|

|

|

|

|||||

|

|

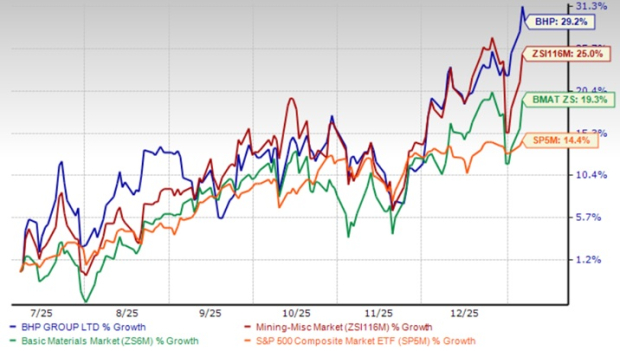

BHP Group Limited BHP shares have gained 29.2% in the past six months, outperforming the Zacks Mining - Miscellaneous industry’s 25% growth. Over the same period, the Zacks Basic Materials sector has gained 19.3% and the S&P 500 has risen 14.4%.

Meanwhile, iron miners like Rio Tinto Group RIO and Vale S.A VALE have gained 44% and 45%, respectively.

BHP shares are trading above both 50-day and 200-day moving averages, signaling a sustained bullish trend.

Despite the industry-beating rally, investors should evaluate the durability of key growth drivers, prospects and potential risks before taking a position.

BHP produced a record 263 Mt of iron ore in fiscal 2025, within its guided 255-265.5 Mt and up 1% year over year. Production at Western Australia Iron Ore (“WAIO”) was a record of 257 Mt (290 Mt on a 100% basis). WAIO has been the lowest-cost iron ore producer globally for more than four years.

For fiscal 2026, BHP expects iron ore production of 258-269 Mt. WAIO’s output is likely to be 251-262 Mt (284-296 Mt on a 100% basis). This factors in the planned renewal of Car Dumper 3 (CD3) and the ongoing tie-in activities for Rail Technology Program 1 (RTP1).

Over the medium term, WAIO production is expected to exceed 305 Mt annually, supported by expanded rail operation capacity unlocked by RTP1 and the Western Ridge Crusher Project, which will replace production from the depleting orebodies around Newman with first production in the first quarter of fiscal 2027. BHP is investing in a sixth car dumper and related infrastructure at Port Hedland.

BHP continues to reshape its portfolio toward commodities such as copper and potash, allocating nearly 70% of its medium-term capital expenditure to these areas. This strategy positions the company to benefit from decarbonization, electrification, population growth and rising living standards in emerging markets.

Copper production reached a record 2,017 kt in fiscal 2025, the first time BHP crossed the 2,000-kt milestone. Output has risen 28% over the past three years, reflecting sustained investment. The fiscal 2026 cooper output is targeted at 1,800-2,000 kt. BHP’s project pipeline could add 2 Mtpa of attributable copper output by the 2030s.

BHP is also advancing the Jansen Stage 1 potash project, a large-scale, low-cost, high-grade resource with a mine life exceeding 100 years. It has been 73% completed and BHP is working toward its first production by mid-2027. Once operational, Jansen Stage 1 is expected to produce 4.35 million tons of potash annually. Stage 2 of the project has been 13% completed and is expected to deliver its first production in fiscal 2031.

These investments will transform Jansen into one of the world’s largest potash mines, doubling production capacity to 8.5 million tons per year, positioning BHP as a major global producer of potash by the end of the decade.

In fiscal 2025, BHP’s net operating cash flow was $18.7 billion, which was down 10% year over year due to lower prices, offset by record copper output. Despite this dip, BHP Group has delivered a net operating cash flow of more than $15 billion from fiscal 2010 to fiscal 2025 (barring fiscal 2016).

Capital and exploration spending is budgeted at $11 billion for fiscal 2026 and 2027, averaging $10 billion annually from fiscal 2028 to 2030. Strong cash flows have enabled BHP to materially reduce debt, with net debt at $12.9 billion at fiscal 2025-end, within its target of $10-$20 billion.

The company also announced a final dividend of 60 cents per share, reflecting a payout ratio of 60%. Total cash returns to shareholders announced for fiscal 2025 were $5.6 billion. Over the past five years, BHP has delivered more than $50 billion in cash dividends to shareholders.

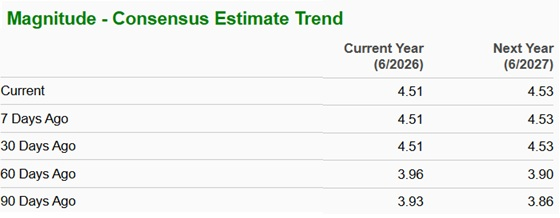

The Zacks Consensus Estimate for BHP’s fiscal 2026 earnings is pegged at $4.51 per share, indicating 23.9% year-over-year growth. The estimate for fiscal 2027 is at $4.53, suggesting a 0.4% rise.

The Zacks Consensus Estimate for fiscal 2025 and 2026 has moved north over the past 90 days.

Iron ore prices have started 2026 on a strong note and are currently around $106 per ton, buoyed by strong demand and ongoing supply constraints in China. Steelmakers are restocking ahead of the Lunar New Year holiday in February, with tight domestic supplies lending support. Going forward, rising steel demand, fueled by strong economic development and urbanization, will lead to high demand for iron ore and support prices.

Copper futures are currently hovering near $6 per pound amid expectations of a further tightening in global supply this year. The long-term outlook for copper is positive as copper demand is expected to grow, partly driven by electric vehicles, and renewable energy and infrastructure investments.

The company’s current dividend yield of 3.66% is higher than the industry’s 2.09% and the S&P 500’s 1.07%.

BHP’s return on equity, a profitability measure of how prudently the company is utilizing its shareholders’ funds, is at 17.7%, higher than the industry’s average of 1.4%.

BHP is trading at a forward 12-month P/E ratio of 14.34X, at a discount to the industry’s 17.32X.

The stock is, however, expensive compared with other iron miners like Rio Tinto Group and Vale, which are trading at 12.04X and 7.04X, respectively.

BHP is well-positioned for durable long-term growth, backed by resilient iron ore operations, expanding exposure to copper and potash, and a disciplined capital allocation strategy. A supportive commodity price backdrop, rising earnings estimates and a robust balance sheet further strengthen its outlook.

With an industry-leading dividend yield, improving profitability and attractive valuation relative to the industry, and Zacks Rank #1 (Strong Buy), BHP stands out as a convincing buy for investors.

You can see the complete list of today’s Zacks #1 Rank stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 9 hours | |

| 12 hours | |

| 12 hours | |

| 13 hours | |

| 14 hours | |

| 14 hours | |

| 17 hours | |

| 19 hours | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-24 | |

| Feb-24 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite