|

|

|

|

|||||

|

|

United Parcel Service UPS and Westinghouse Air Brake Technologies Corporation WAB, which operates as Wabtec Corporation, are well-known players in the Zacks Transportation sector. Despite ongoing economic uncertainty, both companies announced dividend increases in 2025, underscoring their commitment to returning value to shareholders.

Dividend-paying stocks are often favored for their steady income potential and relatively lower volatility. These stocks can help investors build wealth over time, as dividend payouts typically provide a buffer during periods of economic stress, much like the current environment.

In February 2025, Wabtec’s board approved a 25% dividend increase, lifting its quarterly payout to 25 cents ($1.00 annually) from 20 cents per share (80 cents annually).

Wabtec dividend-yield-ttm | Wabtec Quote

During the same month, UPS also raised its dividend, increasing the quarterly payment to $1.64 ($6.56 annually) from $1.63 per share ($6.52 annually).

United Parcel Service dividend-yield-ttm | United Parcel Service, Inc. Quote

Although UPS’ dividend hike last year highlights its shareholder-friendly stance, concerns remain about the long-term sustainability of the payouts. The company’s high dividend payout ratio — representing the proportion of earnings distributed as dividends — raises questions about its ability to sustain these payments over time.

Investors may recall that in the early 2020s, UPS generated strong cash flows amid a surge in e-commerce demand during the pandemic, enabling it to make sizable dividend distributions. However, free cash flow has declined since peaking at $9 billion in 2022.

At present, UPS’ elevated dividend obligations are limiting its financial flexibility. In the first nine months of 2025, the company generated only $2.7 billion in free cash flow and paid more than $4 billion in dividends. In contrast, Wabtec’s significantly lower payout ratio suggests minimal risk to the sustainability of its dividend.

Having assessed dividend strength, let’s compare other key metrics to determine which stock — UPS or WAB — offers a more attractive investment opportunity at present.

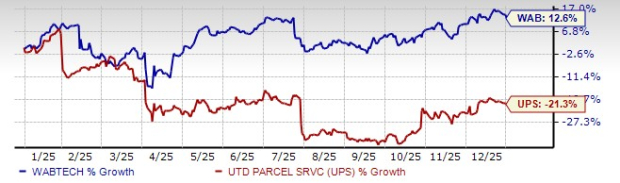

Wabtec has weathered tariff-related market volatility relatively well, gaining in double digits in 2025. In contrast, UPS’ shares have struggled in 2025, posting a double-digit decline.

UPS’ weak stock performance largely reflects revenue pressures stemming from geopolitical uncertainty and persistent inflation, which continue to dampen consumer sentiment and growth expectations. Reduced shipping volumes have further weighed on results.

Meanwhile, Wabtec stock’s strength has been driven by its emphasis on advanced technologies that enhance safety and reliability, along with restructuring efforts and cost-reduction initiatives. Additionally, the global rail supply market is improving in the post-pandemic environment.

Of late, WAB has introduced a number of significant new products, including PTC equipment that includes onboard digital data and global positioning communication protocols. To combat inflationary pressures, WAB is focusing on cost-cutting measures and making efforts to improve productivity and efficiency. WAB also aims to boost profitability by exiting various low-margin product offerings through portfolio optimization. Apart from cost control initiatives, WAB aims to provide real-time visibility and optimization to help busy railroads stay on schedule and recover from disruptions faster, which should help acquire and retain customers.

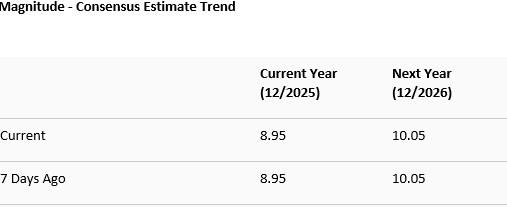

The Zacks Consensus Estimate for Wabtec projects revenue growth of 6.4% in 2025 and 7% in 2026. While the 2025 EPS estimate indicates a year-over-year improvement of 18.4%, earnings are expected to continue their northward movement in 2026 with a 12.3% increase. Notably, EPS estimates for both years have remained stable over the past seven days.

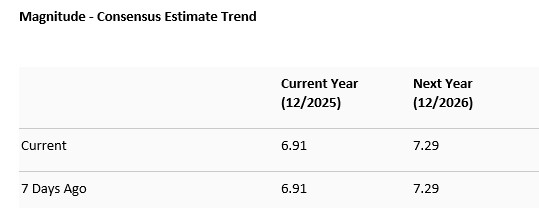

For UPS, the Zacks Consensus Estimate points to a 3.4% decline in sales for 2025, followed by a modest decline of 0.08% in 2026. EPS is projected to fall 10.5% in 2025 before rising 5.4% in 2026. Like WAB, UPS’ earnings estimates for both years have remained stable over the past seven days.

Image Source: Zacks Investment Research

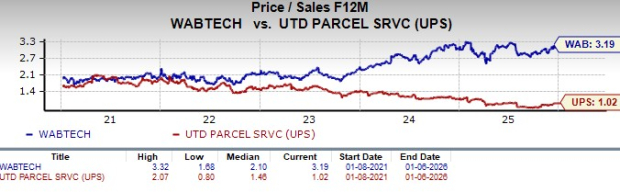

Wabtec currently trades at a forward price-to-sales multiple of 3.19X, well above its five-year median of 2.1X, earning a Value Score of D. UPS, on the other hand, carries a Value Score of B and trades at a forward sales multiple of 1.02X, below its five-year median of 1.46.

While both companies prioritize dividend payments, Wabtec’s lower payout ratio alleviates concerns about dividend sustainability — an issue that continues to loom over UPS. Stronger stock performance suggests that Wabtec’s focus on technological innovation, safety improvements and cost controls is yielding positive results.

The positive developments have likely led to WAB's premium valuations, as investors have high expectations for the company’s prospects and profitability. Consequently, they are willing to pay a premium for the stock, anticipating that it will outperform its peers and the broader market in the coming months. Given its healthier outlook, Wabtec currently appears to be a more attractive investment than UPS.

At present, WAB carries a Zacks Rank #2 (Buy), whereas UPS holds a Zacks Rank #4 (Sell).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 1 hour | |

| Mar-10 | |

| Mar-10 | |

| Mar-10 | |

| Mar-10 | |

| Mar-10 | |

| Mar-09 | |

| Mar-09 | |

| Mar-09 | |

| Mar-08 | |

| Mar-06 | |

| Mar-06 | |

| Mar-06 | |

| Mar-06 | |

| Mar-06 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about Finviz Elite