|

|

|

|

|||||

|

|

We see the weakness in bank stocks following Q4 results as primarily a sell-the-news phenomenon rather than a function of anything fundamentally problematic with the quarterly numbers or even management’s outlook and guidance for the coming periods.

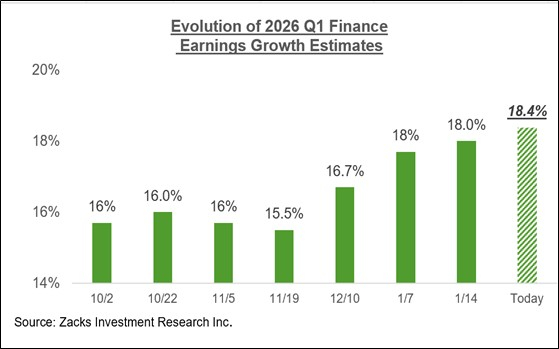

Bank earnings aren’t great, but they aren’t bad either, and broadly reflective of a steadily improving earnings outlook for the group. Our constructive view of the group’s Q4 results is built out by how estimates for the current period (2026 Q1) are evolving, as we show below.

It is still early in the 2025 Q4 reporting cycle, as two-thirds of the Finance sector’s market capitalization in the S&P 500 index has yet to report quarterly results. But these early signs on the revisions front give us confidence that the trends already established will most likely prove enduring.

With respect to the bank earnings scorecard, we now have seen Q4 results from 33.7% of the market capitalization in the S&P 500 index. Total earnings for these Finance sector companies are up +12.6% from the same period last year on +6.9% higher revenues, with 91.7% beating EPS estimates and 66.7% beating revenue estimates.

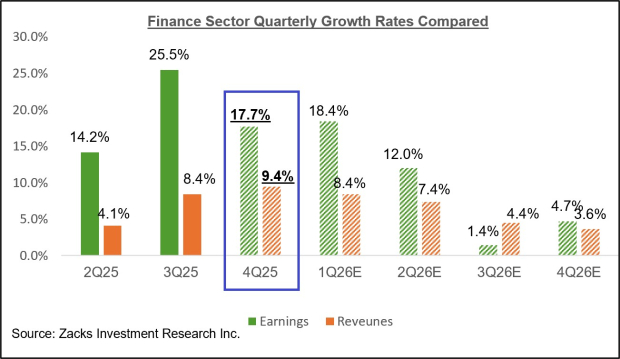

The comparison charts below put the sector’s Q4 earnings and revenue growth rates for the 12 Finance sector companies that have reported already (out of 94 in the Zacks Finance sector) in a historical context.

The comparison charts below put the sector’s Q4 EPS and revenue beats percentages for the same 12 Finance sector companies in a historical context.

As you can see above, the growth rates are below what we had seen from this same group of companies in the preceding period, but otherwise within the range for this period. The beats percentages are on the weak side, with revenue beats notably below the average for this group of companies in the preceding 20-quarter period.

As noted earlier, plenty of Finance sector results are still to come, including those from major regional banks like Fifth Third and KeyCorp. U.S. Bancorp, Truist Financial, and consumer finance operators like Capital One, Ally Financial, and others.

Looking at Q4 as a whole, combining the actual results that have come out with estimates for the still-to-come Finance sector companies, total earnings for the sector are expected to be up +17.7% from the same period last year on +9.4% higher revenues.

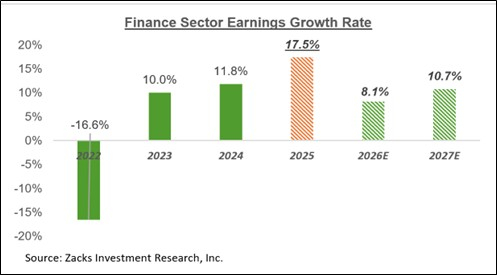

The chart below shows the Finance sector’s growth picture on an annual basis.

Q4 Earnings Season Scorecard

Through Friday, January 16th, we have seen Q4 results from 33 S&P 500 members. Total earnings for these companies are up +17.3% from the same period last year on +7.6% higher revenues, with 87.9% beating EPS estimates and 69.7% beating revenue estimates.

The comparison charts below show the growth rates for these 33 index members compared with what we had seen from this same group of companies in other recent periods.

The comparison charts below show the Q4 EPS and revenue beats percentages for this group of companies relative to what we had seen from them in other recent periods.

Plenty of results are still to come. But at this early stage, the revenue beats percentage is tracking below the historical average, with all the other metrics in the historical range.

Netflix (NFLX)

Netflix NFLX is scheduled to report results after the market’s close on Tuesday, January 20th. The company is expected to report 55 cents per share in earnings on $11.97 billion in revenues, representing year-over-year growth rates of +27.9% and +16.8%, respectively. The stock was down following the last quarterly release on October 21st, with the Warner Brothers acquisition issue adding to the stock’s weakness.

Netflix shares have been in a downtrend since the start of the second half of 2025 and have lost more than -30% of their value in the last 6 months, massively lagging the market’s +13.4% gain. The ongoing Warner Brothers deal will continue to weigh on the stock’s near-term trajectory, while developments on the company’s advertising strategy will be key to this earnings release.

Capital One Financial (COF)

Capital One Financial COF will be reporting Q4 results after the market’s close on Thursday, January 22nd. Recent headlines about interest rate caps have emerged as a material headwind for all consumer finance operators, including Capital One. The stock had led the broader market through January 6th, but has since lost -7.3% of its value (vs. the market’s +0.4% gain). Capital One is expected to report $4.07 per share in earnings on $15.3 billion in revenues, representing year-over-year changes of +31.7% and +50.3%, with the strong growth rates reflecting contribution from the acquired Discover Financial business. The company has a history of strong quarterly results, with the stock typically rising on earnings releases.

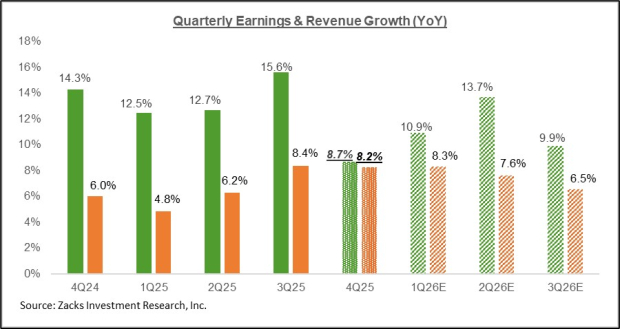

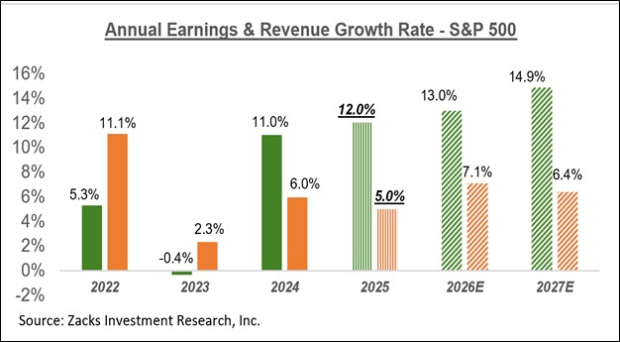

The chart below shows the Q4 earnings and revenue growth expectations in the context of where growth has been in the preceding four quarters and what is expected in the coming three quarters.

The chart below shows the overall earnings picture on a calendar-year basis, with double-digit earnings growth expected in 2025 and 2026.

For a detailed look at the overall earnings picture, including expectations for the coming periods, please check out our weekly Earnings Trends report >>>>Q4 Earnings Season Gets Off to a Solid Start

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 1 hour | |

| 5 hours | |

| 6 hours | |

| 9 hours | |

| 10 hours | |

| 10 hours | |

| 13 hours | |

| 14 hours | |

| 16 hours | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 |

Netflix Gives Paramount One Last Chance In Warner Bros. Bidding War. All Three Stocks Climb.

NFLX

Investor's Business Daily

|

| Feb-17 | |

| Feb-17 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite