|

|

|

|

|||||

|

|

About the Industry

The companies grouped under the Semiconductor – General category produce a broad range of semiconductor devices, both integrated and discrete, like microprocessors, graphics processors, embedded processors, chipsets, motherboards, wireless and wired connectivity products, DLPs and analog, serving multiple end markets. It includes companies like NVIDIA, Texas Instruments, Intel and STMicroelectronics.

Major Themes Shaping the Industry

Zacks Industry Rank Indicates Strong Prospects

The Zacks Semiconductor-General Industry is a stock group within the broader Zacks Computer and Technology Sector. It carries a Zacks Industry Rank of #20, which places it in the top 8% of nearly 250 Zacks-classified industries.

The group’s Zacks Industry Rank, which is the average of the Zacks Rank of all the member stocks, indicates that near-term prospects are improving. Our research shows that the top 50% of the Zacks-ranked industries outperforms the bottom 50% by a factor of 2 to 1.

An industry’s positioning in the top 50% of Zacks-ranked industries is normally because the earnings outlook for the constituent companies in aggregate is relatively strong. The opposite is true for stocks in the bottom 50% of industries. In this case, the aggregate earnings estimate for 2025 is down 29.1% from the year-ago level, although the aggregate earnings estimate for 2026 is up 31%.

Before we present a few stocks that you may want to consider for your portfolio, let’s take a look at the industry’s recent stock-market performance and valuation picture.

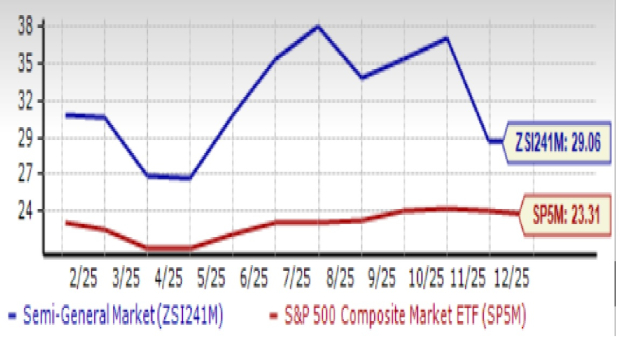

Stock Market Performance Remains Strong

Tracking the performance of the Zacks Semiconductor – General Industry over the past year shows that the industry has traded at a discount to both the broader Zacks Computer and Technology Sector and the S&P 500 index up to May 2025, pulling ahead after that and maintaining its lead to date.

The industry has gained 33.4% over the past year. The broader technology sector gained 26.3% while the S&P 500 index gained 19.3%.

One-Year Price Performance

Current Valuation: Rich

On the basis of forward 12-month price-to-earnings (P/E) ratio, we see that the industry is currently trading at a 29.06X multiple, which is a discount to its median value of 31.32X over the past year. However, since the S&P 500 trades at 23.31X and the sector trades at 27.91X, the industry appears significantly overvalued. Overall, the industry has traded between a low of 26.21X and a high of 38.34X over the past year, always at a premium to both.

Forward 12 Month Price-to-Earnings (P/E) Ratio

2 Stocks To Consider

Macro and geopolitics notwithstanding, the industry stands to benefit from interest cuts this year, which typically drives more money into risky assets. Several of the technology heavyweights in this industry are the core suppliers to the AI mega cycle we are seeing now, so we remain optimistic over the long run. The only stumbling block is the valuation. We continue to like NVIDIA and think that ASYS is worth the deal as well:

NVIDIA Corporation (NVDA): Santa Clara, California-based NVIDIA provides graphics, and compute and networking solutions in the U.S., Taiwan, China and other markets. Its graphics processing units (GPUs) are the most popular in the gaming segment. NVIDIA is also at the leading edge of enterprise, data center, cloud and automotive deployments today.

Generative AI is driving exponential growth in compute requirements. Because NVIDIA’s accelerated computing is versatile, energy-efficient and has low total cost of ownership, companies are rapidly transitioning to its products to train and deploy AI. NVIDIA GPUs, CPUs, networking, AI foundry services and NVIDIA AI Enterprise software are all growth engines. They are opening up opportunities and leading to broad-based growth across geographies and markets.

The company is benefiting from three platform shifts, involving accelerated computing, powerful AI models and agentic applications. Management has said that the AI ecosystem is scaling fast with more new foundation model makers and more AI startups across more industries, and in more countries. Compute and inference demand is going through the roof.

As a result, there is tremendous momentum in the business. Revenues last quarter grew strong double-digits both sequentially and from the prior year, which is huge given the sheer scale it already has. What’s more, management expects this momentum to continue, with visibility into $500 billion of revenue (Blackwell-Rubin) from the beginning to the end of calendar year 2026. With continued product innovation and full-stack design, management expects the company to remain the provider of choice for their estimated $3 trillion-$4 trillion in annual AI infrastructure build by the end of the decade.

Some of its largest cloud customers include AWS, CoreWeave, Google Cloud Platform (GCP), Microsoft Azure and Oracle Cloud Infrastructure (OCI). Healthcare partners like IQVIA, Illumina, Mayo Clinic and Arc Institute are using its products to advance genomics, drug discovery and healthcare. NVIDIA is also seeing momentum across professional visualization and automotive (through collaborations with companies like Toyota, Hyundai, Mercedes-Benz and Audi). The company also gives away billions to shareholders in dividends and share repurchases.

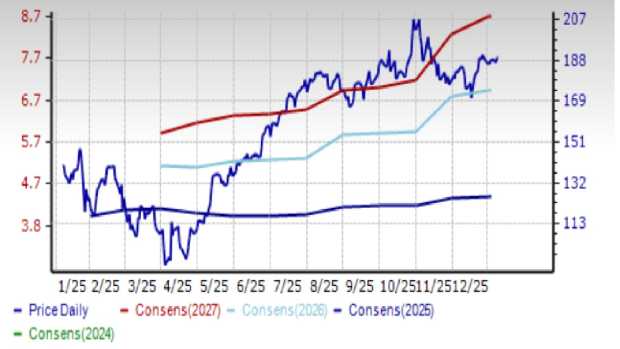

The Zacks Consensus Estimate for 2026 (ending January) has gone from $4.46 60 days ago to the current level of $4.66 (up 4.5%). There’s also an increase of a dollar (16%) in the 2027 estimate. At current levels, analyst estimates represent a 62.4% increase in revenue and 55.9% increase in earnings for 2026 and a 43.2% revenue increase and 55.2% earnings increase in 2027.

The Zacks Rank #1 (Strong Buy) stock is up 35% in the past year.

Price & Consensus: NVDA

Amtech Systems, Inc. (ASYS): Amtech Systems manufactures and sells capital equipment and related consumables and services for semiconductor device packaging, wafer production and device fabrication. Products are sold to semiconductor device packaging, electronic assembly and device fabrication companies worldwide and used to fabricate and package semiconductor devices, such as graphic processing units (GPU’s) used in AI applications, silicon carbide (SiC) and silicon power devices and other optical, analog and digital devices.

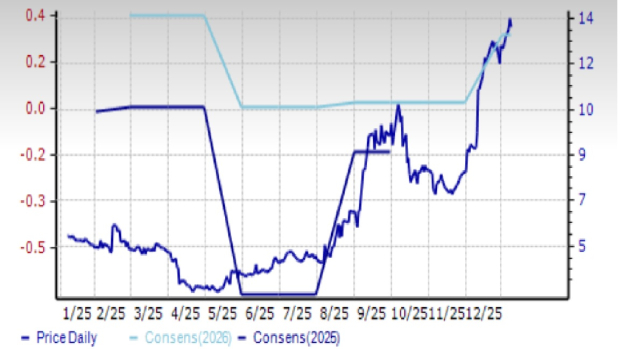

While there were pockets of weakness in both segments, reflow ovens used in AI applications drove demand in Asia and fueled a sequential increase in revenue in the last quarter. AI-related revenue was also up from the previous year although offset by softness at mature semiconductor nodes for wafer cleaning equipment and parts, impacting the Semiconductor Fabrication segment. Diffusion furnaces and high-temperature furnaces in the TPS segment were also softer than in the previous year. With its debt paid down and cost efficiencies ongoing, Amtech is poised for much stronger results going forward.

In the last quarter, Amtech posted a positive surprise of 433.3% as earnings of 10 cents came way ahead of the expected loss of 3 cents. For the year ending September 2026, the Zacks Consensus Estimate has gone from 15 cents to 43 cents in 60 days, up 186.7%.

The Zacks Rank #1 stock is up 145.9% in the past year.

Price & Consensus: ASYS

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 3 hours | |

| 3 hours | |

| 4 hours | |

| 4 hours | |

| 4 hours | |

| 5 hours | |

| 5 hours | |

| 5 hours | |

| 5 hours | |

| 5 hours | |

| 5 hours | |

| 6 hours | |

| 6 hours | |

| 6 hours | |

| 6 hours |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about Finviz Elite