|

|

|

|

|||||

|

|

Dollar General Corporation DG, a prominent discount retailer, is currently trading at a forward 12-month price-to-earnings (P/E) ratio of 16.38, positioning it at a discount relative to the industry average of 31.95. This valuation raises a crucial question: Is the stock an undervalued opportunity for investors, or does it reflect underlying challenges that warrant caution?

Closing at $93.07 last Thursday, shares of Dollar General have advanced 11.9% over the past month, outpacing the industry’s 5.6% rise. The stock is trading above its 50-day and 200-day moving averages, signaling a bullish trend. Despite the recent upswing, the stock continues to trade at a notable discount to the broader industry, indicating that the market may not yet be fully pricing in its recovery potential or operational improvements.

Despite ongoing margin pressures and a tough consumer environment, Dollar General has shown an uptrend. The company has been gaining market share, thanks to its resilient product mix, real estate expansion and strategic initiatives aimed at delivering value to customers. Efforts to lower shrinkage have started to bear fruit, with management expecting continued benefits into fiscal 2025.

DG’s “back-to-basics” initiative has improved its operational foundation, positioning it for sustained growth in fiscal 2025 and beyond. Key achievements include a 6.9% inventory reduction per store and significant SKU rationalization — 1,000 SKUs removed — which enhanced productivity at both store and distribution center levels.

Well, Dollar General is planning an extensive 4,885 real estate projects in fiscal 2025. This includes 575 new store openings in the United States and up to 15 outlets in Mexico, 2,000 remodels and 2,250 upgrades under the “Project Elevate” initiative. The Elevate program has demonstrated first-year comparable sales lifts of 3% to 5%, while the complementary “Project Renovate” is designed to deliver an even stronger 6% to 8% uplift.

Digital expansion is another pillar of Dollar General’s growth strategy. The company is in the early stages of expanding its home delivery service through a partnership with DoorDash, currently operating in around 400 stores. Initial results are encouraging, with higher average order values compared to in-store purchases. Dollar General targets expanding home delivery to as many as 10,000 locations by the end of fiscal 2025.

While consumables currently account for 82% of total sales, Dollar General is actively working to diversify its product mix. Management aims to boost non-consumable sales by at least 100 basis points by fiscal 2027, a move intended to improve profitability without compromising top-line momentum.

Dollar General’s core customer base, which is highly sensitive to inflation and economic pressure, continues to experience financial strain. Despite efforts to maintain low prices, traffic declined 1.1% in the final quarter of fiscal 2024, reflecting the challenges consumers are facing. The company is not expecting meaningful macroeconomic relief for its customer base in 2025.

Management expects selling, general and administrative expenses to deleverage in 2025, citing persistent headwinds such as retail wage inflation of 3.5%-4%, normalized incentive compensation (about $120 million impact) and elevated depreciation from prior capex cycles. The first half of fiscal 2025 is expected to be particularly pressured due to upfront remodeling costs and labor-related expenses.

Dollar General projects EPS to be lower year over year in the first half. We foresee an 11.3% and 7.6% decline in the bottom line for the first and second quarters of fiscal 2025, respectively.

Management highlighted concerns over newly announced tariffs on products relevant to their assortment. Although it successfully mitigated similar impacts in 2018-2019 through selective price increases, the already financially stretched core consumer base remains sensitive to any price adjustments.

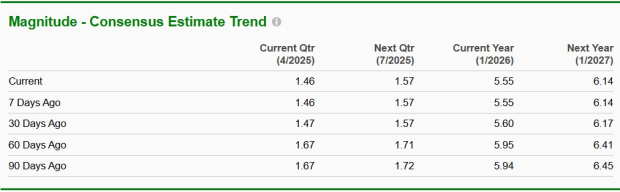

Reflecting a cautious sentiment around Dollar General, the Zacks Consensus Estimate for earnings per share has seen downward revisions. Over the past 60 days, analysts have lowered their estimates for the current and next fiscal years by 40 and 27 cents to $5.55 and $6.14 per share, respectively. (See the Zacks Earnings Calendar to stay ahead of market-making news.)

Management outlined a clear roadmap targeting net sales growth of 3.5%-4% annually starting in fiscal 2025, supported by approximately 2% new unit growth. From 2026, same-store sales growth is targeted at 2%-3%, with operating margin expansion to resume and potentially reach 6%-7% by 2028. Earnings per share (EPS) growth of at least 10% annually on an adjusted basis is anticipated beginning in 2026, alongside a disciplined capital allocation strategy. Capital expenditures are expected to normalize at 3% of sales, and share repurchases could resume as early as 2027.

While Dollar General stock is currently trading at a discount relative to its industry peers, the valuation appears to reflect a mix of both opportunity and risk. On the one hand, the company is actively investing in store modernization, digital expansion and operational efficiency, all of which could support long-term growth. On the other hand, near-term challenges like pressured margins, rising operating expenses and ongoing macroeconomic headwinds may weigh on earnings. For current investors, holding onto this Zacks Rank #3 (Hold) stock could make sense.

Sprouts Farmers SFM, which is engaged in the retailing of fresh, natural and organic food products, currently sports a Zacks Rank #1 (Strong Buy). SFM has a trailing four-quarter earnings surprise of 15.1%, on average. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Sprouts Farmers’ current financial-year sales and earnings implies growth of 11.9% and 24.3%, respectively, from the year-ago reported numbers.

United Natural Foods UNFI, which, together with its subsidiaries, distributes natural, organic, specialty, produce, and conventional grocery and non-food products in the United States and Canada, currently carries a Zacks Rank #2 (Buy). UNFI has a trailing four-quarter earnings surprise of 408.7%, on average.

The Zacks Consensus Estimate for United Natural Foods’ current financial year sales calls for growth of 1.9% from the year-ago reported numbers.

Utz Brands UTZ, which is engaged in the manufacture, marketing and distribution of snack foods, currently carries a Zacks Rank #2. UTZ has a trailing four-quarter earnings surprise of 8.8%, on average.

The Zacks Consensus Estimate for UTZ’s current financial-year sales and earnings suggests growth of 1.2% and 10.4%, respectively, from the year-ago reported numbers.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-16 | |

| Feb-16 | |

| Feb-16 | |

| Feb-16 | |

| Feb-14 | |

| Feb-14 | |

| Feb-13 | |

| Feb-13 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite