|

|

|

|

|||||

|

|

Wells Fargo & Company WFC is slated to report fourth-quarter and full-year 2025 earnings results on Jan. 14, 2026, before market open.

WFC’s first nine-month performance benefited from higher non-interest income and lower provisions. However, an increase in expenses and a decline in net interest income (NII) acted as a spoilsport. This time, the company’s performance is likely to have been decent. The Zacks Consensus Estimate for fourth-quarter revenues of $21.60 billion suggests 6% year-over-year growth.

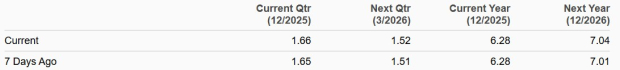

In the past seven days, the consensus estimate for earnings for the to-be-reported quarter has been revised upward to $1.66. The figure indicates a 16.9% improvement from the prior-year quarter’s actual.

Estimate Revision Trend

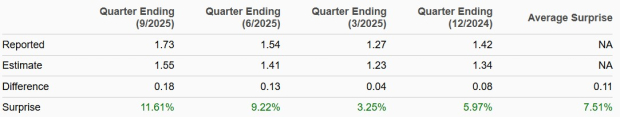

WFC has an impressive earnings surprise history. The company’s earnings outpaced the Zacks Consensus Estimate in the trailing four quarters, the average beat being 7.51%.

Earnings Surprise History

Loans & NII: The Federal Reserve reduced interest rates twice in the fourth quarter, following a 25-basis-point rate cut in September. With this, the Fed funds rate now stands at 3.50-3.75% range. This is likely to have aided WFC’s NII in the fourth quarter, given stabilizing funding/deposit costs.

Also, the overall lending scenario was impressive. Per the Fed’s latest data, the demand for commercial and industrial, real estate, and consumer loans remained solid in the first two months of the quarter. Thus, the company’s lending activity is likely to have witnessed an improvement in the quarter to be reported.

The Zacks Consensus Estimate for NII is pegged at $12.4 billion, which indicates a 4.1% rise from the prior quarter’s reported number. Management expects NII to be $12.4-$12.5 billion.

Non-Interest Revenues: Mortgage rates declined notably in the fourth quarter from the levels observed at the start of 2025 and remained within a low-6% range. This was mainly driven by the Fed’s monetary policy easing. However, refinancing activity and origination volumes have not witnessed significant growth. As a result, Wells Fargo’s mortgage banking fees are expected to have been affected in the quarter to be reported.

The Zacks Consensus Estimate for mortgage banking revenues for the fourth quarter of 2025 is pegged at $258.5 million, suggesting a 3.5% decline from the quarter-ago reported level.

Meanwhile, investment advisory and other asset-based fee revenues are likely to have benefited from increased transactional activity. The consensus mark for investment advisory and other asset-based fee revenues is pegged at $2.8 billion, indicating a sequential rise of 4.4%.

Global mergers and acquisitions (M&As) in the fourth quarter of 2025 surged impressively from the lows witnessed in April and May following President Trump’s announcement of ‘Liberation Day’ tariff plans. Improved visibility on trade policy, a narrowing of buyer–seller valuation expectations, lower funding costs and a focus on scale and AI integration supported a pickup in deal-making activity. This is likely to have supported WFC’s investment banking (IB) revenues in the quarter to be reported.

The Zacks Consensus Estimate for IB income is pegged at $852 million, which indicates a rise of 1.4% on a sequential basis.

Further, rising consumer credit stress is expected to have weighed on consumer spending during the quarter. The Zacks Consensus Estimate for Card fees is pegged at $1.2 billion, suggesting a 3.1% decline from the prior quarter’s reported level.

The Zacks Consensus Estimate for Wells Fargo’s total non-interest income is pegged at $9.2 billion, indicating a 3.4% decline from the prior quarter's reported figure.

Expenses: WFC’s expenses are expected to have witnessed a modest decline in the fourth quarter of 2025, given its prudent expense management initiatives, including the streamlining of its organizational structure, closure of branches and reduction in headcount. Management expects non-interest expenses for fourth-quarter 2025 to be $13.5 billion, suggesting a decline from the $13.9 million reported in the third quarter of 2025.

Asset Quality: We expect the company to keep a decent reserve this time, given a slowdown in job growth, which could pressure consumer demand and lead to higher delinquencies.

The consensus mark for total non-accrual loans is pegged at $8 billion, suggesting a sequential rise of 4.5%. The Zacks Consensus Estimate for non-performing assets of $8.1 billion indicates a 3.5% increase from the quarter-ago reported level.

Our proven model does not conclusively predict an earnings beat for Wells Fargo this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy), or 3 (Hold) increases the odds of an earnings beat. That is not the case here, as you can see below.

The Earnings ESP for WFC is -0.15%. You can uncover the best stocks to buy or sell before they are reported with our Earnings ESP Filter.

Wells Fargo currently carries a Zacks Rank of 3. You can see the complete list of today’s Zacks #1 Rank stocks here.

Wells Fargo expects 2025 NII to be in line with the 2024 reported NII of $47.7 billion.

Management projects non-interest expenses for 2025 to be $54.6 billion, suggesting a rise from $54.3 billion registered in the prior year. This is due to higher-than-expected severance costs, along with continued investments in technology, risk-control infrastructure and other strategic areas. Wells Fargo’s Price Performance & Valuation

In the fourth quarter, WFC shares delivered a strong performance, outperforming the industry and the S&P 500 index. Its close peers, Bank of America BAC and Citigroup C, also performed well.

Price Performance

Bank of America and Citigroup are slated to announce quarterly numbers on Jan. 14, 2026.

Now, let us look at the value WFC offers investors at current levels.

Currently, WFC is trading at 13.59X forward 12 months' price-to-earnings (P/E), below the industry’s forward earnings multiple of 15.35X. The company’s valuation looks inexpensive compared with the industry average. Bank of America is trading at a 12-month forward P/E of 12.92X while Citigroup is trading at 11.95X.

Price-to-Earnings F12M

The removal of the long-standing asset cap has unlocked balance-sheet growth for Wells Fargo, while ongoing business simplification, disciplined expense management and expanding fee-based initiatives, such as entering options clearing, strengthen its earnings profile. Further, Fed rate cuts and a favorable macroeconomic backdrop support the favorable outlook.

WFC’s prudent expense management initiatives have been supporting its financials. The company has been actively engaged in cost-cutting measures, including streamlining organizational structure and headcount reductions. The company keeps investing in and optimizing its branch network to reduce costs. It is advancing its operational transformation through a phased AI rollout, aimed at improving productivity, streamlining workflows and enhancing customer service. Given such efforts, by the end of 2026, WFC expects to achieve $15 billion in gross expense savings.

With greater strategic flexibility and improved earnings visibility, management raised the company’s medium-term return on tangible common equity (ROTCE) target to 17-18% from the earlier 15%, indicating stronger profitability prospects over the next few years.

However, deteriorating asset quality is concerning. Also, the company’s investments in technology and digitalization efforts might increase its expenses in the near term. The bank's performance in the upcoming period will be greatly influenced by its capacity to navigate these challenges to improve its financial performance.

Hence, investors should not rush to buy the Wells Fargo stock now. To get clarity and possibly an appealing entry point, those interested in adding it to their portfolios may be better off waiting until after the quarterly results are out. Those who already have the WFC stock can consider retaining it because it is less likely to disappoint over the long term.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 1 hour | |

| 3 hours | |

| 6 hours | |

| 11 hours | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite