|

|

|

|

|||||

|

|

New Feature: See Wall Street analyst ratings directly on Finviz charts for deeper context into price action.

OraSure TechnologiesOSUR recently announced that it submitted two applications to the FDA seeking approval for its two new at-home tests for sexually transmitted infections (STIs), aiming to expand accessible, home-based diagnostic options. The applications cover a rapid molecular self-test for Chlamydia trachomatis and Neisseria gonorrhoeae (CT/NG), as well as the Colli-Pee device, which enables at-home urine sample collection for STI testing.

Per management, the submissions reflect important advancements in the company’s innovation strategy to decentralize diagnostics by shifting testing away from centralized laboratories and closer to the patient through home-based solutions. The submissions support improved access to STI care that is easier to use, more convenient, private and tailored to patient needs. Looking toward 2026, OSUR focuses on executing its strategy to launch easy-to-use diagnostic tools, making testing available for people outside hospitals or labs, while continuing to drive long-term value for stakeholders.

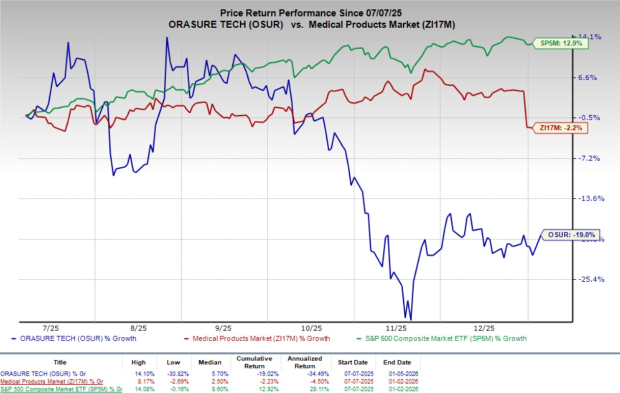

Following the announcement, shares of OraSure gained 3.8% at yesterday’s closing. Over the past six months, shares of the company have lost 19% compared with the industry’s 2.2% decline. However, the S&P 500 has risen 12.9% during the same time frame.

In the long run, the FDA submissions are a positive development for OraSure as it moves the company closer to commercializing at-home STI testing, which will support recurring revenues and strengthen its position in the at-home diagnostics space. Successful FDA clearance and adoption of the CT/NG rapid self-test and Colli-Pee device cater to an underserved market by shifting testing away from centralized labs toward consumer-friendly, over-the-counter formats. Overall, the submissions improve OSUR’s long-term growth outlook, expand its addressable market and reinforce its strategic focus on decentralized diagnostics.

OSUR currently has a market capitalization of $170.73 million.

OSUR’s rapid molecular CT/NG self-test is built on the Sherlock molecular diagnostics technology and is designed to deliver results in about 30 minutes. It’s a fully disposable test, intended for over-the-counter use and relies on a self-collected swab. The test results appear directly on a small handheld device and do not require an external electrical power source, making the test easy and convenient to use at home and in point-of-need settings.

The company also submitted the Colli-Pee device, which is made for collecting urine at home and supports private, easy testing. The submission includes use for several sexually transmitted infections and is being developed in collaboration with a leading diagnostics platform provider. FDA clearance for this device would expand beyond the current research-use-only status to make STI testing more accessible and enhance OSUR’s portfolio in novel sample collection devices and related technologies.

The market of CT/NG testing exceeds $1.5 billion, and with the majority of the U.S. testing still running in centralized laboratories, the introduction of low-cost rapid self-tests creates a strong opportunity for growth by making healthcare more convenient, private and accessible. Upon FDA clearance, these products could drive broader adoption of at-home STI testing, generate recurring revenues and strengthen OSUR’s competitive positioning in decentralized and consumer-focused diagnostics.

Going by data provided by Precedence Research, the home diagnostics market is valued at $6.91 billion in 2025 and is expected to witness a CAGR of 5.26% through 2034. Factors like the growing need for diagnostics due to the rising prevalence of various chronic diseases, conveniences associated with using the diagnostic devices at home and the growing geriatric population across the globe are driving market growth.

OraSure entered a definitive agreement to acquire BioMedomics, adding the SickleSCAN rapid test for sickle cell disease, currently sold outside the United States. The company plans to grow the use of SickleSCAN by using its global sales network and national health programs.

OSUR renewed its partnership with the federally funded Together Take Me Home program, which provides HIV self-tests by mail across the United States. The program aims to reach people at higher risk by offering convenient and private access to testing.

OraSure Technologies, Inc. price | OraSure Technologies, Inc. Quote

Currently, OSUR carries a Zacks Rank #4 (Sell).

Some better-ranked stocks from the broader medical space are Sanara MedTech SMTI, AtriCure ATRC and Boston Scientific BSX.

Sanara MedTech, sporting a Zacks Rank #1 (Strong Buy) at present, reported third-quarter 2025 earnings per share (EPS) of 9 cents, which surpassed the Zacks Consensus Estimate by 137.5%. Revenues of $26.3 million missed the Zacks Consensus Estimate by 1.2%. You can see the complete list of today’s Zacks #1 Rank stocks here.

SMTI has an estimated earnings recession rate of 20.2% for 2025 against the industry’s 12.9% rise. The company beat earnings estimates in the trailing four quarters, the average surprise being 35.20%.

AtriCure, currently carrying a Zacks Rank #2 (Buy), reported a third-quarter 2025 adjusted loss per share of 1 cent, narrower than the Zacks Consensus Estimate by 90.9%. Revenues of $134.3 million beat the Zacks Consensus Estimate by 2.1%.

ATRC has an estimated earnings growth rate of 64.2% for 2025 compared with the industry’s 12.9% rise. The company beat earnings estimates in the trailing four quarters, the average surprise being 67.06%.

Boston Scientific, currently carrying a Zacks Rank #2, reported a third-quarter 2025 adjusted EPS of 75 cents, which surpassed the Zacks Consensus Estimate by 5.6%. Revenues of $5.07 billion beat the Zacks Consensus Estimate by 1.9%.

BSX has an estimated long-term earnings growth rate of 16.4% compared with the industry’s 13.9% rise. The company’s earnings beat estimates in each of the trailing four quarters, the average surprise being 7.36%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-20 | |

| Feb-19 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite