|

|

|

|

|||||

|

|

QuidelOrtho Corporation QDEL is well-poised for growth in the coming quarters, courtesy of its strong product portfolio. The optimism, led by solid third-quarter 2025 results, is expected to contribute further. However, risks due to overdependence on the respiratory business and reimbursement policies persist.

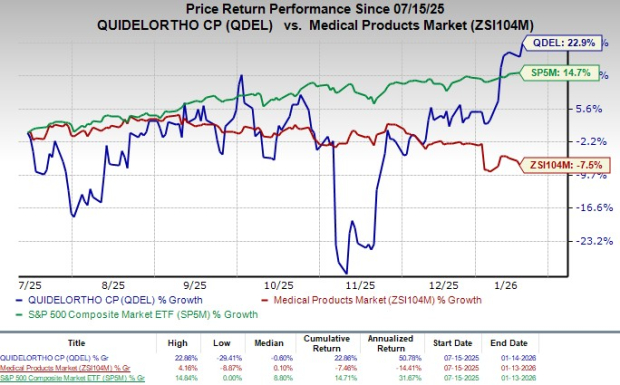

This Zacks Rank #3 (Hold) company has gained 22.9% in the last six-month period against the 7.5% decline of the industry. The S&P 500 has witnessed 14.7% growth in the said time frame.

The renowned rapid diagnostic testing solutions provider has a market capitalization of $2.3 billion. QuidelOrtho’s earnings yield of 7.7% compares favorably with the industry’s 2.8%. The company’s earnings surpassed the Zacks Consensus Estimate in three of the trailing four quarters, breakeven once, with an average surprise being 33%.

Robust Product Portfolio: QuidelOrtho continues to expand its diagnostic portfolio for both healthcare professionals and consumers, with key offerings like Sofia analyzers, QuickVue, and the innovative Savanna instrument, positioned to drive revenue and margin growth after a strong U.S. launch. With FDA approvals secured for the Savanna system and HSV panel, clinical trials for the respiratory and STI panels are slated for 2025. Further strengthening its Labs segment, the company added the ARK Fentanyl II Assay to its U.S. Vitros platforms in April 2024, addressing the rising demand for opioid testing and reinforcing its commitment to tackling evolving public health needs.

Potential in Diagnostic Business: QuidelOrtho’s focus on the diagnostics business has been a wise move, given the strong growth potential in this market. A Mordor Intelligence report states that the clinical diagnostics market is valued at approximately $84.2 billion in 2024 and is anticipated to reach $109.2 billion by 2029, at a CAGR of 5.5%. QuidelOrtho has used its expertise and know-how to develop differentiated diagnostic testing technologies and products that generate specialized results.

In each case, the company attempts to improve its performance in terms of ease of use, reduced cost, increased test accuracy and reduced time to result, thus attracting a growing range of customers and use cases.

Solid Q3 Results: QuidelOrtho ended the third quarter of 2025 with better-than-expected results, where both earnings and revenues beat their respective Zacks Consensus Estimate. The company registered robust revenues from its Labs and Immunohematology business units and EMEA, China and Other regions, which were encouraging. The expansion of margins bodes well.

Third-Party Reimbursement Policies: QuidelOrtho's Point-of-Care products are primarily used by physicians and other healthcare providers. In the United States, these providers, including hospitals and physicians, typically depend on third-party payers, such as private health insurance, Medicare and Medicaid, to reimburse all or part of the cost of diagnostic procedures. The success of QuidelOrtho's products could be impacted if healthcare providers do not receive sufficient reimbursement from third-party payers for the costs associated with its products.

Overdependence on Respiratory Segment: QuidelOrtho’s heavy dependence on its respiratory testing business continues to be a key drag, as third-quarter results once again exposed the inherent volatility of the segment. COVID-related revenue fell sharply by 63%, while flu testing declined 8%, reflecting the ongoing fade of pandemic-era demand and the sensitivity of flu volumes to seasonal dynamics.

This pressure weighed on regional results, with North America revenue down 12% on an unadjusted basis. Given that respiratory testing has historically been a higher-margin business, the uneven performance had a disproportionate financial impact; despite disciplined cost controls lifting adjusted EBITDA margins to 25%, management repeatedly cited respiratory softness as a persistent headwind, highlighting its outsized influence on both revenue stability and margins.

QuidelOrtho is witnessing a stable estimate revision trend for 2025. In the past 60 days, the Zacks Consensus Estimate for its earnings has remained stable at $2.12 per share.

The Zacks Consensus Estimate for the company’s fourth-quarter 2025 revenues is pegged at $705.7 million, indicating a 0.3% decline from the year-ago quarter’s reported number.

Some better-ranked stocks in the broader medical space are IDEXX Laboratories IDXX, Boston Scientific BSX and STERIS STE. Each stock presently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Estimates for IDEXX’s 2025 earnings per share (EPS) have remained constant at $12.93 in the past 30 days. Shares of the company have risen 12.6% in the past year compared with the industry’s 11.1% growth. IDXX’s earnings surpassed estimates in each of the trailing four quarters, the average surprise being 7.1%. In the last reported quarter, it delivered an earnings surprise of 8.3%.

Boston Scientific shares have gained 2.9% in the past year. Estimates for the company’s 2025 EPS have remained constant at $3.04 in the past 30 days. BSX’s earnings beat estimates in each of the trailing four quarters, delivering an average surprise of 7.4%. In the last reported quarter, it posted an earnings surprise of 5.6%.

STERIS shares have risen 9.1% in the past year. Estimates for the company’s 2025 EPS have increased by 2 cents to $10.23 in the past 30 days. STE’s earnings topped estimates in three of the trailing four quarters and matched on one occasion, delivering an average surprise of 2.6%. In the last reported quarter, it posted an earnings surprise of 2.6%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-28 | |

| Feb-27 | |

| Feb-27 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-24 | |

| Feb-23 | |

| Feb-23 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite