|

|

|

|

|||||

|

|

The declining Fed interest rates and a favorable public spending environment are boding well for the infrastructure companies of the United States, including names like Comfort Systems USA FIX and Quanta Services, Inc. PWR. The booming trends toward AI-related products and services are primarily driving the growth prospects of such firms in the economy.

On Dec. 10, 2025, the Federal Reserve slashed its interest rates by another 0.25 percentage points, setting the benchmark between 3.5% and 3.75%. The reduction in the borrowing rate catalyzes the ongoing favorable market trends, boosting more project initiations, leading to a promising future.

Comfort Systems offers installation and contracting services across the HVAC market and is currently focused on seeking opportunities for large-scale projects and investing additional capital in inorganic growth initiatives. Conversely, Quanta’s business surrounds large-scale electrical and utility infrastructure projects, with its focus mainly concentrated on margin improvement efforts and the self-perform model.

Let’s dive deep and closely compare the fundamentals of the two stocks to determine which one is a better investment now.

Comfort Systems is realizing benefits from the robust demand trends across the Technology sector, mainly because of strong data center and chip manufacturing-related activities. So far in 2025, the Technology sector contributed 42% of the total revenues, reflecting growth from 32% a year ago, thanks to hyperscalers and related infrastructure developers continuing to invest aggressively, despite ongoing macro headwinds. As of Sept. 30, 2025, the company had a record backlog of $9.38 billion, with a same-store backlog of $9.2 billion, indicating year-over-year increases of 65.1% and 62%, respectively.

FIX is benefiting from customers committing earlier and booking projects further out, with meaningful portions of the backlog now extending into 2026 and 2027. Beyond data centers, industrial and institutional markets remain supportive. Industrial customers represent roughly two-thirds of revenues, while institutional verticals such as healthcare, education and government continue to show steady activity, including new hospital builds and expansions.

The company also ensures its shareholders are satisfied through share repurchases and dividend payments. During the first nine months of 2025, it repurchased 0.3 million shares for approximately $125.4 million under the buyback program. Also, on Oct. 23, 2025, Comfort Systems’ board of directors hiked the quarterly dividend payment by 20% to 60 cents per share ($2.40 per share annually).

However, FIX’s growing exposure to hyperscale data centers is a double-edged sword. Any slowdown in AI-driven capital expenditures, project deferrals by cloud providers, or power availability constraints could compress backlog growth and utilization. Besides, project delays, scope changes, customer funding issues or cancellations, particularly in large and complex projects, could result in backlog conversion failure. Comfort Systems is also concerned about shortages of skilled labor and rising wage pressure in the current market dynamics. Besides, exposure to competitive pricing, project mix shifts and normalization from peak conditions could disturb its current margin levels and reduce profitability.

Being a specialty contracting services provider, Quanta is capitalizing on the booming trends surrounding electric transmission, grid modernization and power generation tied to AI, data centers, electrification and reshoring. The management indicated that accelerating demand in the Electric segment and broad activity across key end markets are reinforcing these trends and strengthening overall project momentum. As of the third quarter of 2025, PWR’s backlog reached a record $39.2 billion, up from $33.96 billion a year ago, underscoring robust demand visibility.

Moreover, disciplined bidding, effective risk management and a favorable project mix are primarily driving PWR’s margin expansion and consistency. Unlike many peers, Quanta self-performs 80–85% of its work. This approach provides greater control over costs, schedules and quality, mitigating risks associated with subcontracting. In the first nine months of 2025, operating margin increased to 5.5% from 5.2% on a year-over-year basis. During the same time frame, gross margin expanded 50 basis points year over year to 14.8%.

Quanta consistently focuses on reducing leverage while maintaining capacity for selective acquisitions, organic investment and shareholder returns. During the first nine months of 2025, PWR repurchased 538,559 shares for $134.6 million, with $365.1 million remaining under its buyback program. The balance between reinvestment and shareholder returns demonstrates disciplined capital management, enhancing long-term value creation. For 2025, the company expects free cash flow of $1.3-$1.7 billion. It had reported $1.55 billion in 2024.

Although demand visibility is strong, execution risk remains elevated due to the increasing size and complexity of infrastructure projects. Large transmission, generation and data center-related programs often face permitting delays, interconnection bottlenecks and regulatory approvals that can push Quanta’s revenue recognition to the south. Additionally, while renewable and battery projects remain active, the pace of growth is moderating compared with prior years, creating variability in quarterly mix.

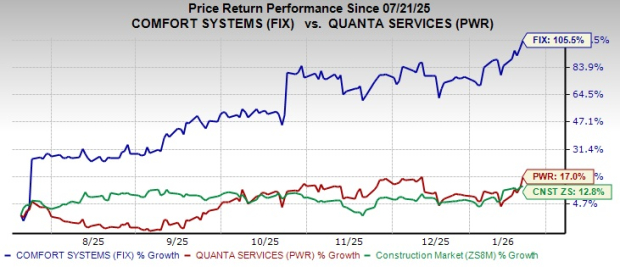

As witnessed from the chart below, in the past six months, Comfort Systems’ share price performance stands significantly above Quanta and the broader Construction sector.

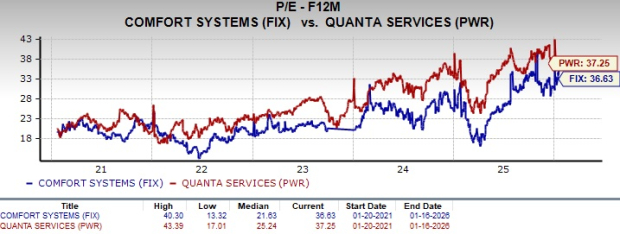

Considering valuation, over the last five years, Comfort Systems has been trading below Quanta on a forward 12-month price-to-earnings (P/E) ratio basis.

Overall, from these technical indicators, it can be deduced that FIX stock offers an incremental growth trend with a discounted valuation, while PWR stock offers a diminishing growth trend with a premium valuation.

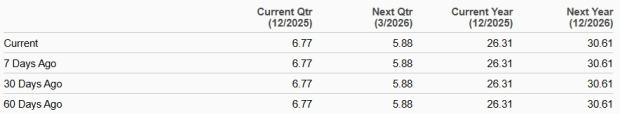

The Zacks Consensus Estimate for FIX’s 2025 EPS indicates 80.2% year-over-year growth, with the 2026 estimate indicating an increase of 16.4%. The 2025 and 2026 EPS estimates have remained stable over the past 60 days.

FIX's EPS Trend

The Zacks Consensus Estimate for PWR’s 2025 earnings implies a year-over-year improvement of 18.1%, while the same for 2026 indicates growth of 17.2%. The EPS estimates for 2025 and 2026 have trended upward in the past 60 and 30 days, respectively.

PWR's EPS Trend

Comfort Systems’ trailing 12-month ROE of 43.6% significantly exceeds Quanta’s average, underscoring its efficiency in generating shareholder returns.

Easing interest rates, strong public infrastructure spending and AI-driven investment are creating a supportive backdrop for U.S. infrastructure contractors. Comfort Systems is benefiting from outsized exposure to data centers, semiconductor facilities and other technology-driven projects. A record backlog extending into 2026-2027, strong pricing discipline and superior return on equity highlight FIX’s execution strength. However, FIX’s heavy reliance on hyperscale data center spending introduces cyclicality risk if AI-related capital expenditures slow or large projects face delays.

On the other hand, Quanta offers broader exposure to regulated utility and power infrastructure spending, providing more stable multi-year visibility. Its record backlog, self-perform model and disciplined bidding have driven steady margin improvement and strong free cash flow generation. That said, large-scale transmission and generation projects carry execution and permitting risks, while moderating growth in renewables could add volatility. PWR also trades at a relative valuation premium.

As both stocks currently carry a Zacks Rank #3 (Hold), given FIX stock’s near-term growth and superior profitability, it is a comparatively better investment option now than PWR stock. You can see the complete list of today’s Zacks #1 (Strong Buy) Rank stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Mar-10 | |

| Mar-10 | |

| Mar-10 | |

| Mar-10 | |

| Mar-09 | |

| Mar-09 | |

| Mar-09 | |

| Mar-09 | |

| Mar-09 | |

| Mar-09 | |

| Mar-09 | |

| Mar-06 | |

| Mar-06 | |

| Mar-06 | |

| Mar-06 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about Finviz Elite