|

|

|

|

|||||

|

|

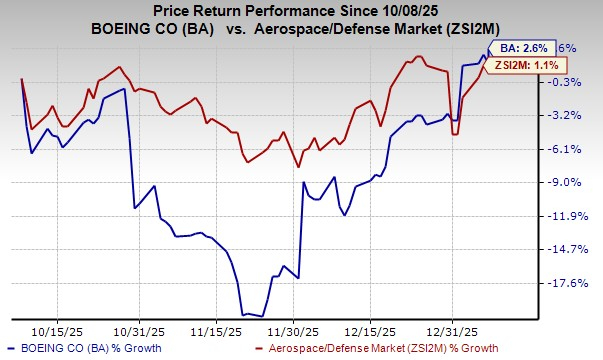

The Boeing Company’s BA shares have rallied 2.6% in the past three months, outperforming the Zacks Aerospace-Defense industry’s growth of 1.1%. The company is seeing growth across its commercial, defense, and services businesses, driven by robust aircraft demand, significant contract awards and a solid backlog that underpins sustained revenue growth.

Other defense stocks, such as Lockheed Martin LMT and General Dynamics GD, have also outperformed during the same period. Shares of Lockheed Martin and General Dynamics have increased 3.9% and 4.2%, respectively, during the same time frame.

Considering Boeing’s outperformance compared with its industry, investors might be left wondering if this is a good time to add BA stock to their portfolio. Let's examine the factors that contributed to the share price gain and assess the stock's investment prospects to make an informed decision.

Boeing continues to benefit from strong demand in commercial aerospace, reflected in solid aircraft orders and deliveries, while its defense and space businesses also maintain a positive outlook given its leading global contractor position.

In January 2026, Boeing and Alaska Airlines announced the carrier's largest-ever airplane order. This order will significantly benefit Boeing by boosting its order backlog and improving long-term revenue visibility, while also reinforcing demand for its 737 and 787 programs.

During the same month, Boeing announced that it has been awarded a $2 billion contract from the U.S. Air Force to continue development of the B-52 Commercial Engine Replacement Program. The contract supports development and integration of new engines and systems that increase the aircraft’s efficiency, range, reliability, and operational life, ensuring continued production and engineering activity over many years. It also reinforces the company’s role as a key defense contractor involved in major strategic modernization programs.

In December 2025, Boeing completed the acquisition of Spirit AeroSystems. This will benefit Boeing by strengthening its supply chain and giving it direct control over key aerostructures production. This is expected to improve quality, reduce bottlenecks and enhance production stability. It also brings Boeing’s largest supplier of spare parts in-house and expands its maintenance, repair, and overhaul services and aftermarket business, boosting long-term revenue potential.

While Boeing presents strong growth potential, it also faces several key challenges that investors should weigh carefully. Although global air travel demand continues to recover and expand, the aviation industry remains constrained by persistent supply-chain disruptions, including shortages of engines, castings and other critical components.

These bottlenecks have delayed aircraft deliveries and increased production costs, limiting manufacturers’ ability to fully capitalize on rising demand. Additionally, geopolitical tensions and logistical challenges across supplier networks could prolong these constraints.

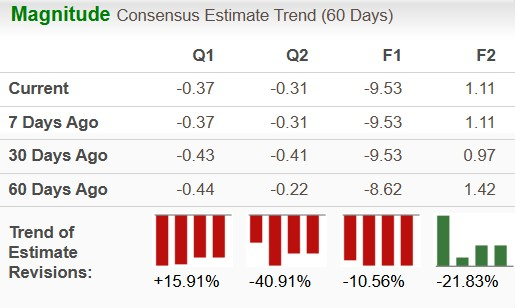

The Zacks Consensus Estimate for 2026 earnings per share (EPS) has decreased 21.83% in the past 60 days. BA’s long-term (three to five years) earnings growth rate is 31.33%.

The Zacks Consensus Estimate for Lockheed Martin’s 2026 EPS has decreased 0.14% in the past 60 days. LMT’s long-term earnings growth rate is 11.94%. The consensus estimate for General Dynamics’ 2026 EPS has decreased 0.06% in the past 60 days. GD’s long-term earnings growth rate is 13.07%.

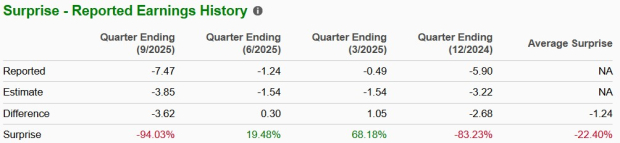

The company beat on earnings in two of the trailing four quarters and missed in the other two, delivering a negative average surprise of 22.4%.

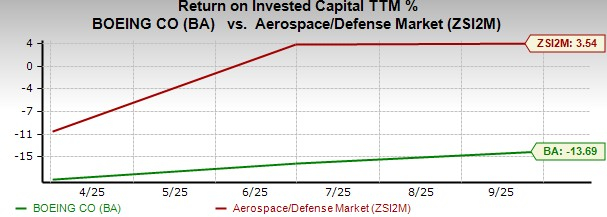

The image below shows that BA stock’s trailing 12-month return on invested capital (ROIC) not only lags the peer group’s average return but also reflects a negative figure. This suggests that the company's investments are not yielding sufficient returns to cover its expenses.

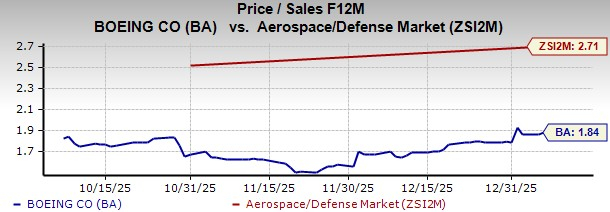

In terms of valuation, Boeing’s forward 12-month price-to-sales (P/S) is 1.84X, a discount to the industry’s average of 2.71X. This suggests that investors will be paying a lower price than the company's expected sales growth compared with that of its peer group.

Boeing is benefiting from strong commercial aerospace demand, supported by solid aircraft orders and deliveries, while its defense and space businesses remain well positioned. Recent contracts will further strengthen Boeing’s backlog and long-term revenue visibility.

However, considering its lower ROIC and declining earnings estimates, new investors should wait and look for a better entry point. Those who already have this Zacks Rank #3 (Hold) stock in their portfolio may continue to retain it, considering the company’s long-term growth projection.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 8 min | |

| 8 hours |

Boeing, Northrop Grumman Stocks Poised To Move On Key Government Approvals

BA

Investor's Business Daily

|

| 8 hours | |

| 9 hours | |

| 9 hours | |

| 11 hours | |

| 18 hours | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-16 | |

| Feb-15 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite