|

|

|

|

|||||

|

|

Palo Alto Networks PANW and Allot Ltd. ALLT are both at the forefront of the network security space, playing key roles in guarding organizations from extensive cyberattacks. While Palo Alto Networks focuses broadly on next-generation firewalls, cloud security and AI-driven threat detection, Allot specializes in network intelligence for Service Providers and Enterprises.

Palo Alto Networks and Allot are riding the key industry trends, fueled by the rise of complex attacks, including credential theft and abuse and social engineering-based strikes by malicious actors. Per a Mordor Intelligence report, the network security space is expected to witness a CAGR of 11.47% from 2025 to 2030.

With this strong growth forecast for the network security market, the question remains: Which stock has more upside potential? Let’s break down their fundamentals, growth prospects, market challenges and valuation to determine which offers a more compelling investment case.

Palo Alto Networks remains a cybersecurity leader, offering solutions for network security, cloud security and endpoint solutions for customers who need full enterprise security support. Its next-generation firewalls and advanced threat detection technologies are widely recognized and adopted globally.

Palo Alto Networks’ wide range of innovative products, strong customer base and growing opportunities in areas like Zero Trust, Secure Access Service Edge (SASE) and private 5G security continue to support its long-term growth potential.

For example, in the first quarter of fiscal 2026, SASE was Palo Alto Networks’ fastest-growing segment, with SASE Annual recurring revenues (ARR) increasing 34% year over year. Growth is mainly coming from customers who want to reduce the number of security tools they use. Many organizations are moving away from older SASE products that do not provide a full view of their networks, cloud workloads, and remote users. A notable example during the first quarter is where a large U.S. cabinet agency signed a $33 million SASE deal covering 60,000 seats after replacing its existing provider.

However, Palo Alto Networks is experiencing a slowdown in its sales growth. Notably, the company’s revenue growth rate has been decelerating over the past two fiscal years. Over the past year, the revenue growth rate has slowed down to a mid-teen percentage range, a sharp contrast from the mid-20s percentage in fiscal 2023. This deceleration is expected to continue into fiscal 2026, with the company forecasting full-year revenue growth in the range of 14-15%. In the first quarter of fiscal 2026, its sales and non-GAAP earnings per share (EPS) grew 16% and 19.2%, respectively, year over year.

Allot provides network-based cybersecurity and network intelligence solutions, mainly for telecom operators and service providers. The company is witnessing strong growth in its Cybersecurity-as-a-Service (SECaaS) business. In the third quarter of 2025, SECaaS’ ARR increased about 60% year over year. Growth was primarily driven by higher adoption from telecom partners and more end users signing up for Allot's security services.

SECaaS made up around 28% of Allot’s total revenues in the third quarter, and looking ahead, management expects this share to move closer to 30%. This is crucial because SECaaS is a subscription-based offering, which offers more predictable revenues. Recurring revenues accounted for 63% of total revenues in the third quarter compared with 58% a year ago, showing a gradual improvement in revenue quality.

During the third quarter earnings call, management outlined a few clear drivers behind SECaaS growth. Large Tier-1 telecom customers that launched services in recent quarters are continuing to add new subscribers, which is driving demand for Allot’s solutions. Existing customers are also buying additional services over time, which supports upselling. Newer offerings, such as OffNetSecure, allow the company to offer protection even when users are off the operator’s network.

In the third quarter of 2025, its sales and non-GAAP EPS grew 14% and 233.3%, respectively, year over year. Considering a strong demand for its solutions and a better-than-expected third-quarter performance, Allot raised its guidance for 2025. The company now expects 2025 revenues to be in the range of $100-$103 million, up from its previous guidance of $98-$102 million. SECaaS ARR growth is now expected to exceed 60% on a year-over-year basis, up from its prior guidance of 55-60%. The above-mentioned factors demonstrate that steady user adoption and strong SECaaS momentum should continue to support Allot’s overall growth in the coming quarters.

The earnings estimate revision trend for the two companies reflects that analysts are turning more bullish toward Allot.

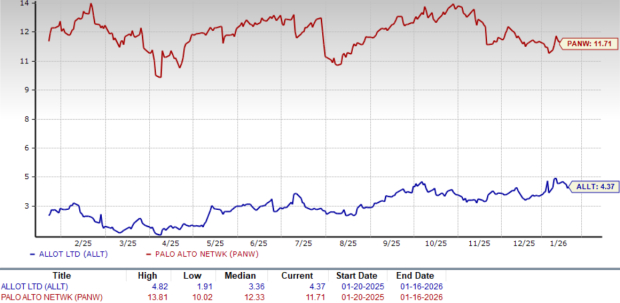

In the past six months, Allot shares have surged 33.8%, while shares of Palo Alto Networks have lost 6.1%.

Currently, Allot is trading at a forward sales multiple of 4.37X, lower than Palo Alto Networks’ forward sales multiple of 11.71X. Palo Alto Networks does seem pricey compared with Allot. In contrast, Allot’s reasonable valuation makes it more attractive for investors looking for value and stability.

Both Allot and Palo Alto Networks are key players in the Network Security space, but Palo Alto Networks is witnessing a slowdown in its sales growth. In contrast, Allot is seeing strong growth in its SECaaS business, which is driving higher revenues, rising recurring income, and better earnings visibility.

Allot’s reasonable valuation offers some downside protection as well, making the stock an attractive buy, particularly for investors seeking exposure to network security growth at a fair price.

Currently, Allot sports a Zacks Rank #1 (Strong Buy), making the stock a clear winner over Palo Alto Networks, which carries a Zacks Rank #4 (Sell).

You can see the complete list of today’s Zacks #1 Rank stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 1 hour | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 |

Palo Alto Networks Lifts Revenue Outlook as Second-Quarter Profit Jumps

PANW

The Wall Street Journal

|

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite