|

|

|

|

|||||

|

|

The artificial intelligence (AI) revolution has transformed cloud computing into a strategic battleground, with global technology giants racing to capture market share in this rapidly expanding sector. Alibaba Group Holding BABA and Microsoft MSFT represent two contrasting approaches to this transformation. While Alibaba dominates China's AI cloud infrastructure market, Microsoft leverages its global enterprise ecosystem to drive AI adoption across multiple platforms. Both companies reported strong cloud growth in their latest quarterly results, yet they face distinctly different challenges in converting AI investments into sustainable profitability.

Let's delve deep and closely compare the fundamentals of the two stocks to determine which one is a better investment now.

Alibaba's Cloud Intelligence Group delivered 34% year-over-year revenue growth in its second quarter of fiscal 2026, reaching RMB 39.8 billion, while AI-related products achieved triple-digit growth for the ninth consecutive quarter. At January 2026's Apsara Conference, the company unveiled its Qwen3 large language model family and announced plans to spin off its Kunlunxin AI chip unit for a Hong Kong listing in early 2027. Management projects AI adoption to drive corporate budgets to increase tenfold compared to traditional IT spending, positioning Alibaba as a critical infrastructure provider for China's AI transformation.

However, headwinds overshadow these achievements. Alibaba's second-quarter earnings plunged 71% year over year to RMB 4.36 per ADS, falling below expectations. This profitability collapse reflects aggressive spending on AI infrastructure and marketing subsidies required to defend market share against fierce competitors, including JD.com, Pinduoduo and Meituan. Sales and marketing expenses more than doubled to RMB 66 billion as the company battles for e-commerce dominance. The quick commerce initiative, while strategically necessary, generated substantial losses that management projects will persist through fiscal 2026.

Core e-commerce growth of 16% represents the fastest expansion since 2021, yet this achievement came at enormous cost. Operating margins compressed dramatically as Alibaba sacrificed profitability to maintain relevance in China's hypercompetitive retail landscape. The company faces mounting pressure from regulators, uncertain macroeconomic conditions in China, and intensifying competition from Western cloud providers expanding into Asian markets. Additionally, Alibaba's planned RMB 380 billion AI infrastructure investment over three years raises questions about capital efficiency and return on investment, particularly given the company's struggling profitability metrics.

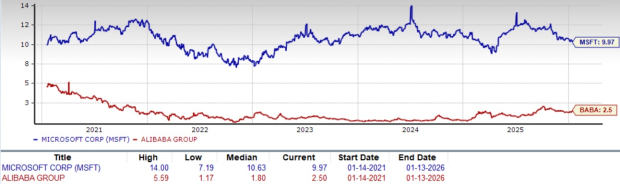

The Zacks Consensus Estimate for fiscal 2026 earnings indicates a downward revision of 2.6% over the past 60 days to $6.42 per share. The market appears to be pessimistic about Alibaba's growth trajectory.

Alibaba Group Holding Limited price-consensus-chart | Alibaba Group Holding Limited Quote

Microsoft's first quarter of fiscal 2026 demonstrated the strength of its integrated AI ecosystem. Total revenues reached $77.7 billion, up 18% year over year, while Azure cloud services accelerated 40% in constant currency. The company's Microsoft Cloud business surpassed $49 billion in quarterly revenues, expanding 26% annually. In January 2026, Microsoft announced the acquisition of Osmos, an agentic AI platform that will enhance autonomous data engineering capabilities within Microsoft Fabric, reinforcing its commitment to simplifying enterprise AI adoption.

The company's partnership with OpenAI continues delivering strategic advantages. An incremental $250 billion Azure services contract with OpenAI, announced in the fiscal first quarter, represents a substantial future revenue opportunity. Microsoft's commercial remaining performance obligation grew 51% year over year to nearly $400 billion, with a weighted average duration of only two years, providing exceptional revenue visibility. Azure AI Foundry now serves 80,000 customers, including 80% of the Fortune 500, demonstrating broad enterprise adoption of Microsoft's AI platform.

Management's guidance for the fiscal second quarter of 2026 projects revenues between $79.5 billion and $80.6 billion, representing 14-16% growth, with Azure expected to maintain 37% constant currency expansion. While Microsoft faces capacity constraints through the fiscal year-end due to infrastructure buildout limitations, this challenge reflects overwhelming demand rather than competitive weakness. The company deployed the world's first large-scale cluster of NVIDIA GB300s and plans to increase total AI capacity by more than 80% this year while roughly doubling data center footprint over two years. Operating margins remained strong at 49%, ahead of expectations, demonstrating Microsoft's ability to scale AI investments without sacrificing profitability.

The Zacks Consensus Estimate for Microsoft’s fiscal 2026 earnings is pegged at $15.61 per share, indicating an upward revision of 0.1% over the past 60 days.

Microsoft Corporation price-consensus-chart | Microsoft Corporation Quote

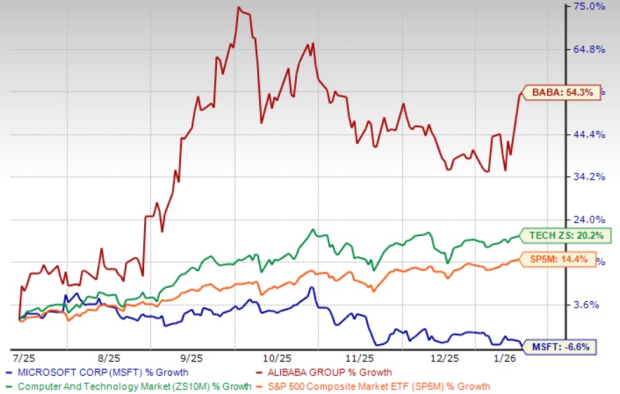

Shares of BABA have returned 54.3% in the past six-month period, while MSFT shares have lost 6.6%. However, this price performance divergence masks fundamental differences in business quality and sustainability.

Both Microsoft and Alibaba shares are currently overvalued, as suggested by a Value Score of D and F, respectively. Microsoft's 27.59x forward P/E multiple reflects justified confidence in sustained growth, underpinned by robust Azure expansion, expanding operating margins, and a $400 billion contracted backlog that provides exceptional revenue visibility. The stock's recent pullback presents an attractive entry point for investors seeking exposure to proven AI monetization capabilities.

Alibaba's stock is trading at a 19.2x P/E ratio, which appears optically attractive but masks fundamental deterioration in earnings quality and profitability metrics. The recent rally was driven primarily by sentiment shifts around Chinese stimulus measures and AI enthusiasm rather than improving business fundamentals. The 71% earnings decline in the fiscal second quarter reveals the unsustainability of current valuation levels, as aggressive marketing spending and quick commerce losses erode shareholder value.

While Microsoft's premium valuation is justified by operational excellence and margin expansion, Alibaba's seemingly modest multiple fails to account for ongoing profitability challenges, intensifying competition, and uncertain execution trajectory in both e-commerce and cloud segments.

Investors should buy Microsoft stock for its better upside potential, driven by sustainable AI-powered revenue growth and stay away from BABA stock right now, given its profitability challenges and execution uncertainties. MSFT currently carries a Zacks Rank #2 (Buy), whereas Alibaba has a Zacks Rank #5 (Strong Sell).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 1 hour | |

| 2 hours | |

| 3 hours | |

| 3 hours | |

| 3 hours | |

| 4 hours | |

| 5 hours | |

| 5 hours | |

| 5 hours | |

| 5 hours | |

| 6 hours | |

| 6 hours | |

| 6 hours | |

| 6 hours | |

| 6 hours |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about Finviz Elite