|

|

|

|

|||||

|

|

SoFi Technologies and Interactive Brokers have delivered substantial returns to investors in recent years.

SoFi is expanding its financial services platform and continues to see its customer base grow rapidly.

Interactive Brokers offers a global brokerage platform with efficiency and low costs, making it especially appealing to high-volume traders.

SoFi Technologies (NASDAQ: SOFI) and Interactive Brokers Group (NASDAQ: IBKR) are two growth stocks that have delivered strong returns for investors in recent years. Since the start of 2023, SoFi and Interactive Brokers stock prices are up 496% and 278%, respectively.

The companies have benefited from better stock market conditions, and their growth has enabled them to deliver outsize returns. SoFi became profitable for the first time in 2024 and continues to grow at an impressive pace. Interactive Brokers has a longer track record, delivering 21% annualized returns over the past decade.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now, when you join Stock Advisor. See the stocks »

If you're an investor looking for growth stocks to buy and these two stocks are on your radar, consider the following.

SoFi operates a digital-native banking platform. The fintech began as a student loan provider and has since expanded to include personal and home loans. This helps it generate income from interest, fees, and loan sales to investors.

Then there is its financial services business, which is booming. Here, it offers checking and savings accounts, investments, and money management tools.

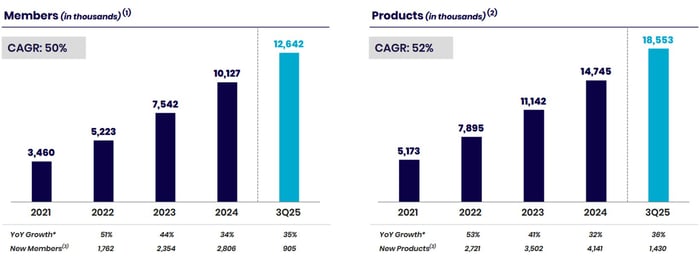

In the third quarter, SoFi's member count, or the total number of customers across its platform, grew to 12.6 million. Since 2021, its customer count has increased 265%. The company has executed strong cross-selling, reflected in 18.5 million total products across its member base at the end of the third quarter.

Image source: SoFi Technologies.

Interactive Brokers operates in the investment space as a global brokerage and clearing platform, enabling customers to buy and sell a wide variety of investments, including stocks, options, futures, and cryptocurrencies. Its brokerage platform caters to tech-savvy investors, enabling them to leverage its analytics, global market access, and a powerful application programming interface (API) for trading to automate and build custom strategies.

Its trading platform is highly automated, driven by management's laser focus on reducing customer costs. As a result, it has some of the lowest fees in the industry along with a stellar profit margin, driven by its operational efficiency and cost structure.

Image source: Getty Images.

Interactive Brokers' growth is also impressive. Customers are drawn to its low-cost platform, which features strong execution, thereby attracting high-volume traders. Over five years, client accounts have grown from 981,000 to 4.1 million as of the third quarter, a 33% annual rate. Equity balances for clients have increased from $233 billion to $750 billion, representing a 27% annual growth rate.

SoFi aims to be a one-stop shop for all of its customers' financial needs, and its long-term opportunity is cross-selling to its huge customer base. As that base grows, SoFi can sell its lending, investing, banking, and insurance products to existing members at low marginal cost, driving revenue growth and boosting margins.

One smaller component of SoFi's business that could provide extra upside is its technology segment. Here, the company uses technology it acquired in recent years, such as Galileo Financial Technologies and Technisys, to provide core banking products to nonbanking fintechs. This business is capital-light and could generate recurring revenue that's diversified beyond lending and financial services.

Interactive Brokers' opportunity is in expanding its market share, especially internationally. The company provides trading across 160 electronic exchanges in 36 countries and serves customers in 200 countries. Management is expanding exchange access to include the Taipei Exchange, the United Arab Emirates, and Brazil.

The brokerage operator should also benefit from the growing value of assets and increased investor interest in the market. Rising client assets, driven by stock markets and other price increases, are expanding its asset base and supporting growing net income, margin lending, and transaction activity.

SoFi and Interactive Brokers are two fintech stocks that offer solid growth potential for investors.

SoFi Technologies may have greater growth potential because it is a younger company that continues to expand rapidly. It stands to benefit from cross-selling opportunities and has potential for further growth in its technology segment. But the stock is currently expensive, with a forward price-to-earnings ratio of 49.7, making it best for investors who believe it can meet the lofty expectations already priced in.

Interactive Brokers Group is more established and is likely to benefit as it expands its reach and asset values rise. Its stock valuation is attractive at 28.7 times forward earnings, which may appeal to more-conservative investors.

Before you buy stock in SoFi Technologies, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and SoFi Technologies wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $488,653!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,148,034!*

Now, it’s worth noting Stock Advisor’s total average return is 971% — a market-crushing outperformance compared to 196% for the S&P 500. Don't miss the latest top 10 list, available with Stock Advisor, and join an investing community built by individual investors for individual investors.

*Stock Advisor returns as of January 7, 2026.

Courtney Carlsen has positions in Interactive Brokers Group and SoFi Technologies. The Motley Fool has positions in and recommends Interactive Brokers Group. The Motley Fool recommends the following options: long January 2027 $43.75 calls on Interactive Brokers Group and short January 2027 $46.25 calls on Interactive Brokers Group. The Motley Fool has a disclosure policy.

| Feb-15 | |

| Feb-13 | |

| Feb-12 | |

| Feb-11 | |

| Feb-11 | |

| Feb-11 | |

| Feb-11 | |

| Feb-11 | |

| Feb-11 | |

| Feb-11 | |

| Feb-11 | |

| Feb-10 | |

| Feb-10 | |

| Feb-10 | |

| Feb-10 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite