|

|

|

|

|||||

|

|

New Feature: See Wall Street analyst ratings directly on Finviz charts for deeper context into price action.

Monster Beverage Corporation MNST remains one of the leading global beverage companies, with a powerful brand portfolio that continues to outperform in a competitive and evolving market. Backed by strong category demand, consistent innovation and disciplined execution, the company has delivered solid financial performance while strengthening its long-term growth foundation.

As consumer preferences shift toward functional and zero-sugar beverages, Monster Beverage’s ability to adapt, scale and protect margins positions it as a resilient player worth holding, even amid macro and cost-related uncertainties.

Here’s a closer look at the key factors supporting the case for retaining MNST stock at this time.

Monster Beverage’s disciplined pricing strategy has emerged as a key profitability driver. Targeted price adjustments and reduced promotional spending have allowed the company to grow earnings faster than sales, supporting margin expansion despite higher aluminum and logistics costs. This pricing flexibility reflects MNST’s strong value proposition and loyal consumer base, giving it room to protect profitability without materially impacting demand.

Innovation continues to anchor Monster Beverage’s growth strategy. The success of the Ultra and Juice Monster families, along with a steady pipeline of new flavors and zero-sugar offerings, keeps the brand relevant and engaging across markets. Limited-time offerings and athlete-backed launches further support repeat purchases and market share gains, reinforcing the company’s leadership in the energy drink category.

Monster Beverage’s expanding international footprint is another key tailwind. Rising household penetration, growing demand in emerging markets and strong execution across regions are driving sustained growth outside the United States. Supported by high-impact marketing, global sponsorships and deep cultural resonance, the company’s brand equity remains a competitive advantage that continues to fuel long-term momentum.

Monster Beverage is also benefiting from strong structural trends within the global energy drink market. Energy drinks continue to gain acceptance as everyday functional beverages, supported by demand for convenience, alertness and affordable indulgence. Compared with coffeehouse drinks and other non-alcoholic beverages, energy drinks offer a compelling value proposition, helping sustain volume growth even in a price-sensitive environment. As category growth outpaces broader non-alcoholic ready-to-drink beverages, the company’s scale, distribution strength and category leadership position it well to capture incremental demand and support continued growth.

One of the key challenges facing Monster Beverage is ongoing cost pressure, particularly from higher aluminum prices and tariffs. Increased Midwest aluminum premiums have raised can costs, while a complex and shifting global tariff environment adds uncertainty to input expenses. Although the company has been able to offset some of these pressures through pricing and supply-chain efficiencies, sustained cost inflation could limit future margin expansion if pricing flexibility narrows or consumer sensitivity increases.

While the core energy drink segment remains strong, the Alcohol Brands segment has continued to underperform, weighing on overall growth. Slower traction in this segment highlights execution and adoption risks as Monster Beverage expands beyond its core energy portfolio. Any prolonged weakness could dilute management focus and pressure consolidated results, especially if new launches fail to gain meaningful scale.

Monster Beverage also faces growing regulatory and market-specific challenges across its global footprint. New excise taxes on sugary and artificially sweetened beverages in markets such as Mexico, along with tightening labeling and health regulations in several regions, could affect pricing, demand and product mix. In addition, currency volatility and economic uncertainty in certain international markets may create near-term sales variability, even as long-term growth opportunities remain intact.

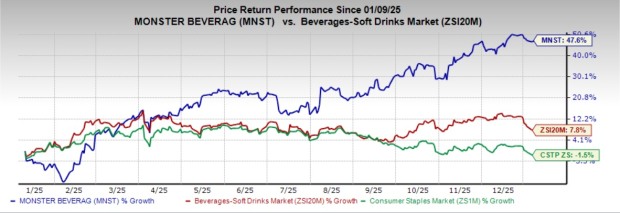

Shares of this Zacks Rank #3 (Hold) company have appreciated 47.6% in the past year, outperforming the Zacks Beverages - Soft Drinks industry’s rise of 7.8% and the broader Consumer Staples sector’s decline of 1.5%.

Monster Beverage shares are currently trading at a forward 12-month price-to-earnings (P/E) multiple of 33.56X, significantly above the industry’s average of 17.59X.

United Natural Foods, Inc. UNFI distributes natural, organic, specialty, produce and conventional grocery and non-food products in the United States and Canada. At present, United Natural flaunts a Zacks Rank of 1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The consensus estimate for United Natural’s current fiscal-year sales and earnings implies growth of 1% and 187.3%, respectively, from the year-ago figures. UNFI delivered a trailing four-quarter earnings surprise of 52.1%, on average.

Village Farms International, Inc. VFF produces, markets and distributes greenhouse-grown tomatoes, bell peppers, cucumbers and mini-cukes in North America. It sports a Zacks Rank #1 at present. Village Farms delivered a trailing four-quarter earnings surprise of 155.6%, on average.

The Zacks Consensus Estimate for Village Farms’ current fiscal-year earnings indicates growth of 165.6% from the prior-year levels.

The Vita Coco Company, Inc. COCO develops, markets and distributes coconut water products under the Vita Coco brand name. COCO currently flaunts a Zacks Rank #1. Vita Coco delivered a trailing four-quarter earnings surprise of 30.4%, on average.

The Zacks Consensus Estimate for Vita Coco's current fiscal-year sales and earnings implies growth of 18% and 15%, respectively, from the year-ago figures.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-21 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite