|

|

|

|

|||||

|

|

AT&T, Inc. T and Charter Communications, Inc. CHTR are both prominent players in the U.S. connectivity landscape. Charter Communications is the second-largest cable operator in the United States and a leading broadband communications company providing video, Internet and voice services.

AT&T Inc. is the second-largest wireless service provider in North America and one of the world’s leading communications service carriers. Through its subsidiaries and affiliates, the company offers a wide range of communication and business solutions that include wireless, local exchange, long-distance, data/broadband, Internet, video, managed networking, wholesale and cloud-based services.

Growing usage of high data-intensive applications such as cloud, gaming and IoT has led to a substantial increase in data traffic. The government’s initiative to reduce the digital divide and expand connectivity in rural and remote areas is also driving growth. However, high capex requirement remains an obstacle. With deep industry expertise, both AT&T and Charter are strategically positioned in the highly competitive U.S. telecom sector. Let us analyze the competitive strengths and weaknesses of the companies in depth to understand which is better positioned to maximize gains from the emerging market trends.

Charter continues to benefit from strong nationwide 5G coverage. In the third quarter of 2025, Charter added 493 thousand total mobile lines. The total mobile lines customer base was 11.4 million, up 22% year over year. Charter’s strategy of transforming its business model from legacy cable toward integrated broadband and mobile connectivity is a prudent decision. The focus on high-speed Internet, 5G-based mobile and enterprise solutions aligns with structural trends favoring converged digital access over traditional television. Connectivity revenues rose 3.8% year over year in the third quarter of 2025, highlighting the resilience of the core growth engine despite legacy segment contraction.

The company is rapidly expanding its network infrastructure. In the fourth quarter of 2025, the company expanded Spectrum Internet, Mobile, TV and Voice services coverage in several states, including North Carolina, Wisconsin, Florida and Tennessee. It has also expanded its fiber network in Missoula County, MT, and Jefferson County, IL, recently. It is one of the fastest-growing rural internet service providers in the country. It is closely working with the federal government to accelerate the process. It is committed to investing $7 billion to add 100,000+ miles of fiber-optic network infrastructure. The goal is to deliver symmetrical and multi-gigabit Internet services across 1.7 million locations.

The company is collaborating with AWS to utilize its generative AI capabilities, accelerate software development and improve operational efficiency. However, the company is facing multiple challenges. Despite its network expansion initiatives, Total Internet customers decreased by 109K in the third quarter of 2025. Total video customers decreased 70K, while total wireline voice customers decreased 200K. Charter operates in one of the most contested connectivity markets in U.S. telecom history. It faces competition from major players like AT&T and Verizon Communications, Inc. VZ. Verizon is rapidly expanding its fiber footprint, and the acquisition of Frontier by Verizon will accelerate the deployment process. This could pose a challenge to Charter’s network expansion effort.

AT&T is benefiting from solid traction in the Communications segment. Revenues from the Consumer wireline improved 4.1% year over year to $3.56 billion in the third quarter of 2025. The uptick is a result of solid momentum in the fiber broadband business. AT&T recorded net fiber additions of 288,000, while Internet Air added 270,000 subscribers during the quarter. By the end of 2030, AT&T expects to reach approximately 50 million customer locations with its in-region fiber network and more than 60 million fiber locations when including the Lumen Mass Markets fiber assets.

The company’s client-oriented approach is a major tailwind. It’s the first and only carrier in the industry to introduce a customer guarantee for both wireless and fiber networks. AT&T Guarantee offers proactive bill credits to customers in case of fiber downtime lasting 20 minutes or more and wireless downtime lasting 60 minutes or more.

However, the company operates in a highly saturated U.S. telecom market and faces competition from major players such as Verizon, Charter, Comcast and T-Mobile. The company has been taking a multidimensional approach to gain a competitive edge amid intensifying competition. It is steadily upgrading its network infrastructure. In recent months, the company has deployed mid-band spectrum from EchoStar around 23,000 cell sites. This will ensure a significant increase in speed and capacity for customers in 5,300 cities across 48 states. The integration of the spectrum from Echo Star has improved download speed for mobility by 80%, while it has improved 55% for AT&T Internet Air users.

The second approach is that the company is expanding its portfolio cater to new high-growth markets and lowering its dependence on legacy telecom services. It has recently introduced the AT&T IoT Network Intelligence, a leading-edge solution designed to enhance enterprise visibility across its connected devices ecosystem. Businesses across sectors are rapidly incorporating IoT devices to streamline workflow and improve efficiency. The innovative features of AT&T’s IoT solutions will likely boost its commercial prospects across multiple industries such as healthcare, transportation, logistics and more.

The company is also collaborating with Mitsubishi Motors North America to bring advanced 5G connectivity to the upcoming Mitsubishi Outlander SUV. is collaborating with AST Spacemobile to expand into the emerging satellite connectivity space. Despite rapid deployments of 5G and fiber networks nationwide, a large area of the United States has remained outside of the network coverage area. By utilizing the ASTS Satcom portfolio, T aims address these limitations of terrestrial network infrastructure. Such actions augur well for long-term sustainable growth.

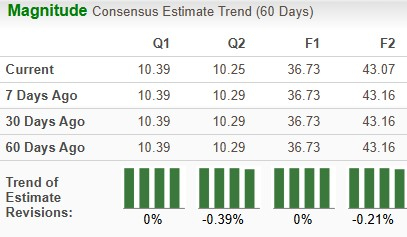

The Zacks Consensus Estimate for Charter’s 2025 sales implies a year-over-year decline of 0.29%, and EPS implies year-over-year growth of 5.03%. The EPS estimates for 2025 have remained unchanged, while estimates for 2026 have been trending southward over the past 60 days.

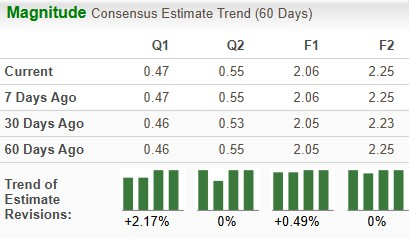

The Zacks Consensus Estimate for AT&T’s 2025 sales indicates growth of 2.14% year over year, while EPS is projected to decline 8.85%. The EPS estimates for 2025 have been trending northward over the past 60 days, while for 2026, the estimates have remained unchanged.

Over the past year, AT&T has gained 7.7%, while CHTR has returned 41.9%.

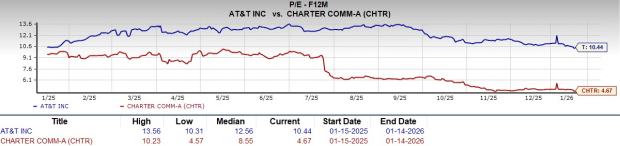

CHTR looks more attractive than AT&T from a valuation standpoint. Going by the price/earnings ratio, CHTR’s shares currently trade at 4.67 forward earnings, lower than 10.44 for AT&T.

AT&T carries a Zacks Rank #3 (Hold) and Charter has a Zacks Rank #4 (Sell), at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

AT&T and Charter are both steadily expanding their network infrastructure. Charter’s collaboration with the government to expand rural connectivity is a positive. However, the company is affected by stiff competition in the telecom market. Besides augmenting its network infrastructure, AT&T is expanding its portfolio cater to various applications in automotive, healthcare, public safety and the transportation industry. This exposure to other industries opens up new revenue-generating opportunities for the company. Its collaboration with ASTS to bring space-based connectivity will likely bring long-term benefits. Owing to these factors, AT&T appears to be a better investment option at the moment.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 1 hour | |

| 2 hours | |

| 3 hours | |

| 4 hours | |

| Mar-08 | |

| Mar-08 | |

| Mar-07 | |

| Mar-06 | |

| Mar-06 | |

| Mar-06 | |

| Mar-06 | |

| Mar-06 | |

| Mar-06 | |

| Mar-06 | |

| Mar-05 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite