|

|

|

|

|||||

|

|

Viking Therapeutics VKTX announced that it has completed enrolling patients in its exploratory maintenance dosing study of VK2735, the company's dual agonist of the GLP-1 and GIP receptors. VKTX is developing the candidate in both oral and subcutaneous (SC) formulations for the potential treatment of various metabolic disorders, such as obesity.

Viking Therapeutics’ phase I maintenance dosing study for VK2735 is aimed at assessing long-term treatment options following initial weight loss. The randomized study has enrolled around 180 otherwise healthy adults with a body mass index of at least 30 kg/m². All participants first receive weekly SC doses of VK2735 or placebo for 19 weeks to induce weight loss.

After this lead-in period, patients transition to a range of maintenance regimens, including weekly, biweekly, or monthly SC dosing, as well as daily or weekly oral dosing, or placebo, through week 31. The study is designed to evaluate the safety, tolerability, and pharmacokinetic profile of VK2735 across these dosing strategies, with exploratory endpoints examining changes in body weight from baseline and from Week 19 to the end of the study.

The program underscores Viking Therapeutics’ strategy to differentiate VK2735 through flexible long-term dosing using the same active molecule in both injectable and oral formulations. This approach could support improved treatment adherence and position VK2735 as a potentially more convenient and durable option in the increasingly competitive obesity market.

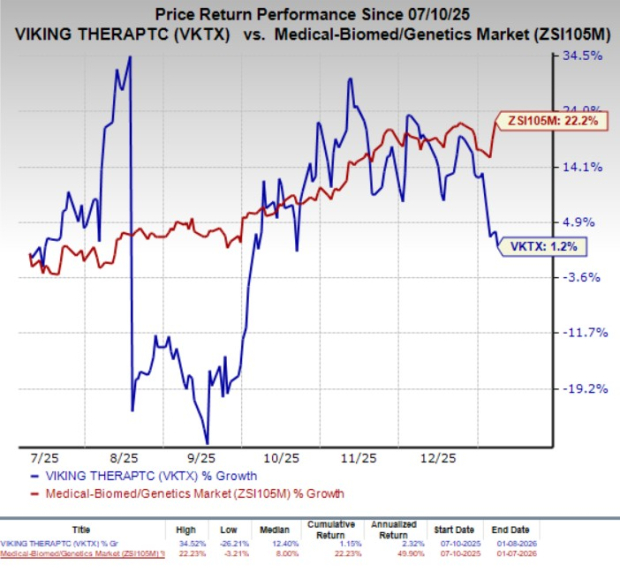

In the past six months, VKTX’s shares have gained 1.2% compared with the industry’s 22.2% growth.

Alongside its maintenance dosing program, Viking Therapeutics is advancing two pivotal phase III studies, VANQUISH-1 and VANQUISH-2, evaluating once-weekly SC VK2735 for obesity. Both studies are designed to assess the long-term efficacy and safety of VK2735 over a 78-week treatment period.

VANQUISH-1 has completed enrollment of approximately 4,650 adults who are obese or overweight with at least one weight-related comorbidity, while VANQUISH-2 is enrolling around 1,100 adults with type II diabetes who are obese or overweight. VKTX expects to complete enrollment in the VANQUISH-2 study in the first quarter of 2026. In both studies, patients are randomized to receive either of the three VK2735 dose levels (7.5 mg, 12.5 mg, or 17.5 mg) or placebo, positioning the program as a broad, late-stage clinical effort aimed at supporting potential regulatory filings and commercialization. Data from both VANQUISH studies are not expected until 2027.

Viking Therapeutics is witnessing rapid enrollment trends in the phase III obesity program, which suggest strong demand and interest around VK2735. This aligns with the market expansion for weight loss drugs fueled by the success of Eli Lilly’s LLY Zepbound and Novo Nordisk’s NVO Wegovy. The quick recruitment also indicates high patient and physician enthusiasm, which could translate into significant commercial potential if the drug proves effective and safe.

Viking Therapeutics has also completed a phase II VENTURE-Oral Dosing study that evaluated the oral formulation of VK2735 for obesity in 2025. Per the data readout, patients who received the highest drug dose (120 mg) lost up to 12.2% of their body weight after 13 weeks of daily dosing compared with 1.3% in the placebo group. The company is on track to meet with the FDA to determine the next steps for oral VK2735 soon.

Viking Therapeutics, Inc. price-consensus-chart | Viking Therapeutics, Inc. Quote

The obesity market has garnered much interest lately, as both Lilly and Novo Nordisk dominate this space with their respective obesity drugs. The companies have not only optimized their production capacities but are also developing more potent and convenient GLP-1-based candidates in their clinical pipeline.

Novo Nordisk recently won the race to introduce an oral weight-loss treatment in the U.S. market. Last month, Novo Nordisk announced the FDA approval of the Wegovy pill (once-daily oral semaglutide 25 mg) for obesity, which was launched earlier this week. This marked a major milestone for Novo Nordisk, making it the first GLP-1 RA in an oral form for weight management. Compared with injectable formulations, the pill offers a far more convenient administration option.

NVO recently submitted a regulatory application seeking FDA approval of its next-generation obesity candidate, CagriSema injection (a combination of semaglutide and cagrilintide). Novo Nordisk also plans to initiate phase III development of another next-generation candidate, amycretin, for weight management in early 2026, both as an injection and oral pill.

Lilly is also investing broadly in obesity and has several new molecules currently in clinical development with a range of oral and injectable medications with different mechanisms of action. This includes two late-stage candidates, orforglipron, a once-daily oral GLP-1 small molecule, and retatrutide, a GGG tri-agonist, and some mid-stage candidates, bimagrumab, eloralintide and mazdutide. LLY has already filed a regulatory application for orforglipron in the United States for the treatment of obesity.

Other smaller biotechs like Structure Therapeutics GPCR are also developing oral GLP-1 drugs for treating obesity. Structure Therapeutics’ ACCESS study on its orally GLP-1 RA, aleniglipron, for obesity met its primary and all key secondary endpoints. In the study, the 120 mg dose delivered an 11.3% placebo-adjusted weight loss. Higher doses drove deeper reductions, reaching 15.3% at 240 mg. Structure Therapeutics expects to initiate the late-stage program of aleniglipron in obesity around mid-2026.

Viking Therapeutics currently carries a Zacks Rank #4 (Sell).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 15 min |

Novo Nordisk, Eli Lilly Stocks Drop on Wegovy Maker's Price-Cut Plan

NVO LLY

The Wall Street Journal

|

| 34 min | |

| 41 min | |

| 51 min | |

| 1 hour | |

| 1 hour | |

| 1 hour | |

| 1 hour | |

| 1 hour | |

| 1 hour | |

| 1 hour | |

| 2 hours | |

| 2 hours | |

| 3 hours | |

| 3 hours |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite