|

|

|

|

|||||

|

|

Ondas Holdings Inc. (ONDS) is a provider of private wireless data solutions through its Ondas Networks division and autonomous drones via Ondas Autonomous Systems (“OAS”).

OAS has emerged as the main growth engine as the company focuses on the lucrative drone market. In the last reported quarter, total revenues surged more than sixfold year over year to $10.1 million, driven almost entirely by OAS, which contributed $10 million compared with just $1 million a year earlier.

A rapidly expanding opportunity set encompassing counter-UAS demand, strategic partnerships (Rift Dynamics) and NDAA-compliant U.S. production readiness is likely to keep the engine humming for OAS. To complement organic expansion, ONDS has several buyouts that expand its reach into areas of unmanned ground systems, robotics and fiber optic communications, subsurface intelligence and demining robotics.

On the other hand, Ondas Networks remains a longer-dated catalyst. On the last earnings call, management noted that Ondas Networks continues to build long-term value as a foundational enabler for next-generation rail communications. ONDS highlighted that the Association of American Railroads (“AAR”) Wireless Communications Committee selected IEEE 802.16t ("dot16") upgrade 160 MHz LMR voice network. dot16 has already been adopted across 900 MHz and 450 MHz frequencies.

Ondas Holdings Inc. price-consensus-eps-surprise-chart | Ondas Holdings Inc. Quote

This places ONDS for a multi-year upgrade cycle across all AAR-owned frequencies, covering thousands of miles of railroad infrastructure across North America. It is working on expanding the ecosystem of dot16-enabled third-party applications.

However, at present, it expects “meaningful adoption” by the railroads in 2026 for dot16, but at present has “modest revenue expectations from Ondas Networks relative to the OAS business”.

This conservative treatment implies that the 2025 revenue guidance is based mostly on OAS momentum.

Ondas expects revenues for the full year to be at least $36 million (previous target: $25 million), with fourth-quarter revenues estimated to be more than $15 million. Management anticipates revenues in 2026 to be at least $110 million, driven by increasing customer base, backlog and acquisitions.

However, relying on OAS, ONDS will have to navigate a multitude of challenges. Scaling the OAS business while dealing with integration risks amid an acquisition spree is likely to be tough. ONDS is in the middle of a massive transition and already incurring sizable expenses. Management described a period of heavy infrastructure building and team expansion. These moves strengthen long-term competitive moat, but amplify short-term financial pressure.

AeroVironment (AVAV) is one of the key pure-play beneficiaries of rising global demand for military drones and its biggest competitive moat is the strategic ties with the U.S. and allied governments. Frequent product launches are the key catalyst in driving business momentum. In the fiscal second quarter, the company unveiled the next generation of Switchblade loading munitions (Switchblade 600 Block 2, Switchblade 400 and Switchblade 300 Block 20), as well as upgraded JUMP 20 and JUMP20-X (its Group 3 uncrewed aircraft system).

AVAV’s expanding software ecosystem, anchored by the AV_Halo open-architecture platform, is emerging as a powerful long-term growth driver. It recently launched two products, namely AV_Halo Cortex (an advanced intelligence fusion and analysis environment) and AV_Halo Mentor (a war fighter readiness suite that uses AR/VR weapons training and mission rehearsal). For fiscal 2026, it expects revenues between $1.95 billion and $2 billion.

Draganfly (DPRO) is a Canada-based drone solutions and systems developer. The company’s drones include Commander 3XL, Heavy Lift Drone, Commander 2 and Draganfly Medical Response Drone. Increasing deals with the U.S. military bode well. One of the most significant developments is the company’s first major U.S. Army FPV drone order, which is not only a product sale but also includes providing supply-chain and logistical support. It also includes onsite assembly and manufacturing training for the Army to allow them to make “modifications on the fly.”

In October 2025, the company introduced its Outrider Southern Border drone, which is a North American-built, NDAA-compliant multi-mission drone platform. DPRO has 5-plus drone systems that are all NDAA-compliant. As the United States and NATO aggressively eliminate non-compliant Chinese systems from critical infrastructure, this compliance advantage becomes a moat.

Shares of ONDS have surged 38.9% in the past month.

In terms of the forward 12-month Price/Sales ratio, ONDS is trading at 31.82, considerably higher than the Communication - Network Software industry’s multiple of 2.13.

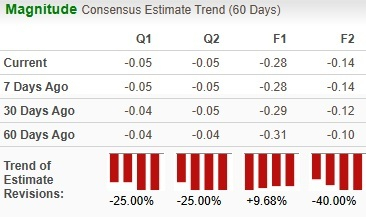

The Zacks Consensus Estimate for ONDS’ earnings for the current year has been revised north over the past 60 days.

ONDS currently has a Zacks Rank #4 (Sell).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 4 hours | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-14 | |

| Feb-14 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite