|

|

|

|

|||||

|

|

Cloud computing continues experiencing explosive growth as artificial intelligence drives unprecedented infrastructure demand. Amazon AMZN and Oracle ORCL represent two distinct approaches to capturing market share in this trillion-dollar opportunity.

Amazon dominates through AWS, commanding approximately 29% market share with $33 billion in third-quarter 2025 revenues. Oracle pursues enterprise database workloads and AI training infrastructure, partnering with OpenAI, Meta, and NVIDIA to achieve 68% Cloud Infrastructure growth.

Let's delve deep and closely compare the fundamentals of the two stocks to determine which one is a better investment now.

AWS delivered its strongest performance in nearly three years during third-quarter 2025, accelerating to 20.2% year-over-year growth, the highest expansion rate in 11 quarters. The segment generated $11.4 billion in operating income while maintaining profitability amid aggressive capacity expansion. Cloud backlog reached $200 billion, providing substantial revenue visibility.

Infrastructure buildout demonstrates unmatched scale and AI commitment. Amazon added over 3.8 gigawatts of power capacity in the past 12 months, with plans to double total capacity by 2027. January 2026 announcements included a multi-year $38 billion deal with OpenAI, $50 billion investment in defense-focused AI data centers, and enhanced Alexa+ integrations across consumer devices. Management expects full-year 2025 capital expenditures to reach approximately $125 billion, increasing further in 2026.

AWS benefits from a comprehensive AI infrastructure spanning custom silicon, advanced managed services and developer tools. Trainium2 chips achieved 150% quarter-over-quarter growth and are fully subscribed. Amazon S3 Vectors reached general availability in January 2026 with capacity for 2 billion vectors per index, reducing the total cost of ownership by up to 90%. Fourth-quarter guidance projects revenues between $206 billion and $213 billion, suggesting 10% to 13% growth, with operating income expected at $21 billion to $26 billion.

The Zacks Consensus Estimate for AMZN’s 2026 earnings is pegged at $7.87 per share, which has seen an upward revision of 0.4% over the past 30 days. This indicates a 9.65% increase from the figure reported in the year-ago quarter.

Amazon.com, Inc. price-consensus-chart | Amazon.com, Inc. Quote

Oracle transformed itself into a formidable cloud infrastructure player with Remaining Performance Obligations soaring to $523 billion, up 438% year over year. The company added $68 billion in new commitments during second-quarter fiscal 2026 from Meta, NVIDIA, and others. Cloud Infrastructure revenues grew 68% to $4.1 billion, driven by AI training workload demand.

Oracle's differentiated approach delivers secure, high-performance infrastructure specifically optimized for enterprise databases and AI models. Chairman Larry Ellison's vision emphasizes private data inferencing as potentially the next trillion-dollar AI market. Oracle AI Database 26ai launched in January 2026 for on-premises deployment, enabling customers to run dynamic agentic AI workflows combining private database data with public information. The company operates 147 live customer-facing regions with 64 more planned.

However, Oracle faces execution challenges. The company raised fiscal 2026 capital expenditure guidance to approximately $50 billion, up $15 billion, reflecting massive infrastructure investments required. Second-quarter fiscal 2026 free cash flow was negative $10 billion, substantially worse than the analyst consensus. Customer concentration poses material risk, with OpenAI's reported $300 billion infrastructure deal representing the majority of RPO growth. Rising leverage amid negative cash flow generation raises questions about financial flexibility. Third-quarter fiscal 2026 guidance calls for revenue growth of 19% to 21%, with $4 billion additional revenues expected in fiscal 2027.

The Zacks Consensus Estimate for ORCL’s fiscal 2026 earnings is pegged at $7.42 per share, marking an upward revision of 1.8% over the past 30 days. The earnings figure suggests 23.05% growth over the figure reported in fiscal 2025.

Oracle Corporation price-consensus-chart | Oracle Corporation Quote

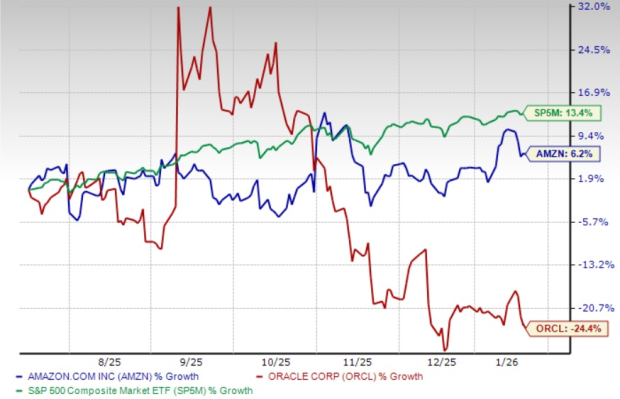

Market sentiment has diverged sharply between these cloud competitors. Shares of AMZN have returned 6.2% over the past six months, while ORCL shares have plunged 24.4% in the same timeframe.

Both Amazon and Oracle shares are currently overvalued, as suggested by a Value Score of C and D, respectively. Amazon trades at a 3.18x forward price-to-sales multiple, representing justified confidence in sustained AWS growth while generating substantial free cash flow. Oracle commands a significantly higher 6.96x P/S ratio despite customer concentration concerns and execution uncertainty.

Amazon emerges as the superior investment opportunity based on execution track record, diversified revenue streams and sustainable growth fundamentals. AWS' reacceleration to over 20% growth, combined with $200 billion in cloud backlog and proven infrastructure scaling capabilities, positions Amazon to capitalize on AI-driven cloud transformation while maintaining profitability. Oracle's $523 billion RPO introduces material concentration risk and requires flawless execution of unprecedented infrastructure buildout funded through rising debt. Amazon's premium valuation reflects achievable growth with strong return visibility, whereas Oracle's higher multiple prices reflect optimistic assumptions. Investors should buy Amazon stock for its compelling risk-reward profile and hold or wait for a better entry on Oracle. AMZN currently carries a Zacks Rank #2 (Buy), whereas Oracle has a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 1 hour | |

| 2 hours | |

| 2 hours | |

| 3 hours | |

| 3 hours | |

| 4 hours | |

| 5 hours | |

| 6 hours | |

| 7 hours | |

| 7 hours | |

| 8 hours | |

| 10 hours | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite