|

|

|

|

|||||

|

|

In the rapidly evolving world of digital finance, platforms that help consumers compare loans, credit cards and other financial products are battling for long-term dominance. Two prominent players — NerdWallet, Inc. NRDS and LendingTree, Inc. TREE — stand out for their scale, brand recognition and data-driven marketplaces.

While both operate in the same broad ecosystem, their business models, growth strategies and financial trajectories differ meaningfully. As market conditions shift and investors look for sustainable growth, comparing NerdWallet’s affiliate-led, content-driven approach with LendingTree’s diversified marketplace strategy offers valuable insight into which company may be better positioned to win the long-term digital finance race.

NRDS is more of an affiliate marketing provider. It produces massive volumes of personal finance advice, reviews and guides, monetizing through affiliate partnerships when readers click through and sign up for credit cards, loans or other financial products.

NedWallet has established a strong market position in the landscape of personal finances, offering valuable resources and tools to empower clients to make informed decisions. The company empowers both individuals and small and medium businesses (SMBs) to make smarter financial decisions with its digital platform.

The company’s NerdWallet application platform delivers unique value across many financial products, including credit cards, mortgages, insurance, SMB products, personal loans, banking, investing, and student loans.

NRDS’s user base has grown substantially over the past year. Collaborations with several financial institutions have expanded its reach and credibility. One recent milestone includes its October 2024 acquisition of Next Door Lending, a mortgage brokerage that enhances NerdWallet’s home financing offerings by connecting users with wholesale lenders. In September, the company launched an enhanced data initiative to support its customer relationship management (CRM) efforts by improving the usability of its registered user database.

Over the years, NRDS has expanded its reach in the U.K., Canada, and the Australian markets as an opportunity for growth. With a diversified revenue approach, NRDS is well-positioned for sustained growth in the future.

In third-quarter 2025, LendingTree’s adjusted EBITDA increased 25% year over year. NerdWallet expects its 2025 adjusted EBITDA to be $141-$45 million, up from the earlier stated $106-$116 million. In 2024, adjusted EBITDA was $108 million.

TREE is a key player in the growing digital lending space. It is an online marketplace that connects consumers with financial service providers for mortgages, loans, credit cards and insurance. The company’s operating strategy has been evolving, with a notable shift in focus toward boosting the top line by diversifying into non-mortgage products, particularly in the consumer segment.

Over the years, TREE has expanded its services to include credit cards and widened its loan offerings by providing personal, auto, small business and student loans. LendingTree entered the branded credit market in 2023 with the launch of the WinCard, its first consumer credit product, in partnership with Upgrade. The company’s initiatives, including SPRING (previously MyLendingTree) and TreeQual, are bolstering its cross-selling opportunities.

LendingTree has also been leveraging data and technology to augment user experience and monetization. The company’s investment in EarnUp (in early 2022), a consumer-facing payment platform, demonstrates its commitment to building a more comprehensive, tech-enabled ecosystem for financial health management. TREE intends to continue adding offerings for consumers, small businesses and network partners to its online marketplace to expand and diversify its revenue sources.

In third-quarter 2025, LendingTree’s adjusted EBITDA increased 48% year over year, fueled by strong revenue growth across all three business segments. For 2025, adjusted EBITDA is projected to be $126-$128 million, up from the prior stated $119-$126 million.

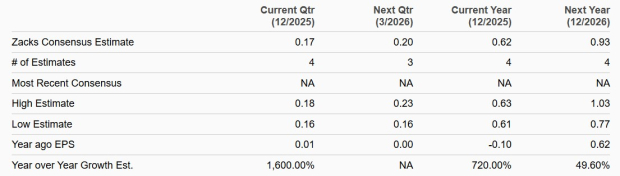

The Zacks Consensus Estimate for NRDS’ 2025 and 2026 earnings implies year-over-year increases of 720% and 49.6%, respectively. EPS estimates have been unchanged for both years over the past seven days.

Earnings EStimates

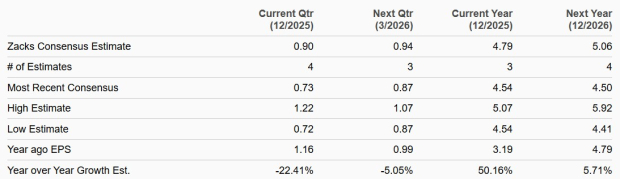

The Zacks Consensus Estimate for TREE’s 2025 and 2026 earnings suggests year-over-year growth of 50.2% and 5.7%, respectively.EPS estimates have been unchanged for both years over the past seven days.

Earnings EStimates

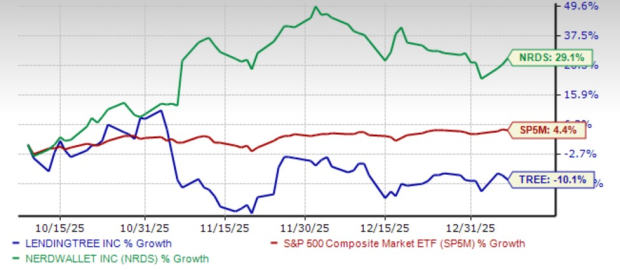

In the past three months, NRDS shares have gained 29.1%, whereas the TREE stock has declined 10.1% compared with the S&P 500’s rise of 4.4%. Hence, in terms of investor sentiments, NRDS has the edge.

Price Performance

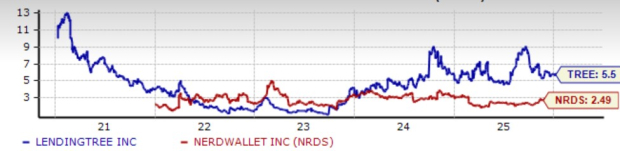

From a valuation perspective, TREE is trading at a five year forward price-to-book (P/B TTM) multiple of 5.5X. NRDS’ forward P/B multiple sits at 2.5X. Thus, currently, the NRDS stock is inexpensive compared with LendingTree.

Price-to-Book TTM

Both NerdWallet and LendingTree are well-positioned in the digital finance space, but NerdWallet’s scalable, asset-light affiliate model, trusted personal finance brand, and expanding user base provide a solid foundation for long-term growth. Strategic moves such as the Next Door Lending acquisition, enhanced data initiatives and international expansion further strengthen its competitive position.

Financially, NRDS offers a more attractive growth profile, with sharply higher projected earnings and rising adjusted EBITDA, while trading at a lower valuation than LendingTree. Its recent stock outperformance also signals stronger investor confidence.

Although LendingTree continues to diversify and improve profitability, slower earnings growth and a richer valuation limit its upside. Overall, NerdWallet’s growth potential, valuation appeal and strategic momentum make it a compelling bet for investors now.

Currently, NRDS sports a Zacks Rank #1 (Strong Buy) and LendingTree carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 9 hours | |

| Feb-16 | |

| Feb-13 | |

| Feb-12 | |

| Feb-11 | |

| Feb-10 | |

| Feb-10 | |

| Feb-09 | |

| Feb-09 | |

| Feb-08 | |

| Feb-06 | |

| Feb-04 | |

| Feb-03 | |

| Jan-30 | |

| Jan-29 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite