|

|

|

|

|||||

|

|

New Feature: See Wall Street analyst ratings directly on Finviz charts for deeper context into price action.

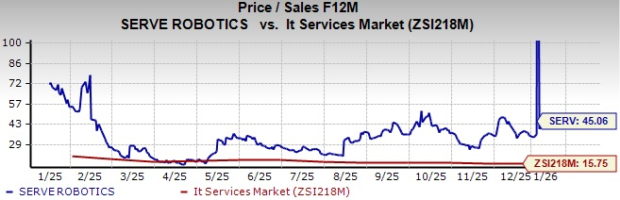

Serve Robotics Inc. SERV is currently trading at a forward 12-month Price/Sales (P/S F12M) ratio of 45.06, reflecting a premium of about 186% compared with the Zacks Computers – IT Services industry average of 15.75. The valuation also stands well above the broader Zacks Computer and Technology sector multiple of 7.46X and exceeds the S&P 500 composite level of 5.67X.

The premium valuation reflects strong recent momentum in autonomous delivery adoption and rapid fleet expansion. The company continues to see growing engagement from delivery platforms and restaurant partners as automation gains wider acceptance. Progress in autonomy and learning from real-world operations is supporting efforts to scale the network. These factors have contributed to improved growth expectations, even as execution remains ongoing. Despite these supportive trends, several headwinds continue to weigh on the company’s growth prospects.

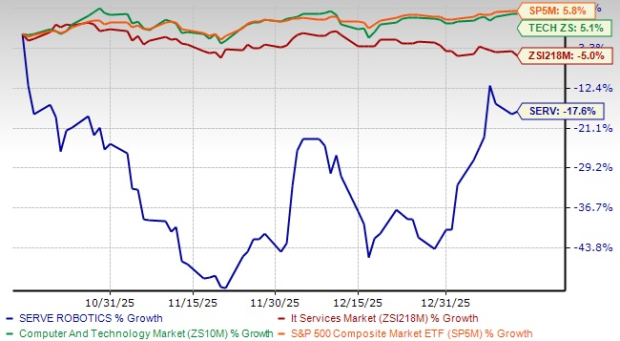

Shares of this leading autonomous sidewalk delivery company have declined 17.6% in the past three months, sharply underperforming the industry, the broader technology sector and the S&P 500, as shown below.

Despite rapid expansion, several challenges continue to temper the investment case for Serve Robotics. Losses remain elevated, reflecting the high cost of scaling operations. The company reported a GAAP net loss of $33 million in the third quarter of 2025 and $67 million over the first nine months of 2025, while adjusted EBITDA stayed deeply negative. These trends highlight the extended path toward breakeven as spending continues across fleet deployment, technology development and market expansion.

Ongoing cash burn has increased reliance on external funding. Shares outstanding rose to 67.8 million by the end of the third quarter following multiple capital raises to support growth initiatives. With losses persisting and investment needs remaining high, the risk of further dilution cannot be ruled out, which may continue to pressure shareholder returns.

Earnings expectations for Serve Robotics continue to reflect near-term challenges. Estimates remain weak as the company continues to invest heavily in scaling operations, technology development and market expansion. Persistent losses and limited profitability visibility have weighed on forward projections. The Zacks Consensus Estimate for the 2026 loss per share has widened to $1.83 over the past 30 days compared with a year-ago estimate of a loss of $1.59, reinforcing concerns around the earnings trajectory.

That said, some underlying trends remain supportive of the company’s long-term growth direction.

Serve Robotics is entering a critical scaling phase as autonomous delivery moves from pilot programs to broader urban deployment. The company is focused on expanding sidewalk autonomy across dense metropolitan environments while maintaining safety, reliability and consistent performance. Its operating model emphasizes disciplined rollout, higher utilization and steady improvements in autonomy within real-world city conditions.

In the third quarter of 2025, Serve Robotics reported sharp growth in delivery volumes while maintaining reliability near peak levels and a strong safety record. The company expanded into multiple large metro markets and improved utilization through broader platform reach. Serve Robotics also met its 2025 operational milestone by deploying more than 2,000 autonomous robots, making it the largest sidewalk delivery fleet in the United States. A rising share of miles driven autonomously and lower human intervention signal improving system performance, supporting broader urban-scale deployment in 2026.

Serve Robotics’ acquisition of Vayu represents a strategic step toward improving autonomy performance and operational efficiency. The company is building a robotics-and-autonomy-as-a-service platform that combines hardware, software and urban operations, with Vayu adding large-scale AI models and a simulation-driven data engine. This capability is designed to accelerate physical AI development while lowering data infrastructure costs.

During the third quarter of 2025, Serve Robotics advanced execution across engineering and operations while integrating Vayu alongside Phantom Auto. The acquisition strengthens expertise in urban robot navigation and enhances the company’s ability to train models in complex, real-world environments. Management expects the integration to improve autonomy metrics, reduce reliance on manual intervention and speed iteration cycles. Over time, the combination of richer operational data, smarter AI models and lower infrastructure costs supports a flywheel effect, positioning Serve Robotics to scale more efficiently and improve unit economics as deployment expands in 2026.

Partnerships play a central role in amplifying the impact of Serve Robotics’ growing fleet. Integrations with major delivery platforms allow robots to dynamically accept orders across networks, improving utilization and reducing idle time. Collaborations with Uber Technologies UBER and DoorDash DASH enable Serve Robotics to operate within high-volume demand ecosystems, while national restaurant partners increase order density across markets.

Serve Robotics’ collaborations with brands such as Shake Shack, Little Caesars and newly added Jersey Mike’s Subs support higher throughput as fleet scale grows. New city launches introduce varied operating conditions that help refine autonomy models and strengthen system-wide performance. As platform reach expands across Uber and DoorDash, Serve Robotics benefits from stronger utilization, richer data capture and improved economics. These partnerships reinforce the company’s ability to convert fleet growth into revenue leverage, supporting broader urban adoption and monetization opportunities in 2026.

Serve Robotics continues to make progress in autonomous sidewalk delivery, supported by fleet expansion, improving autonomy and growing platform integrations with Uber and DoorDash. These partnerships reinforce the company’s long-term vision to scale urban autonomy across major U.S. markets.

However, despite these advances, Serve Robotics remains in an early stage of commercialization, with profitability still distant and execution risks elevated as fleet scale increases. In addition, the stock’s current valuation appears to reflect optimistic expectations for long-term adoption, leaving limited margin for error. Given these factors, SERV carries a Zacks Rank #4 (Sell). Existing investors may consider trimming exposure, while new investors may prefer to wait for clearer visibility.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 3 hours | |

| Feb-21 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite