|

|

|

|

|||||

|

|

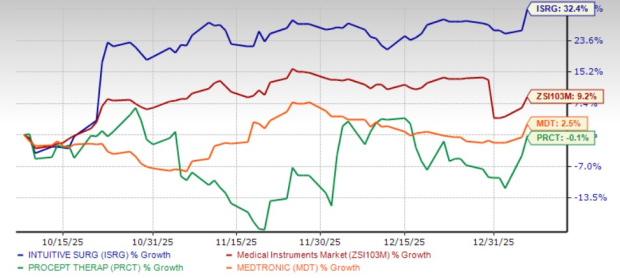

Intuitive Surgical ISRG stock has delivered a strong recent run, rising 32.4% over the past three months and currently trading at $592.85, just 3.8% below its all-time high of $616 reached in February 2025. This rally reflects growing investor confidence in the company’s operating momentum, particularly following a robust third-quarter earnings performance.

With shares hovering near record levels, the key question for investors is whether Intuitive Surgical’s fundamentals, especially procedure growth and the early impact of da Vinci 5, support further upside or suggest a pause after the recent surge. ISRG has outperformed its peers — Medtronics MDT and PROCEPT BioRobotics PRCT — in the past three months. While MDT has gained 2.5%, PRCT declined 0.1%.

ISRG’s 3-Months Price Performance

Procedure growth remains the backbone of Intuitive Surgical’s long-term value creation, and third-quarter results reinforced its strength. Total worldwide procedures grew 20% year over year, driven by 19% growth in da Vinci procedures and a 52% increase in Ion procedures.

Importantly, this growth was not isolated to a single geography or specialty. Management cited strength in U.S. benign general surgery, such as cholecystectomy, appendectomy, and hernia repair, alongside broad-based international growth across general surgery, gynecology, colorectal and thoracic procedures.

Utilization trends further strengthened the investment case. Average system utilization increased 4% for da Vinci multiport, 35% for SP, and 14% for Ion, reflecting rising throughput within the installed base. Management emphasized that da Vinci 5 utilization is already outpacing the earlier Xi platform at a comparable stage, validating the system’s design intent to support higher efficiency. This combination of procedural expansion and utilization leverage supports recurring revenue growth and reduces dependence on pure system placements for top-line acceleration.

The broad launch of da Vinci 5 is emerging as a key catalyst for incremental revenue growth. During the third quarter, Intuitive Surgical placed 240 da Vinci 5 systems, bringing the installed base to 929 systems globally. Upgrade-driven demand was particularly strong in the United States, with 141 trade-in transactions, as hospitals sought to expand throughput and modernize fleets rather than add incremental capacity.

Crucially, da Vinci 5 is not merely replacing older systems — it is driving higher engagement. Management highlighted that nearly 90% of da Vinci 5 procedures utilized integrated insufflation technology, underscoring rapid adoption of platform-specific features.

Higher utilization, combined with a greater mix of da Vinci 5-specific instruments and accessories, supports recurring revenue growth, which already accounts for 85% of total revenues. As da Vinci 5 penetration increases across large health systems and international markets, Intuitive Surgical is positioned to compound revenue growth through both volume and mix.

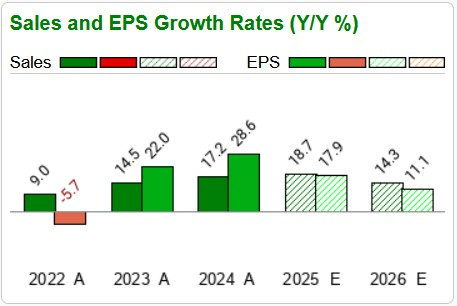

Revenue & EPS Estimates

Beyond initial adoption, Intuitive Surgical’s strategy for da Vinci 5 centers on continuous enhancement through software and hardware updates. In third-quarter, the company received FDA 510(k) clearance for the first in a series of software releases, enabling remote deployment via Network Central Configuration Management. This capability reduces operational friction for hospitals and strengthens the long-term value of the installed base.

Additional features introduced include Force Gauge and Focus Mode, which provide visual force representation, in-console video replay and 3D model manipulation. Early clinical data discussed on the call showed reductions in applied surgical force when force feedback is used, supporting the potential for gentler surgery and improved learning curves.

Management framed these releases as foundational, with future updates expected to further integrate digital tools, AI-driven insights and intraoperative guidance, deepening differentiation and reinforcing switching costs over time.

Rising competition in surgical robotics extends beyond Medtronic’s Hugo platform to other emerging U.S.-listed rivals, such as Procept BioRobotics, which recently received FDA clearance for its AI-powered HYDROS robotic system for urology and benign prostatic hyperplasia. Both Medtronic’s Hugo and Procept BioRobotics’ HYDROS target procedure growth and utilization gains that could erode parts of Intuitive Surgical’s dominance in specific indications.

Medtronic’s Hugo offers a modular, multi-specialty approach, while Procept BioRobotics focuses on autonomous tissue removal in urology; together, they signal intensifying competitive pressure within the robotic surgery market.

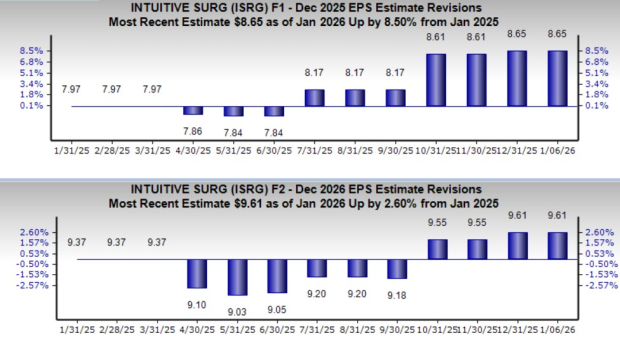

Estimates for Intuitive Surgical’s 2025 earnings have moved up 8.5% to $8.65 per share over the past year, while the same for 2026 earnings has improved 2.6% to $9.61. The positive estimate revision depicts bullish sentiments for the stock.

Although ISRG shares are trading just below all-time highs, the valuation remains well below the five-year peak reached in February last year. Moreover, third-quarter results suggest that Intuitive Surgical’s recent stock rally is grounded in tangible operational momentum.

Sustained procedure growth, rising utilization, accelerating da Vinci 5 adoption, and a robust pipeline of follow-on feature releases position the company for durable growth into 2026. For investors with a long-term horizon, the current pullback from peak levels may represent an opportunity to gain exposure to a structurally strengthening robotics platform rather than a signal to step aside.

With a Zacks Rank #2 (Buy), Intuitive Surgical appears to be a potential addition to one’s portfolio. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 2 hours | |

| 2 hours | |

| 7 hours | |

| 9 hours | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite