|

|

|

|

|||||

|

|

Restaurant Brands International Inc. QSR continues to strengthen its market position by leveraging its brand value through innovative menu offerings, enhanced operational efficiency and strategic restaurant remodels. Disciplined cost management, combined with strong performance from Tim Hortons in Canada and Burger King in the United States, underscores the resilience of the company’s business model and reinforces its long-term relevance in the competitive quick-service restaurant industry.

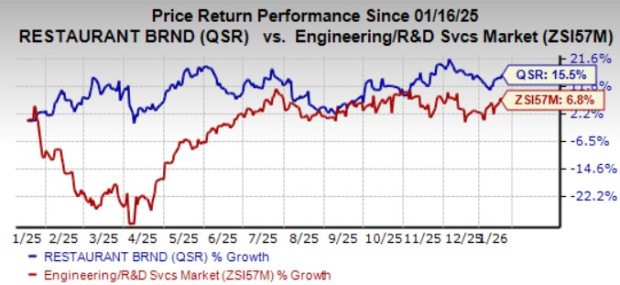

Shares of this casual quick-service restaurant chain have gained 15.5% in the past year, outperforming the Zacks Retail - Restaurants industry’s 6.8% growth. Its earnings topped the Zacks Consensus Estimate in two of the trailing four quarters, and missed on two occasions, with an average being negative 0.4%.

Currently, QSR has had its 2026 EPS estimate revised upward to $3.99 from $3.97 over the past 60 days. Although lingering inflation pressures and a challenging macro backdrop are concerning, the company’s organic and inorganic strategies have been driving growth.

Restaurant Brands — a Zacks Rank #2 (Buy) stock — has a favorable VGM Score of B. Our research shows that stocks with a VGM Score of A or B, combined with a Zacks Rank #1 (Strong Buy) or 2, offer the best investment opportunities to investors.

Let’s delve into the major driving factors.

Core Brands Drive Growth: Restaurant Brands is strategically capitalizing on the strength of its three core brands — Tim Hortons, Burger King and Popeyes — to drive sustained growth and operational excellence across markets. Tim Hortons, contributing about 44% of operating profit, delivered 4.2% comparable sales growth in the third quarter of 2025, outperforming the Canadian QSR industry by roughly three points, supported by strong brand affinity, menu innovation and operational execution. Burger King U.S. continues to gain traction under the Reclaim the Flame strategy, supported by menu innovation, operational improvements and restaurant remodels, resulting in 3.2% comparable sales growth.

Meanwhile, Popeyes is accelerating its international expansion across EMEA and China, generating the strongest system-wide sales growth among RBI’s scaled global peers.

Remodeling & Refranchising Initiative: Restaurant Brands continues to advance its remodeling and refranchising initiatives to modernize its restaurant base, enhance the guest experience and strengthen franchisee economics. At Burger King U.S., the company is making steady progress under the Reclaim the Flame strategy, with approximately 400 remodels expected in 2025. In parallel, RBI is progressing with the refranchising of Burger King restaurants through its Crown Your Career program and with experienced franchise partners and remains on track to refranchise between 50 and 100 restaurants in 2025. Together, these initiatives support a more modern, capital-light and franchise-led system positioned for sustainable long-term growth.

Focus on Menu Innovation: Restaurant Brands continues to leverage menu innovation to drive traffic, strengthen customer engagement and keep its brands relevant. At Tim Hortons, breakfast food sales rose 6.5%, fueled by the 100% Canadian freshly cracked Scrambled Egg platform and the successful introduction of the Loaded Croissant breakfast sandwich. Seasonal baked goods, including the Spice Vanilla-filled Donut and Halloween Timbits Bucket, saw strong consumer demand, while the fall beverage lineup — featuring Chai Lattes, the return of Pumpkin Spice and protein lattes — has performed well, particularly among health-conscious guests.

At Burger King, the Barbecue Brisket and Crispy Onion Whoppers delivered better-than-expected results, highlighting the continued strength of the Whopper franchise, with the expansion into Whopper Junior helping attract women and Gen-Z consumers. Together, these focused innovation initiatives support evolving consumer tastes, reinforce value propositions, and sustain sales momentum across markets.

Higher ROE: QSR’s trailing 12-month return on equity (ROE) is indicative of its growth potential. The company’s ROE of 32.4% compares favorably with the industry’s 23.3%, which signals more efficiency in using shareholders’ funds than peers.

Other top-ranked stocks from the Zacks Retail-Wholesale sector are:

Dillard's, Inc. DDS flaunts a Zacks Rank #1 at present. The company delivered a trailing four-quarter earnings surprise of 26.5%, on average. DDS stock has rallied 47.1% in the past six months. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Dillard’s fiscal 2026 sales indicates growth of 1.1%, while EPS indicates a decline of 9.4% from the year-ago period’s levels.

Expedia Group, Inc. EXPE flaunts a Zacks Rank of 1 at present. The company delivered a trailing four-quarter earnings surprise of 4.5%, on average. EXPE stock has surged 63.1% in the past six months.

The Zacks Consensus Estimate for EXPE’s 2026 sales and EPS indicates growth of 6.3% and 20.9%, respectively, from the prior-year levels.

Brinker International, Inc. EAT presently carries a Zacks Rank #2. The company delivered a trailing four-quarter earnings surprise of 18.7%, on average. Brinker's stock has declined 0.3% in the past six months.

The Zacks Consensus Estimate for Brinker’s fiscal 2026 sales and EPS indicates a decline of 6.5% and 14.9%, respectively, from the year-ago period’s levels.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 |

These Stocks Are Getting Hammered By The 'Bomb Cyclone' Hitting The East Coast

EXPE -7.36%

Investor's Business Daily

|

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-22 | |

| Feb-22 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite