|

|

|

|

|||||

|

|

Once dominant in their respective corners of the athleticwear market, lululemon athletica inc. LULU and Under Armour Inc. UAA now stand at the crossroads. lululemon has carved out a premium niche built on brand heat, pricing power and a loyal consumer base, steadily gaining share in the high-margin athleisure space. Under Armour, in contrast, operates in a broader, more performance-driven arena, where intense competition and shifting consumer preferences have made market share harder to defend.

This face-off examines how the two companies stack up on market position, share gains (or losses) and business mix, highlighting the strategic choices that define their trajectories. As the athleticwear industry grapples with slower growth, elevated promotions and evolving demand patterns, the contrast between lululemon’s focused, premium-led model and Under Armour’s diversified, volume-driven approach offers a revealing look at what it takes to win — and sustain — share in today’s crowded sportswear landscape.

lululemon’s investment case is fundamentally driven by its premium market leadership and sustained share gains within the global athletic apparel industry. The company holds the first position in women’s activewear in the United States and has built a meaningful global footprint across more than 30 geographies, with China emerging as its second-largest market.

Over the past several years, lululemon has significantly expanded its revenue base and global relevance, positioning itself as a leading player within the consumer discretionary landscape, supported by strong brand loyalty and pricing power. Its digital channel now represents a substantial portion of total sales, reinforcing lululemon’s influence across both physical and online retail ecosystems.

lululemon is strengthening its competitive moat through a disciplined three-pillar operating model focused on product creation, product activation and enterprise efficiency. Management is reenergizing the product portfolio by increasing new-style penetration to 35%, accelerating design cycles and emphasizing innovation in performance-led categories such as run, train and outerwear.

The company’s portfolio is increasingly diversified across women’s, men’s and accessories, enabling broader demographic reach while maintaining its premium positioning. Investments in localized assortments, enhanced in-store storytelling and a redesigned digital platform further elevate the brand experience and support market share stability in a competitive industry.

However, several near-term headwinds could weigh on the company’s performance. Management has acknowledged that demand in its most mature market, North America, has softened amid a cautious consumer backdrop and elevated promotional intensity across the apparel industry. Trading-down behavior and slower traffic trends suggest that even premium brands are not immune to macro pressure, limiting near-term volume growth and increasing competitive risks.

lululemon faces margin pressure from higher tariffs, increased markdowns and elevated sourcing costs, which are expected to persist into the coming year. Management has indicated that the removal of the de minimis exemption and a higher tariff environment will outweigh internal efficiency gains in the near term, constraining operating margin recovery.

While near-term pressures from tariffs and a cautious consumer environment persist, the company’s financial flexibility allows continued investment in innovation, digital capabilities and brand building.

Under Armour occupies a distinct position within the global athleticwear landscape, anchored by its credibility in performance apparel and equipment for serious athletes. With an annual revenue base of roughly $5 billion, the company commands a meaningful share of the performance-oriented segment of the broader consumer goods industry, particularly in training, running and team sports.

Unlike lifestyle-driven peers, Under Armour has built its brand around function, durability and athlete credibility, giving it strong resonance with young athletes, competitive amateurs and organized sports participants. This authenticity-driven positioning allows the brand to maintain relevance across key global markets while aligning product development closely with real athletic use cases.

Under Armour is sharpening its competitive profile through disciplined portfolio and category management. Management has streamlined assortments and concentrated investment behind franchises where the brand can lead, including HeatGear, ColdGear, Velociti and core sportswear platforms. This tighter focus enhances product consistency, strengthens storytelling and supports premium brand expression.

Footwear remains an important growth lever, positioned as an extension of Under Armour’s apparel leadership and anchored in performance validation across cleated, training and running categories. Innovation in materials, fit and performance technologies continues to reinforce the brand’s technical edge and differentiation.

Under Armour is also strengthening consumer engagement through upgraded e-commerce platforms, immersive content, and social commerce integration. These capabilities enhance conversion and deepen brand connection, particularly among 18-34-year-old consumers, a key demographic for long-term brand relevance. Athlete partnerships and sport-specific marketing further reinforce credibility while driving demand across channels.

Under Armour’s emphasis on brand elevation, disciplined distribution and operational focus supports sustainable cash generation and improving profitability over time. Together, these elements position UAA as a focused, performance-driven consumer brand with the ability to compound brand equity and shareholder value across cycles.

The Zacks Consensus Estimate for lululemon’s fiscal 2025 sales suggests year-over-year growth of 5.1%, while that for EPS indicates a decline of 10.7%. The EPS estimate has moved up 0.4% in the past seven days.

The Zacks Consensus Estimate for Under Armour’s fiscal 2026 sales and EPS implies year-over-year declines of 4.5% and 87.1%, respectively. The EPS estimate has been unchanged in the past 30 days.

The estimate revision trends highlight a clear divergence in earnings momentum between lululemon and Under Armour. lululemon’s upward estimate revision suggests analysts are incrementally growing more confident in management’s ability to mitigate margin pressures. This recent upward movement indicates that downside risks may be increasingly priced in, lending modest support to near-term sentiment around the stock.

In contrast, Under Armour’s estimate trends remain notably weaker. The company’s EPS estimate has been unchanged, signaling a lack of positive catalysts or improving visibility. This flat revision trend reflects analyst caution and suggests that confidence in a near-term earnings inflection remains limited.

In the past year, the lululemon stock has underperformed, recording a decline of 46.3%. This has noticeably lagged Under Armour’s decline of 31.8% and the benchmark S&P 500’s growth of 21.8%.

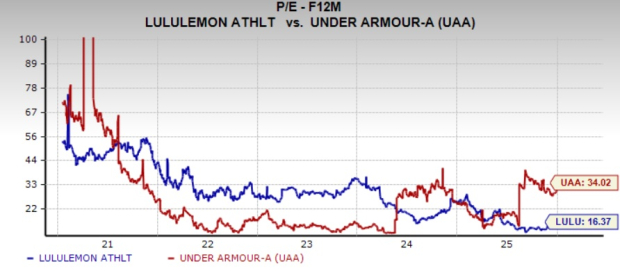

From a valuation perspective, lululemon trades at a forward price-to-earnings (P/E) multiple of 16.37X, which is below its 5-year median of 29.1X. However, the lululemon stock trades below Under Armour’s forward 12-month P/E multiple of 34.02X, with a 5-year median of 19.42X.

Under Armour trades at a higher valuation than lululemon and above its own historical norm despite having a more volatile earnings profile and a business still in the middle of brand and portfolio repositioning. This premium valuation appears to reflect optimism around a potential turnaround rather than established earnings power.

lululemon looks significantly de-rated relative to its history, suggesting that much of the current earnings and margin uncertainty is already reflected in the stock price. The shares trade well below the company’s long-term average valuation, indicating a more cautious market stance despite lululemon’s premium brand positioning, global scale and structurally stronger profitability profile. This discount implies limited expectations for near-term growth and leaves room for valuation recovery if operating trends stabilize or investor confidence improves.

Under Armour emerges as the stronger contender, supported by relatively better performance momentum, improving execution and clearer growth visibility. While lululemon continues to benefit from strong brand equity and premium positioning, its business is in a transition phase, facing softer demand in its core market and ongoing margin pressures. These factors have weighed on sentiment despite the company’s long-term strengths.

Under Armour, in contrast, is gaining traction from a sharper focus on performance-led categories, tighter portfolio discipline and stronger alignment with its core athletic consumer. The market’s willingness to assign a premium valuation to UAA reflects growing confidence in its growth trajectory and earnings recovery potential.

While lululemon remains a high-quality brand, Under Armour offers a more compelling near-term investment case, combining better relative performance, premium valuation support and improving growth prospects. lululemon has a Zacks Rank #3 (Hold), whereas Under Armour currently flaunts a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-16 | |

| Feb-15 |

Companies Are Replacing CEOs in Record Numbersand Theyre Getting Younger

LULU

The Wall Street Journal

|

| Feb-15 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-12 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite