|

|

|

|

|||||

|

|

The streaming industry's competitive landscape continues to intensify as two entertainment titans — Netflix NFLX and The Walt Disney Company DIS — battle for dominance in the digital content space. Netflix, the pure-play streaming pioneer, operates with more than 300 million global subscribers and has established itself as the dominant force in on-demand entertainment. Meanwhile, Disney leverages a diversified entertainment empire spanning streaming services Disney+ and Hulu, world-renowned theme parks, and powerful intellectual property franchises, including Marvel, Star Wars, and Pixar.

As each company navigates evolving consumer preferences and mounting competitive pressures, investors must weigh profitability trajectories, content investments, and valuation metrics to determine optimal positioning.

Let's delve deep and closely compare the fundamentals of the two stocks to determine which one is a better investment now.

Netflix maintains its position as the world's leading streaming service, demonstrating resilience through strategic monetization initiatives and content excellence. The company's third-quarter 2025 results reflected 17% revenue growth across all regions, with particularly strong performance in Asia-Pacific territories where revenues jumped 21% year over year. Netflix projects full-year 2025 revenues of $45.1 billion, suggesting 16% growth, alongside fourth-quarter revenue guidance of $11.96 billion. The company has successfully navigated its password-sharing crackdown, which added approximately 50 million new subscribers since its implementation.

The advertising business represents Netflix's most promising growth avenue, with management projecting ad revenues to more than double in 2025 despite operating from a relatively small base. The company's ad-supported tier now attracts more than half of new sign-ups in markets where it's available, reaching approximately 94 million monthly active users as of mid-2025. Netflix's January 2026 content slate includes highly anticipated releases, such as The Rip starring Matt Damon and Ben Affleck, Bridgerton Season 4, and new seasons of fan-favorite series, including The Night Agent and One Piece. The company's December announcement of its comprehensive 2026 content lineup showcased ambitious projects, including Greta Gerwig's Narnia adaptation and Peaky Blinders: The Immortal Man film.

The consensus mark for 2026 earnings is pegged at $3.21 per share, indicating 26.93% year-over-year growth.

However, Netflix faces significant challenges that temper its growth story. The company's heavy reliance on content spending creates continuous capital demands, with limited revenue diversification beyond subscriptions and nascent advertising initiatives. Operating margin guidance of 29% for full-year 2025 reflects compression from the previously projected 30%, primarily due to the unexpected Brazilian tax matter. Netflix's pure-play streaming model lacks the complementary business segments and merchandising synergies that diversified entertainment conglomerates leverage during market downturns, creating vulnerability to economic headwinds and content production disruptions.

Netflix, Inc. price-consensus-chart | Netflix, Inc. Quote

Disney presents a compelling investment thesis underpinned by transformational progress across its diversified entertainment ecosystem. The company's fourth-quarter fiscal 2025 results demonstrated strong momentum in streaming profitability, with Direct-to-Consumer operating income reaching $352 million, contributing to full-year streaming operating income of $1.3 billion, exceeding original guidance by $300 million and representing a remarkable turnaround from $4 billion losses just three years prior. Disney+ added 3.8 million subscribers during the quarter, bringing total Disney+ and Hulu subscriptions to 196 million, while CEO Bob Iger reaffirmed double-digit adjusted earnings growth targets for both fiscal 2026 and 2027.

The consensus mark for fiscal 2026 earnings is pegged at $6.60 per share, indicating 11.3% year-over-year growth.

The Experiences segment delivered record full-year operating income of $10 billion, with domestic and international parks demonstrating sustained demand despite competitive pressures. Disney's capital allocation strategy reflects confidence in its growth trajectory, with the board doubling share repurchases to $7 billion for fiscal 2026 and raising the annual dividend 50% to $1.50 per share. The company projects $24 billion in content spending across entertainment and sports for fiscal 2026, alongside $9 billion in capital expenditures to support strategic expansion initiatives, including new cruise ships Disney Destiny and Disney Adventure.

Disney has lined up major theme park enhancements for 2026, including the reopening of Big Thunder Mountain Railroad with new features in Spring 2026, updated audio-animatronics for Frozen Ever After debuting in February, and the transformation of Rock 'n' Roller Coaster with a Muppets theme closing in March 2026. January 2026 streaming releases feature anticipated content, including theatrical releases like Venom: Let There Be Carnage and Disney+ originals like Wonder Man (Marvel series), The Doomies, Percy Jackson and the Olympians Season 2, each leveraging Disney's unparalleled intellectual property portfolio. The company's integrated entertainment model enables powerful cross-promotional synergies, merchandising opportunities, and multiple revenue touchpoints that pure-play streaming competitors cannot replicate. Disney's strategic investments in direct-to-consumer profitability, combined with resilient Experiences segment performance, position the company for sustainable long-term value creation.

The Walt Disney Company price-consensus-chart | The Walt Disney Company Quote

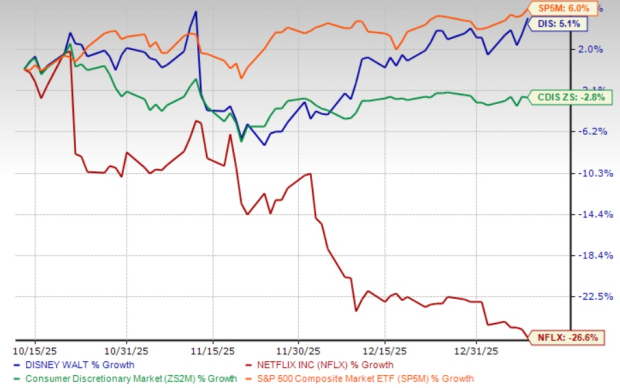

Recent price performance underscores the diverging investor sentiment toward these streaming giants. Over the past three months, Netflix shares have plunged 26.6%, significantly underperforming Disney's 5.1% gain and the Zacks Consumer Discretionary sector's 2.8% decline.

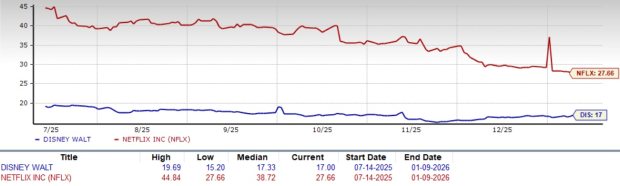

Valuation metrics reveal further disparities between the two entertainment companies. Netflix currently trades at a price-to-earnings ratio of 27.66x based on forward 12-month earnings, reflecting a premium valuation. Disney presents a significantly more attractive valuation profile, trading at a forward P/E ratio of 17x, representing a substantial discount to Netflix and below the S&P 500 average. Disney's current valuation multiples sit well below the company's 10-year historical averages, suggesting meaningful upside potential as the streaming business achieves sustained profitability and the Experiences segment maintains its momentum.

Disney emerges as the superior investment opportunity, offering compelling upside potential through its attractive valuation, diversified revenue streams, and accelerating streaming profitability. Investors should track Disney stock for attractive entry points as the multi-year transformation gains traction, while exercising caution regarding Netflix's premium valuation that offers limited upside relative to execution risks in an increasingly competitive streaming landscape. DIS and NFLX carry a Zacks Rank #3 (Hold) each at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 36 min | |

| 1 hour | |

| 1 hour | |

| 1 hour | |

| 2 hours | |

| 2 hours | |

| 2 hours | |

| 2 hours | |

| 3 hours | |

| 3 hours | |

| 3 hours | |

| 3 hours | |

| 4 hours |

Netflix Gives Paramount One Last Chance In Warner Bros. Bidding War. Two Stocks Are Rising.

NFLX

Investor's Business Daily

|

| 4 hours | |

| 4 hours |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite