|

|

|

|

|||||

|

|

Butterfly Network BFLY recently announced its plans to launch its Beam Steering API to support advanced third-party AI applications and technology development. The API, expected to be released in the first half of 2026, will be available through the company’s Butterfly Garden and Ultrasound-on-Chip co-development programs. This release will provide external developers with access to imaging capabilities that were exclusive to the BFLY’s own applications, including features such as iQ Slice and iQ Fan.

Per management, providing developers with digital beam steering access enables more advanced imaging AI tools and simplifies image capture. BFLY’s beam steering is software-based and runs on a semiconductor chip and uses advanced imaging modes such as Biplane, iQ Slice and iQ Fan. As the platform develops, partners can use more core imaging features to create advanced applications, accelerating innovation and broadening ultrasound use across care settings.

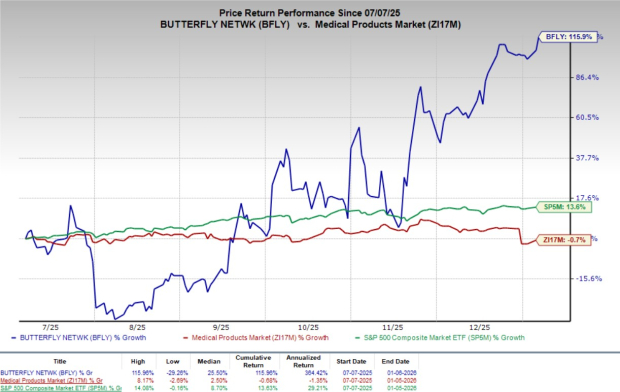

Following the announcement, shares of Butterfly Network gained 4.9% at yesterday’s closing. Over the past six months, the stock soared 115.9% against the industry’s 0.7% decline. However, the S&P 500 has risen 13.6% during the same time frame.

In the long run, the initiative enhances the value of Butterfly Garden by positioning Butterfly Network as not just a device maker, but a platform for imaging innovation. Opening core imaging capabilities will enable developers to leverage the company’s 3D imaging capabilities and accelerate ecosystem growth, deepen partner relationships and support long-term adoption of the BFLY’s handheld ultrasound solutions across global healthcare settings.

BFLY currently has a market capitalization of $977.57 million.

Butterfly Network’s Beam Steering API is built on its electronically controlled 3D imaging software, which enables off-axis beam tilting of up to 20 degrees, allowing the technology to support advanced imaging applications that minimize the need for precise probe placement. By reducing dependence on operator technique, the API helps clinicians obtain clearer, more consistent and high-quality images with improved usability and reliability across a range of clinical settings.

Butterfly Network’s technology is based on a semiconductor chip that uses a fully electronic two-dimensional capacitive micromachined ultrasonic transducer array with roughly 9,000 elements. The company’s semiconductor-based design allows ultrasound beams to be controlled through software, rather than traditional mechanical movement. By enabling beam steering in all three dimensions, the system delivers greater flexibility and precision in imaging.

By making these capabilities available through an SDK, BFLY aims to develop more sophisticated AI applications that simplify image acquisition and improve diagnostic consistency. As portable ultrasound moves earlier in the care pathway and into more diverse clinical environments, usability and AI-assisted workflows become critical adoption drivers. Planned support spans multiple clinical presets, including abdominal, cardiac, obstetric, musculoskeletal, vascular and lung imaging.

Going by data provided by Precedence Research, the artificial intelligence (AI) in the ultrasound imaging market is valued at $1.12 billion in 2025 and is expected to witness a CAGR of 8.45% through 2034. Factors like the recognition of the benefits of AI-based technologies and the growing applications of AI in diagnostic activities are driving market growth.

Butterfly Network recently announced the launch of Compass AI, the latest version of its enterprise software platform. Powered by artificial intelligence, Compass AI is designed to streamline clinical workflows and enable scalable, revenue-generating point-of-care ultrasound programs for healthcare systems.

Butterfly Garden reached a key milestone with the launch of HeartFocus by DESKi, the first FDA-cleared third-party application available on the platform. The app allows Butterfly Network users to perform AI-guided echocardiography exams, expanding access to advanced cardiac imaging.

The company supported the launch of a first-of-its-kind AI-based Gestational Age Calculator in Malawi and Uganda, developed by the University of North Carolina with funding from the Gates Foundation, where it is submitted for FDA review.

Butterfly Network, Inc. price | Butterfly Network, Inc. Quote

Currently, BFLY carries a Zacks Rank #3 (Hold).

Some better-ranked stocks from the broader medical space are Veracyte VCYT, KORU Medical Systems, Inc. KRMD and Schrodinger SDGR.

Veracyte, sporting a Zacks Rank #1 (Strong Buy) at present, reported third-quarter 2025 adjusted earnings per share (EPS) of 51 cents, which surpassed the Zacks Consensus Estimate by 59.4%. Revenues of $131.8 million beat the Zacks Consensus Estimate by 5.5%. You can see the complete list of today’s Zacks #1 Rank stocks here.

VCYT has an estimated earnings growth rate of 38.7% for 2025 compared with the industry’s 14.8% rise. The company beat earnings estimates in the trailing four quarters, the average surprise being 45.12%.

KORU Medical Systems, currently carrying a Zacks Rank #2 (Buy), reported a third-quarter 2025 loss per share of 2 cents, which came narrower than the Zacks Consensus Estimate by 33.3%. Revenues of $10.4 million beat the Zacks Consensus Estimate by 7.1%.

KRMD has an estimated earnings growth rate of 53.9% for 2025 compared with the industry’s 20.4% growth. The company beat earnings estimates in the trailing four quarters, the average surprise being 20.83%.

Schrodinger, currently carrying a Zacks Rank #2, reported a third-quarter 2025 loss per share of 45 cents, which came narrower than the Zacks Consensus Estimate by 40.0%. Revenues of $54.3 million beat the Zacks Consensus Estimate by 8.7%.

SDGR has an estimated long-term earnings growth rate of 37.8% compared with the industry’s 27.9% growth. The company’s earnings have missed estimates in the trailing four quarters, the average surprise being 0.93%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Mar-09 | |

| Mar-08 | |

| Mar-03 | |

| Mar-02 | |

| Mar-02 | |

| Mar-02 | |

| Feb-28 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite