in backlog conversion failure.

FIX is also concerned about shortages of skilled labor and rising wage pressure in the current market dynamics. Besides, exposure to competitive pricing, project mix shifts and normalization from peak conditions could disturb its current margin levels and reduce profitability.

Comfort Systems sits at a critical execution layer of the AI-driven data center and technology infrastructure boom, competing with EMCOR Group, Inc. EME, Quanta Services, Inc. PWR and Carrier Global Corporation CARR across distinct but overlapping segments.

EMCOR brings greater scale and broader service offerings, including facilities maintenance and a wider electrical footprint, which helps it secure large, multi-site contracts with hyperscalers. However, Comfort Systems’ decentralized model allows faster local execution and innovation, often translating into higher margins on complex projects. On the other hand, Quanta competes more indirectly. It mainly focuses on the power generation, transmission and grid infrastructure required to support AI-driven electricity demand. While Quanta captures significant AI-related capital spending, its exposure is upstream from FIX’s core business.

Carrier Global plays a different role as an equipment and solutions provider, supplying HVAC, thermal management and data center cooling technologies. Carrier Global benefits from rising demand for advanced cooling driven by AI servers, but it does not directly compete with FIX on installation and project execution.

Overall, Comfort Systems’ integrated MEP capabilities position it as a high-value beneficiary of sustained AI and technology-led data center demand compared to EMCOR, Quanta and Carrier Global.

As discussed above, Comfort Systems is gaining from powerful secular tailwinds tied to AI-driven data center construction, advanced manufacturing and favorable public spending conditions. Robust backlog growth, expanding margins and strong capital returns underscore the company’s solid operating momentum. Strong liquidity, share repurchases and a higher dividend further enhance shareholder returns, with an industry-leading ROE highlighting efficient capital deployment. Stable earnings estimates for 2025 and 2026 still imply attractive double-digit growth, reinforcing FIX stock’s long-term earnings power.

However, heavy reliance on hyperscale data center demand exposes the company to potential project delays, capital funding moderation and power constraints. Labor inflation, competitive pricing pressure and execution risk on large and complex projects could also weigh on margins as conditions normalize.

Comfort Systems remains fundamentally strong with long-term growth drivers intact, but the current premium valuation and balanced risk profile cloud investment judgment for the near term. Thus, it is prudent for existing investors to retain this Zacks Rank #3 (Hold) stock for now. New investors are advised to wait and look for a better entry point when the near-term trends favor FIX stock. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 3 hours | |

| 4 hours | |

| 5 hours |

Blue Collar AI Stock Comfort Systems Jumps On Blowout Earnings, Soaring Backlog

FIX +6.46%

Investor's Business Daily

|

| 5 hours | |

| 5 hours | |

| 8 hours | |

| 9 hours | |

| 9 hours | |

| 10 hours | |

| 10 hours | |

| 10 hours | |

| 13 hours | |

| 13 hours | |

| 14 hours | |

| 16 hours |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite