|

|

|

|

|||||

|

|

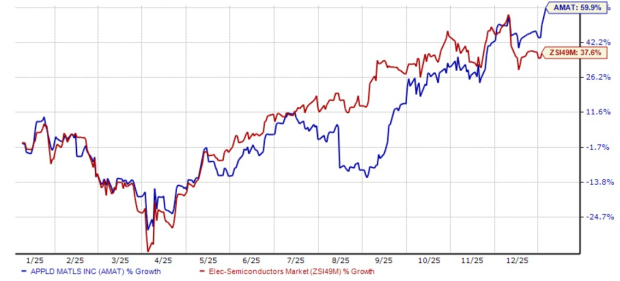

Applied Materials AMAT stock’s 52-week low was recorded at $123.7 in early April 2025. Since then, AMAT stock has climbed 114.1%. In the past year, AMAT stock has surged 59.9%, outperforming the Zacks Electronics - Semiconductors industry’s return of 37.6%. Given the rise in share price, investors might ask: Should they buy, sell or hold the stock? Let’s discuss the fundamentals in detail.

Applied Materials’ wafer fabrication equipment (WFE) is experiencing increased demand due to rising usage of semiconductors in artificial intelligence and high performance computing. AMAT reported that its leading-edge foundry/logic, DRAM and advanced packaging will be the fastest-growing areas of the WFE market.

AMAT specializes in Gate-All-Around transistors at 2nm and below, Backside power delivery, Advanced wiring and interconnect, HBM stacking and hybrid bonding and 3D device metrology, which are indispensable for manufacturing next-generation semiconductor chips. Recent launches like Xtera epi, Kinex hybrid bonding, PROVision 10 eBeam will add to AMAT’s growth story.

AMAT expects next-generation technologies to be produced in large volume, which means that the company’s customers will be ramping up their foundries, naturally benefiting AMAT’s business. In 2025, AMAT strengthened its leadership in DRAM, growing revenues from leading-edge customers by more than 50%. This trend is likely to continue in the future.

AMAT expects its leading-edge foundry, logic, dynamic random access memory and high bandwidth memory to be the fastest-growing wafer fabrication equipment businesses in 2026. AMAT’s advanced packaging business, which is currently valued at $1.5 billion, is still on track to double to $3 billion over the next few years, driven by HBM demand and next-generation packaging architectures.

AMAT restructured its pricing program, and it is expected to contribute most of the 120-bps gross margin expansion in the coming fiscal year. This cost restructuring will further provide AMAT with enough headroom to ramp up its R&D investments. AMAT is setting up the Equipment and Process Innovation and Commercialization center for research, which is expected to be operational by 2026.

This surge in the stock price has led AMAT’s shares to trade above the 50-day and 200-day simple moving averages (SMAs), indicating a bullish trend.

A major headwind for Applied Materials is increasing U.S.-China tensions and export restrictions on semiconductor manufacturing equipment. China remains a crucial market for Applied Materials, accounting for a significant portion of total revenues. However, U.S. government restrictions on selling advanced semiconductor equipment to Chinese manufacturers are hurting Applied Materials’ sales and growth outlook.

Moreover, the broader semiconductor market is recovering, but memory markets, including DRAM and NAND, remain weak. The company expects only a gradual recovery in memory-related semiconductor demand in 2025, which could weigh on Applied Materials’ revenue growth in the near term. Furthermore, the competition from players like KLA Corp. KLAC, Lam Research LRCX and ASML Holding ASML in the semiconductor supply chain market is also a concern for AMAT.

Lam Research’s memory segment, accounting for both Dynamic Random Access Memory and Non-Volatile Memory divisions, is gaining traction on the back of AI. Lam Research’s memory and Non-Volatile Memory division’s sales are gaining traction. The rising demand for AI chips is also ramping up the demand for advanced process control and process-enabling solutions provided by KLA Corp.

KLAC’s advanced packaging solutions are also experiencing robust traction on the back of AI and high-performance computing. ASML Holding’s DRAM and logic customers are driving the demand for its products. These customers are ramping up leading-edge nodes using ASML’s NXE:3800E EUV systems. Additionally, ASML noted that multiple DRAM customers are adopting EUV lithography, which helps in shortening cycle time and lowering costs.

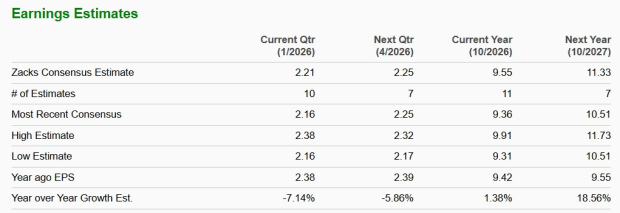

Rising competition is forcing AMAT to increase its sales, marketing and research and development costs to maintain its competitive edge in the market. Although this will help AMAT in the long run, the margins are likely to shrink in the near term. The Zacks Consensus Estimate for AMAT’s first and second quarters of fiscal 2026 is pegged at $2.21 and $2.25, suggesting a year-over-year decline of 7.1% and 5.8%, respectively.

Applied Materials enjoys powerful AI-driven momentum across logic, DRAM and advanced packaging, supported by expanding margins and rising investor confidence. Yet export restrictions, competitive pressure and a stretched valuation limit near-term upside. Considering these factors, we suggest that investors should retain this Zacks Rank #3 (Hold) stock at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 49 min | |

| Mar-12 | |

| Mar-12 | |

| Mar-12 | |

| Mar-12 | |

| Mar-12 | |

| Mar-12 | |

| Mar-12 | |

| Mar-11 | |

| Mar-11 | |

| Mar-11 | |

| Mar-10 | |

| Mar-10 | |

| Mar-10 | |

| Mar-10 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about Finviz Elite